3 stocks to buy: April 2022

3 stocks to buy in April 2022

Equity prices have fallen over the recent months on fears of high inflation and a hawkish Fed. The S&P 500 index has fallen 5.83% while the high-flying Nasdaq has fallen 12.24% year-to-date. For investors with a long time horizon, the recent market selloff may present an opportunity to purchase some high-quality stocks at reasonable prices. In this article, I highlight 3 stocks worth looking into for investors looking to buy high-quality companies at a reasonable price (GARP).

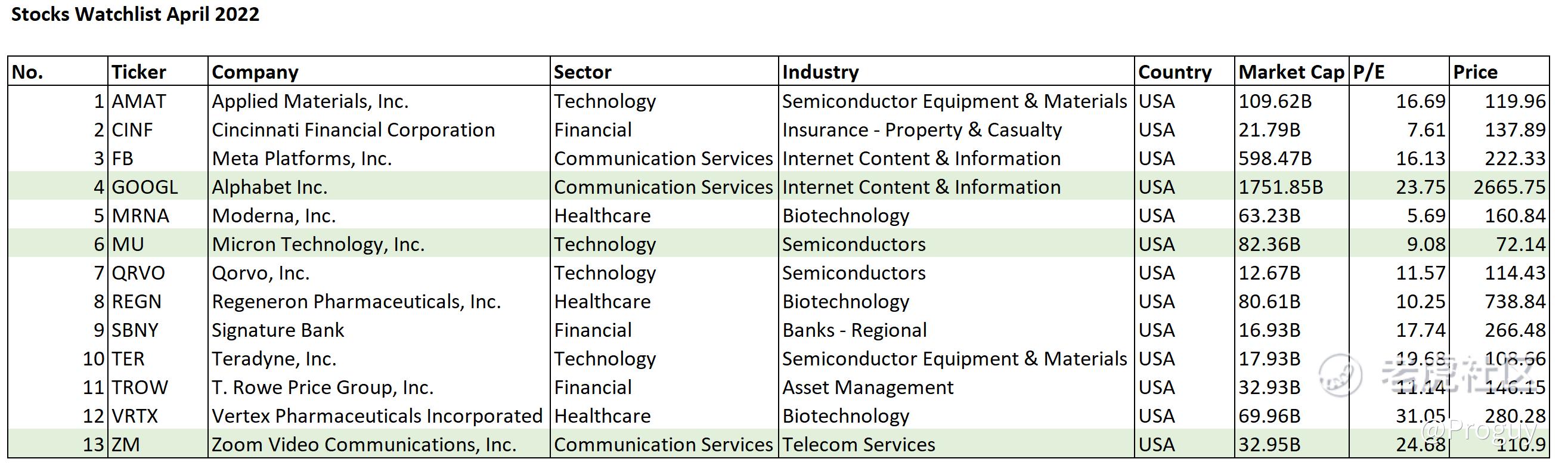

Stock screener

To screen for high-quality stocks trading at reasonable prices I used the following criteria:

- Large Market Cap (>$10B)

- Located in the US

- Low Debt-to-Equity ratio (<0.2)

- Inexpensive P/FCF (<30)

- High operating margin (>25%)

- Positive sales growth in the past 5 years (>0%)

From this list of 13 stocks, I narrowed my focus down to 3 companies that I believe will continue to demonstrate strong operating results. In the next section, I will be elaborating on these 3 companies and how they can add value to investors' portfolios.

Alphabet (GOOGL)

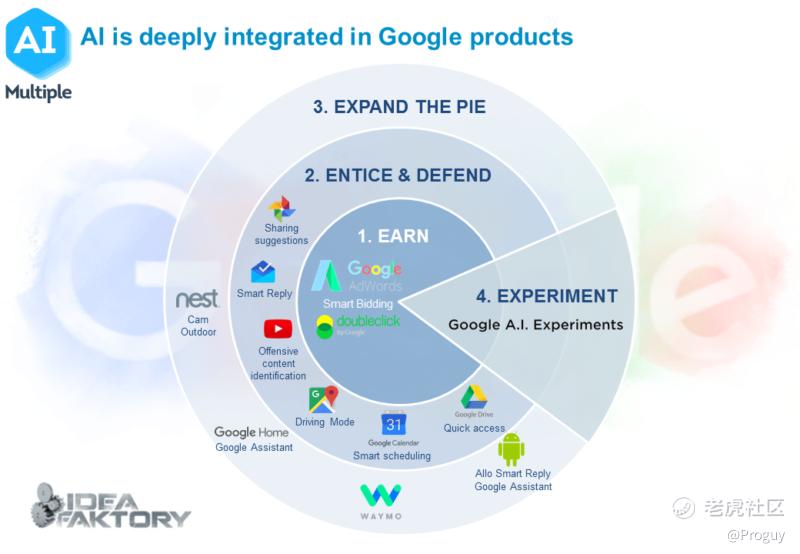

$谷歌A(GOOGL)$ is the first stock to make this list due to its phenomenal growth and bulletproof balance sheet. Since 2010, the company has achieved tremendous growth in the areas of operating cash flow, free cash flow and net income. According to CEO Sundar Pichai, the company has been firing on all cylinders and in Q4 2021 "saw strong growth in Google's advertising business, a quarterly sales record for its Pixel phones despite supply constraints and a Cloud business which continues to grow strongly.” The company has continued to invest in AI technology which continues to drive extraordinary value for businesses and people. Waymo, a subsidiary of Alphabet, has recently started offering self-driving robotaxi services for its employees and could potentially tap into a market of $40 billion by 2030.

