ADBE: Poised for future growth

ADBE: Poised for secular growth

Investment Thesis

Tech stocks have underperformed in 2022 as investors ditch their risk assets and rotate into more defensive positions. Even large-cap tech stocks with strong balance sheets such as $Adobe(ADBE)$ have not been spared from the sell-off, the company's shares falling over 20% from its peak. As valuation multiples contract, these tech stocks have become cheaper for investors to own. I believe that now could be the time for investors to go shopping for some of the beaten-down tech names which are in a position of secular growth as the risk of a US economic recession increases.

ADBE is the global leader in digital media and digital marketing solutions. Its Digital Media Offerings include applications such as PhotoShop and Lightroom which allow creative professionals and enthusiasts to express themselves through apps and services for photography, video and more. It also operates Document Cloud which is a cloud-based subscription offering that enables digital document and signature workflows to drive business productivity. Document Cloud includes Acrobat DC which enables users to create secure, reliable and compact PDF documents and enables automated, collaborative workflows with a rich set of commenting, editing and sharing tools and direct integration with Adobe Sign. Lastly, its Digital Experience segment comprises a comprehensive collection of best-in-class products and solutions to manage the customer experience, all integrated onto a cloud platform, along with service, support and an open ecosystem.

With the digitization of the global economy, ADBE has become an essential enterprise system used by businesses to drive productivity. Its solutions are used not only for digital design but also as a cloud platform for companies to store their information and digital assets. As the market leader, ADBE has pricing power and is able to increase the prices of its solutions to offset the effects of inflation. Therefore, I believe that in a high-inflation environment, brands such as ADBE will be able to achieve secular growth through their best-in-class products which provide innovative solutions to customers.

Why did ADBE's shares sink?

In December 2021, ADBE provided FY2022 guidance which missed analyst estimates, causing its shares to slide 10% together with other software companies. For fiscal 2022, Adobe forecast adjusted earnings of $13.70 per share on sales of $17.9 billion. Wall Street was targeting earnings of $14.26 a share on sales of $18.16 billion. For its fiscal first quarter in 2022, Adobe expected to earn an adjusted $3.35 per share on sales of $4.23 billion. Analysts had predicted Adobe earnings of $3.39 a share on sales of $4.33 billion. Investors were quick to write off the company’s growth on expectations of tighter monetary policy by the Fed.

However, in its most recent quarterly report, ADBE beat analyst estimates earning an adjusted $3.37 per share vs estimates of $3.34. While the company did not beat expectations by a large margin, it shows that management has been conservative on its guidance and has executed well despite the challenging macroeconomic conditions.

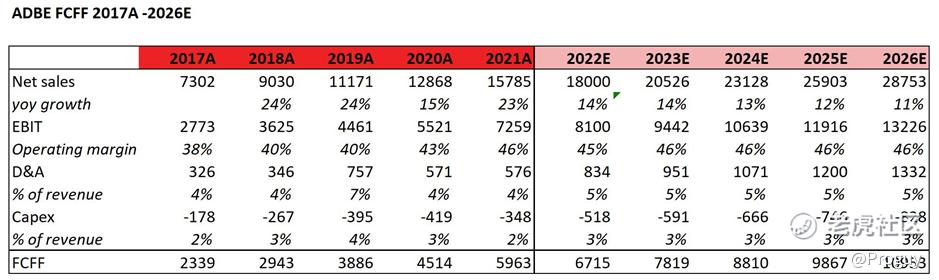

Forecasting future cash flows

I first forecasted ADBE’s future revenue by making a slight positive adjustment to analyst estimates based on my bullish thesis. I then calculated operating income (EBIT) using an operating margin of 46% which is again similar to what analysts have forecasted. I then projected Depreciation and Amortisation expense and CapEx as a percentage of revenue based on a historical figure. I used these figures to calculate the predicted future cash flows for ADBE from FY2022 to 2026.

