Butterfly option strategy, generating profit at (almost) all situation.

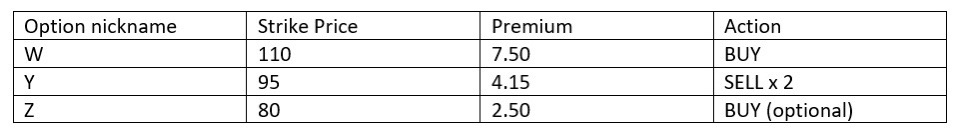

Picking a stock, with PUT option at these existing prices listed in the images, rounded off some numbers for simple illustration. Using $BABA as an example, with option expiry date set to be on 17.12.2021.

Strategy 1: Buy PUT with Strike Price 110, and Sell 2 x PUT with Strike Price 95. You made a profit of $80.

If stock price ends above 110, you gain $80

If stock price ends at 105, gain from option W = $500 and initial profit = $80, total profit = $580

If stock price ends at 100, gain from option W = $1000 and initial profit = $80, total profit = $1080

If stock price ends at 95, gain from option W = $1500 and initial profit = $80, total profit = $1580

If stock price ends at 90, gain from option W = $2000, loss from option Y = $500 x 2 and initial profit = $80, total profit = $1080

If stock price ends at 85, gain from option W = $2500, loss from option Y = $1000 x 2 and initial profit = $80, total profit = $580

If stock price ends at 80, gain from option W = $3000, loss from option Y = $1500 x 2 and initial profit = $80, total profit = $80

If stock price ends at 75, gain from option W = $3500, loss from option Y = $2000 x 2 and initial profit = $80, total loss = $420

Strategy 2: Buy PUT with Strike Price 110, and Sell 2 x PUT with Strike Price 95, and BUY PUT with Strike Price 80. You made a loss of $170.

If stock price ends above 110, you lose $170

If stock price ends at 105, gain from option W = $500 and initial loss = $170, total profit= $330

If stock price ends at 100, gain from option W = $1000 and initial loss = $170, total profit = $830

If stock price ends at 95, gain from option W = $1500 and initial loss = $170, total profit = $1330

If stock price ends at 90, gain from option W = $2000, loss from option Y = $500 x 2 and initial loss = $170, total profit = $830

If stock price ends at 85, gain from option W = $2500, loss from option Y = $1000 x 2 and initial loss = $170, total profit = $330

If stock price ends at 80, gain from option W = $3000, loss from option Y = $1500 x 2 and initial loss = $170, total loss = $170

If you do option 2, you basically protect yourself from huge losses if the price of Alibaba were to fall a lot.

My personal preference is Option 1, since I don’t mind holding Alibaba, at a discounted price compared to current price of $111. Hopeit provides you with greater insights for options.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。