Micron (MU)

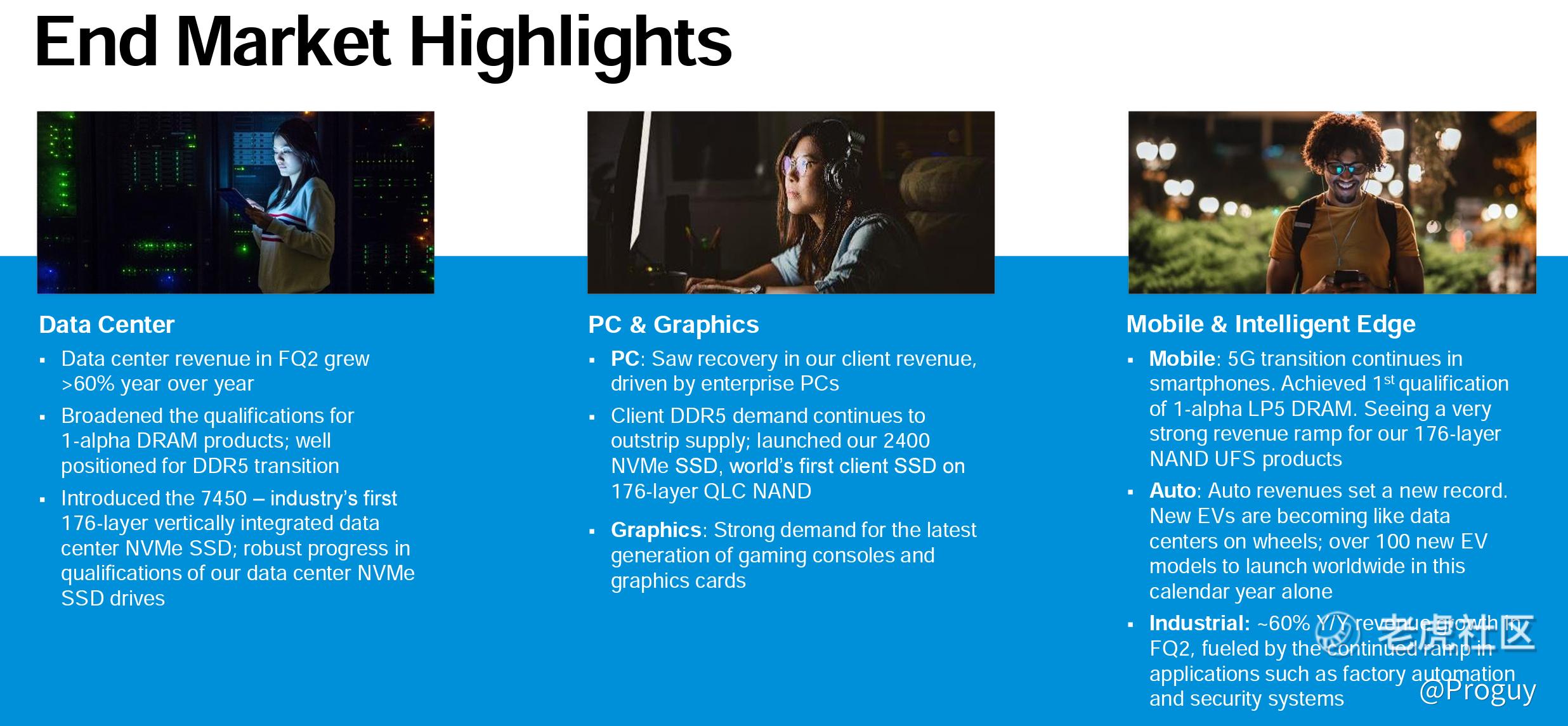

$美光科技(MU)$ is an American semiconductor company that produces memory chips including dynamic random-access memory (DRAM), flash memory (NAND), and USB flash drives. Micron's chips are important components of hardware devices such as laptops, computers smartphones which have experienced tremendous growth since the start of the Covid 19 pandemic and the digitalisation of the global economy. Micron's revenue and profits have been rather cyclical in the past as prices of memory chips were tied to the amount of supply and demand in the economy. However, the recent boom in semiconductor sales, as well as the global supply chain constraints, are tailwinds for Micron's business in the medium term. Currently, the memory chip market is dominated by a few larger players such as Samsung and SK Hynix. Therefore, these firms, including Micron have pricing power and are able to raise their prices should they experience an increase in inflationary costs.

