寒冬暴雪初來袭, 原油期貨入冬眠;

小鱷未見熊泡澡, 对策收紧表怀疑。

流水不争, 滔滔不絕! 当前全球金融市场『盤路調整』有点看不透,,不像是2021 経濟復甦 起飛大格局.....🤣

牛年報佳音 経濟復甦谁領先|

星级牛X专家有料港股今年升至37000点, 各类資產現"牛踪"!

调仓盤整意味深長.. 旧経濟繼续脫实入虚 新經濟崛起 順随产业升級新能源大洗牌 資本集中營正在邁向东南亞新兴市场 直接打脸摩根早前官方放的空屁🌫

吹一吹近排美股市场熱点🇺🇸

按十年美債盈虧失衡, 高見膨脹凸頂, 是否重現2000科技大泡沫!?

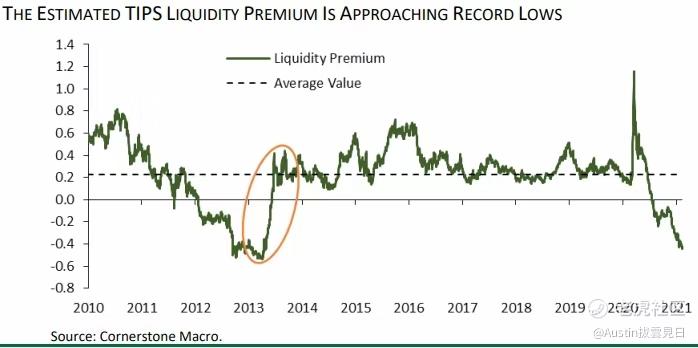

What's driving breakevens? The recent increase in the 10Y yield has been primarily a function of rising breakeven yields as real yields remained pinned (your chart). Breakevens are a measure of market inflation expectations and tend to move with oil prices. Indeed, as oil prices rallied YTD, so have breakevens (my first chart). These are classic reflationary dynamics, but perhaps there is a case to be made that excessive liquidity conditions in the TIPS market (where breakevens are based), thanks to Fed's QE (they have been buying more TIPS than is being issued) have distorted this signal. By CSM's measure, the liquidity premium in TIPS has plunged significantly and no doubt exacerbated the move higher in breakevens. Why this matters is because while Fed officials have pushed back on taper, there is a risk that if the credibility of continued QE is challenged because of a communication error, then a reversal in the liquidity premium could cap or even reverse the rally in breakevens, at least until true inflation expectations rise more meaningfully (the last chart). 👽👽

Just starting?

The yield on the 10-year Treasury rose above 1.33% in overnight trading, hitting the highest level since February 2020. While that move has eased somewhat in European trading, volatility markets are signaling that U.S. bonds could be in for more wild gyrations in the coming months. There are plenty of reasons for the move, as investors try to price in the impact of a still-to-be-completed stimulus bill, and the reopening of the U.S. economy.

Passing the stimulus bill could move the needle a lot. Strong buy for blue chips.

Citi sees 10% market pullback, gives stocks that can buck the trend( Confirmation of global economic early stages recovery??)

U.S. retail sales surprised strongly to the upside in January, showing that fiscal stimulus does in fact work. While all major retail categories increased, most encouraging was the strong gain in discretionary categories. Retail sales are now 7.8% above pre-crisis levels, but can this be sustained without further stimulus? While the top-line number is strong, is there weakness hiding below the surface?

Confirmation of global economic early stages recovery👽

波士顿联储行长认為, 目前就业市场的风險比通貨膨胀风险更大! 其次是估值高企涨势疲惫之际, 空头大举围攻新兴市场|

按最不好的一面:

経济全面坍缩若是即將开始, 大家就要做好准备迎接全球經济大蕭條。(实在忍不住的話三两天的波段就好~別指望長線)

股市上漲需要所有人合力的熵减对抗多空分化的熵增, 資金短时间内暴增, 可以创造逆熵, 但是始終无法改变抵挡整体熵增趋勢! 再过一小段時間BTC下跌的通道就会全面打開, 這次可能又会埋掉一批菜~🤣

目前《信報》最多新聞和論述的『物体』, 竟然是比特幣(Bitcoin)。 此物引起作者和編者「高度關注」,反映近日其价乃有「升完可以再升」的牛氣, 已在一般人特別是投資(機)者心中留下不可磨滅的印记, 也意味有廣泛市场需求, 本報遂詳加報道。

這種現實, 加上和過去如二○一七年的爆升狂瀉潮的肇因是由比特幣「持份者」及散戶入市亂炒招致不同, 而主導牛年比特幣升勢如虹的, 從近來的相關新聞推測, 是職业投机者!炒家身份從业餘「升呢」至專业、從個人身份進化至抱團機構投資者, 「行家落疊」, 市情必趨熱鬧、影響必然深廣, 這才是令比特幣的去從值得留意的關鍵!

