FOMC Preview: What is the Fed's Next Move?

Hey Tigers!

Hope you had a terrific day! ☀️

The stock market got slashed for a second straight day as we impatiently await the Fed’s meeting. Each index closed negative. The Nasdaq dipped 1.14% while the S&P 500 retreated 0.75%.

The most concerned question is:

How fast does the Federal Reserve want to move on drawing down its pandemic-era stimulus?

That’s the question that Fed officials will have to answer in its two-day meeting kicking off Tuesday, where the major discussion will focus on the pace of the central bank’s wind down of its asset purchase program.

With inflationary pressures continuing to rise, Fed watchers expect the policy-setting Federal Open Market Committee (FOMC) to lean into a speedier timeline. For the Fed, which had insisted for most of 2021 that high inflationary readings would be “transitory,” the concern is that it may have to play catch-up to quell any fears of further inflation.

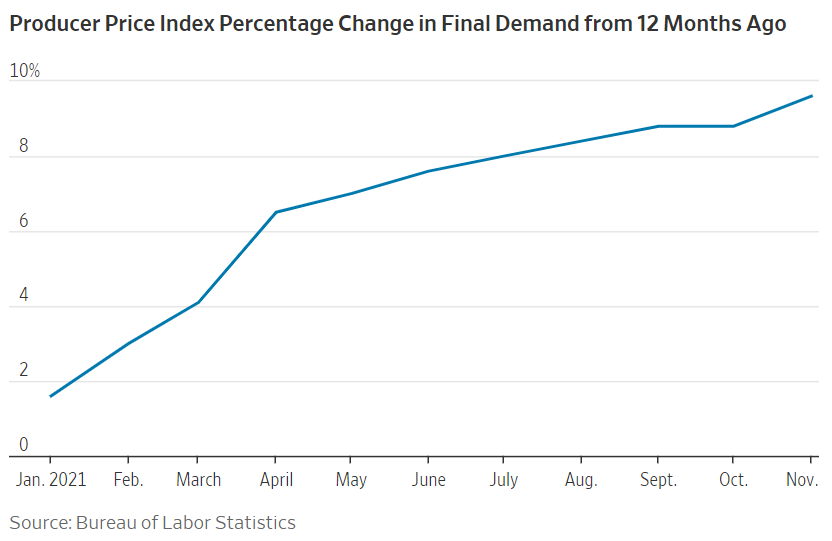

According to WSJ, prices for final goods increased 9.6% year-on-year in November, up from 8.8% in October. The chart shows how wholesale prices have risen every month but one this year on an annual basis, and across most major goods and services. Producer prices tend to flow into consumer prices, which were up 6.8% year-on-year in November.

Faxstreet states, as much as the Fed likes doing dovish surprises, which please investors, they hate the hawkish surprises which would destabilize the financial place. Because a hawkish surprise, and a market selloff would only delay the Fed action and get things worse even in terms of inflation. And this is exactly why we have forward guidance. And the forward guidance for this week’s meeting is faster QE and a possible revision of the timing of the first rate hike. And that hawkish shift is already priced in. Therefore, it would be surprising to see a significantly more hawkish FOMC announcement. Hence, there is hope for a relief rally in risk assets following today’s FOMC decision. All three major indices have come close to their 50-dma levels.

What do you think about the major index?

Will Nasdaq rise or fall after FOMC?

Is the next step hawkish or dovish?

Leave your opinions in the comment!

You may be rewarded with Tiger Coins💸💸💸

Don't forget I am the richest tiger in this community😎😎

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

This December considered dovish, next year then Hawkish.. so trade safely, friends!