Valuation

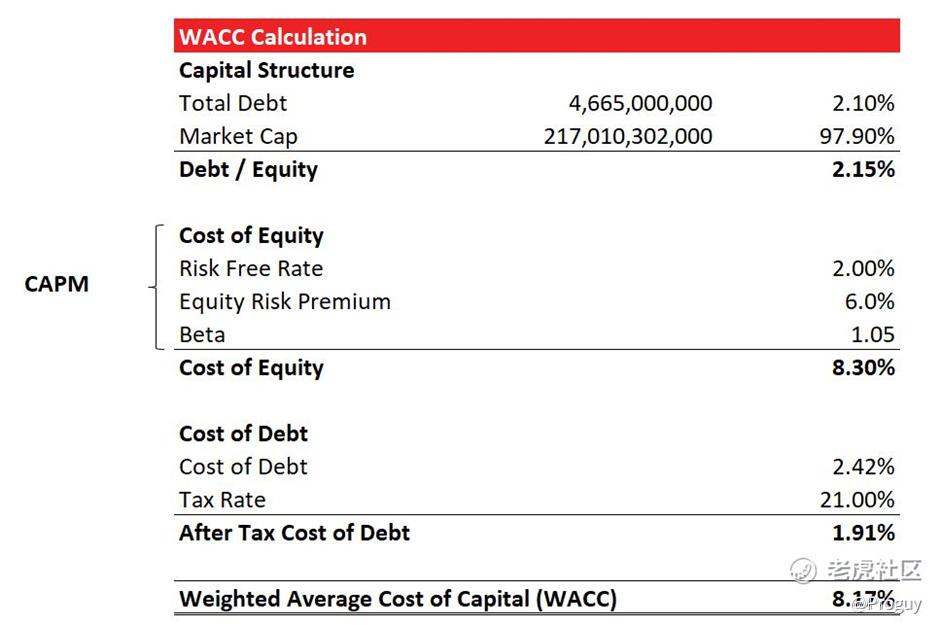

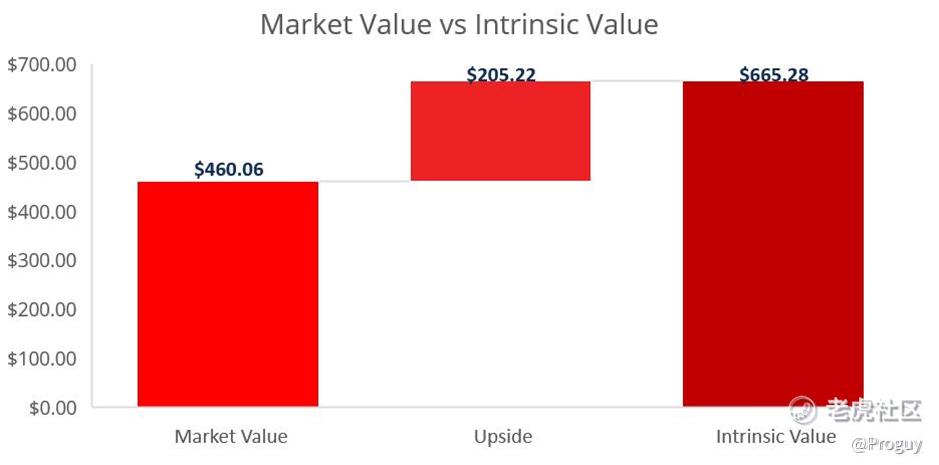

I used a 5 Year DCF Model to calculate the intrinsic value of ADBE’s shares at present. Firstly, I used ADBE’s WACC to derive a discount rate of 8.17% based on a cost of equity of 8.30% which was derived using the CAPM equation and an after-tax cost of debt of 1.91% which was then used to discount future cash flows to present value. I used a terminal EV/EBITDA multiple of 27.81x which is the mean EV/EBITDA the company has been trading at. Based on these inputs, ADBE’s intrinsic value is $665 per share which is 45% higher than what it is currently trading at ($460). Therefore, I would assign a buy rating on the stock with a price target of $665 per share.

Conclusion

ADBE has become an integral component of the enterprise software infrastructure and is expected to experience secular growth as companies continue to leverage its innovative media and cloud solutions. The recent sell-off in the technology sector presents investors with a good opportunity to buy shares at a discount to their intrinsic value. By holding these shares in the long run, investors are likely to compound their returns over time and achieve positive capital returns.

Disclaimer: This article is for educational/informational purposes and does not constitute investment advice. Perform your own due diligence and seek financial counsel before making any investment decisions.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

Wow