不帶貶义, 以上观点仅供参考!😄

BTC(期货)方面| 向上到达了提醒近週二的目标和阻力53000附近区域(高見52280回调, 各路大侠注意获利减仓),比特幣当前波动幅度大, 直接牵动所有区块链板塊, 尤其是第九城市已上頂位。目前比特幣下跌通道支撑47000和43000, 上方目标和阻力不变:衝頂53000-54000

油方面、隨北极寒潮全球進入馬太效应的气候, 直接助推油上60窗口, 提醒的上方第二目标和强阻力区域63-64不變, 短期需要盘整蓄勢。油趋勢强烈向上, 逢支撑做多为主, 逢阻力做空为辅。油支撑59.7,58.6和57.5;阻力61.3,61.9和62.6. 标普E-mini期货ES, 再创新高到达的目标和阻力3955附近后如期开始反复的高位震荡(很好的短线做空套保和套利),开盘后ES到达提醒几天的支撑3895附近(回撤幅度近60点)。大盘趋勢强烈向上, 但反复提醒警惕股指期货高位反复宽幅震荡。股指期货ES逢支撑做多为主, 做多仓位获利丰厚; 逢阻力做空为辅, 特别注意长线做多仓位的获利和加对冲保护(393X-395X有较强阻力)

昨日美股大收割| 自螞蟻散莊空軍們佈局加拿大大媽, 獲大英牌照批准膳豺后牵起一股浪潮, 随续进軍撒狗糧市场, DPW∽RIOT高開低走 漲的挺不错, 不知螳螂捕蝉, 狗莊在后。多少中途入貨的小票却被当日关門打狗😱 令人发指! 近期留意CLPS、EH 小心浑水机构埋雷。

自港股初五接財神🇭🇰開門見牛🐮派利是

当日北上收水| 如今港股回调多个板塊大瀉, 隨高瓴資本集中调仓试水AI芯片边缘化板塊, 巴佬、大鱷們也在注水油氣, 中钙新能源汽車也是量价齐跌锕↓

今天A股市场🇨🇳收盤上漲3600多家, 下跌才500多家, 涨停139家, 跌停才8家——按時到场的也没有红包领T﹏T 有意思。其中光伏、芯片板塊量价齐升↑尤其是中芯國际穩步求進, 內外兼收, 惋惜的是在港股市场裡只是一枝独秀。

值得留意的早日, 立讯公佈基本面精密直线跳水, 跌幅一度达到7%, 並拖累苹果产业链, 集体走弱。闻泰科技昨晚公告并购欧菲光旗下北美大客户摄像头相关业务, 部分投資人担心, 這將与立讯大股东旗下立景(及高伟)在北美大客户前摄形成竞争。

蓝思科技昨晚公告投建手机组装业務, 市场担心蓝思、領益等进军手机组装, 未来与立讯在组装、以及金属件(日铠)等, 將形成竞争。

朗朗乾坤欲加之罪, 何患无词。大跌总要找原囙, 不过這兩个消息对立讯实际影响, 這种想法确实有些过于狹隘牵强~

贵州茅台跌5%就跌了130元, 直接把指數拖下水, 但个股是喜开颜笑锕。权重抱团股使劲堕落, 而个股奋力反击; 数字貨幣之汇金, 智度等具有连续漲停的基因。

当前国内疫情也是控制住了, 大家也过了一个平安快乐的好年, 市场目前气氛就是明牌博弈, 而具体指數高开高走还是高开低走真不好說, 重点还是关注量能, 寡人同感认为重回万亿轻而易举, 仓位重的今日高开太多可以调仓切换一下, 小胜小红无咎, 大而美的审美取向还是不變!

在此預祝各位有緣人新春愉快, 恭喜發財, 牛年破釜沉舟, 吉祥如意。[抱拳] [抱拳] [梭哈] [抱拳] [比心] 😄😄

-2021 /02/18

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。