Zoom (ZM)

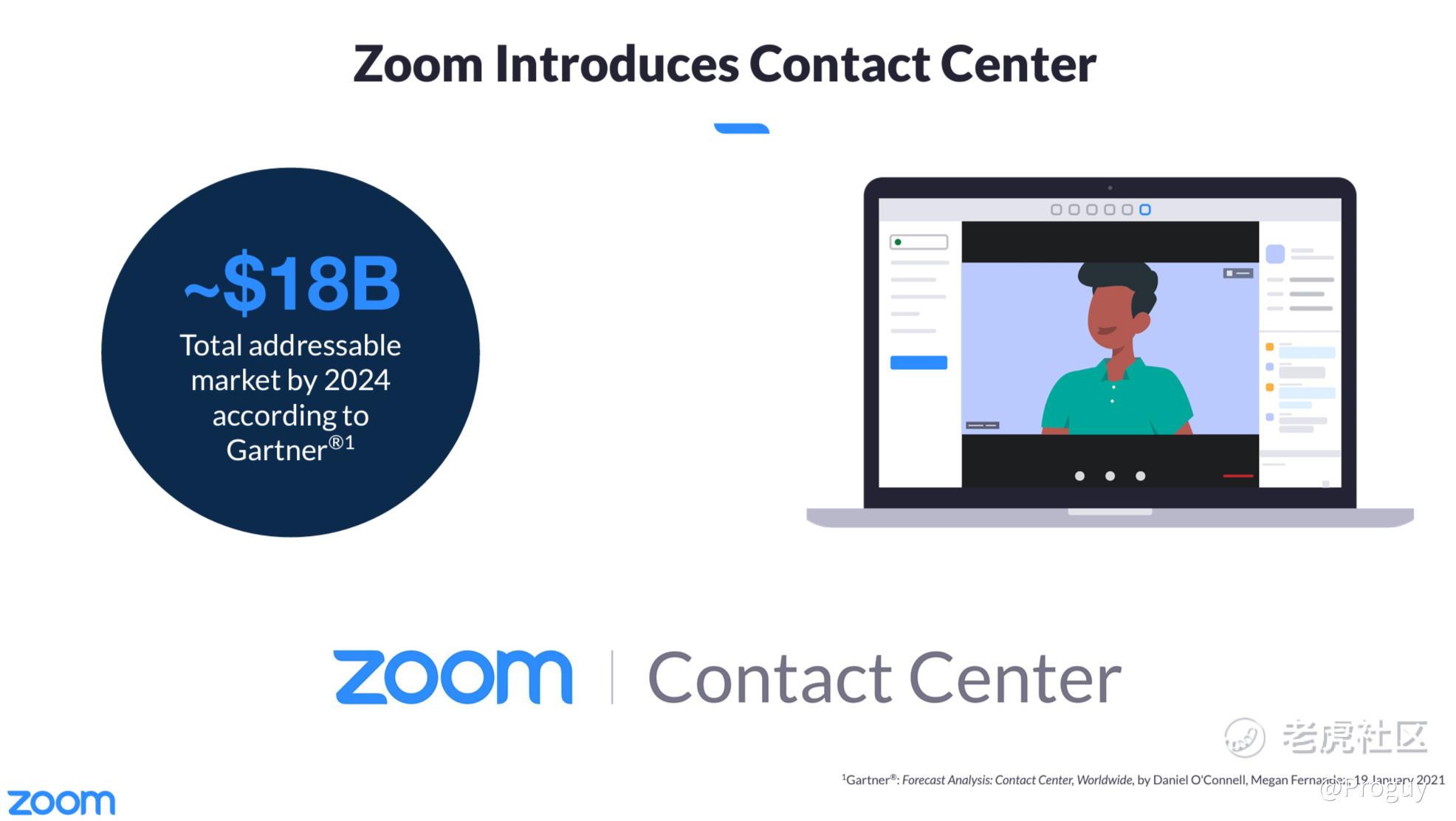

$Zoom(ZM)$ is said to be a major beneficiary of the Covid 19 pandemic as economies were shut and people were forced to work from home. However, just 2 years after the start of the pandemic, ZM's share price has fallen below its pre-pandemic levels as investors ditch their "pandemic plays". I disagree that ZM will become obsolete with the seeming end of the pandemic as I believe that the company has the potential to become a permanent platform for us to communicate through web conferencing. While Zoom has faced competition from rivals such as Microsoft Teams and Google Meet, a lot of businesses are sticking to using Zoom to host their online webinars and conferences as it is the method consumers are most accustomed to. The company is also investing aggressively in the customer experience market as it sees potential growth and opportunity in that area. I too believe that video conferencing is the future of customer experience as it is much more effective than communicating through a telephone.

Conclusion

In this article, I have highlighted 3 stocks that investors could look to own during the recent market selloff. All 3 of the companies have demonstrated excellent operational resilience, healthy financial positions and inexpensive valuations. During these tough times, it is important to stick to high-quality companies. As legendary investor, Warren Buffet once said:

“Only when the tide goes out do you discover who's been swimming naked.”

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。