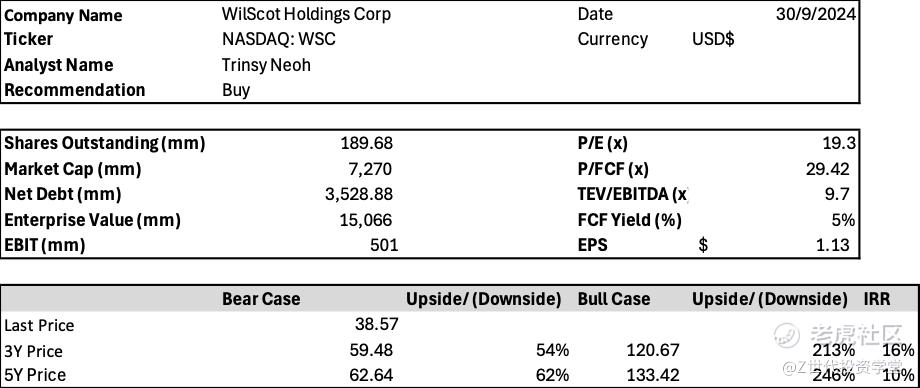

Initial Report Part 1: WillScot Holdings Corp (NASDAQ:WSC), 246% 5-yr Potential Upside (EIP, Trinsy NEOH)

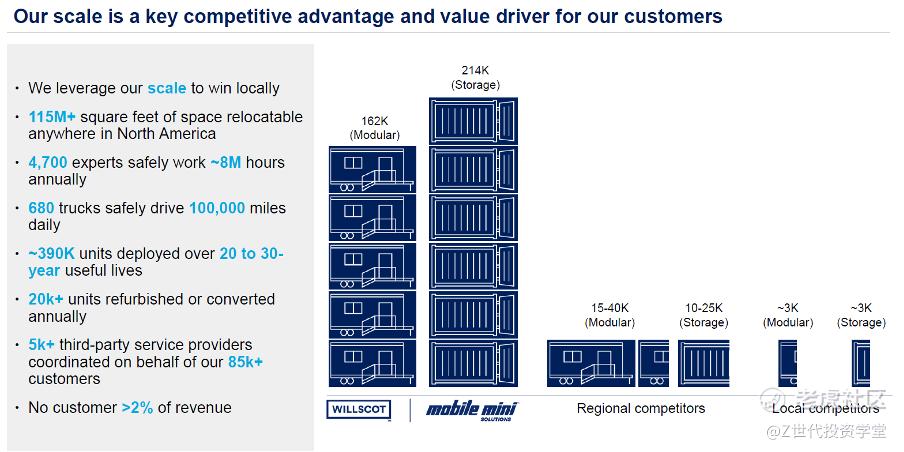

Most of us are familiar with Lego blocks—you can stack them to build something and dismantle them when you're done. WillScot Holdings (NASDAQ: WSC) operates similarly but in the context of temporary space solutions. Unlike traditional construction methods, which build structures on-site, the company assembles pre-fabricated sections, or modules, in a factory setting before transporting them to the construction site. Today, WSC is the market leader in North American modular workplace solutions (with ~50% market share) and portable storage solutions (around 25% market share).

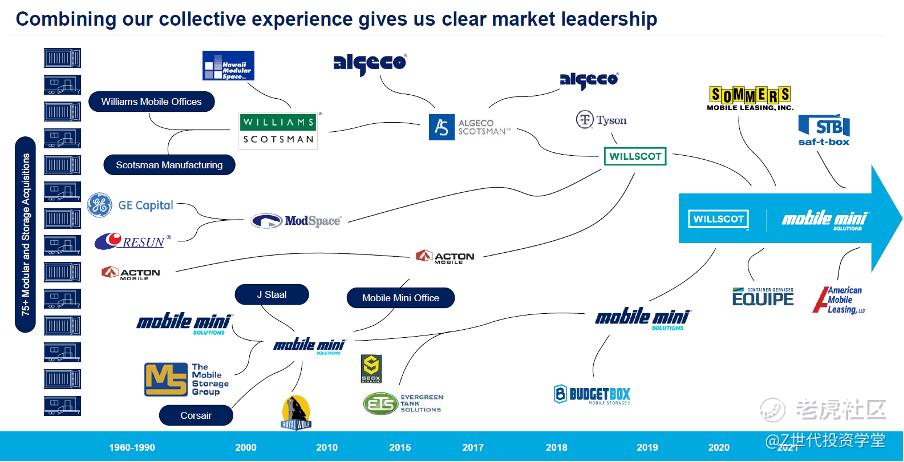

WSC is the result of a merger between two companies, WillScot and Mobile Mini. Prior to their 2020 merger, WillScot Corp was the largest U.S. supplier of mobile office trailers, while Mobile Mini Inc was the leading U.S. provider of portable storage solutions. After the merger, WillScot CEO Brad Soultz became CEO of the combined company, while Kelly Williams, CEO of Mobile Mini, took on the role of president and COO (Kelly left in 2021, as he wished to return to a CEO position).

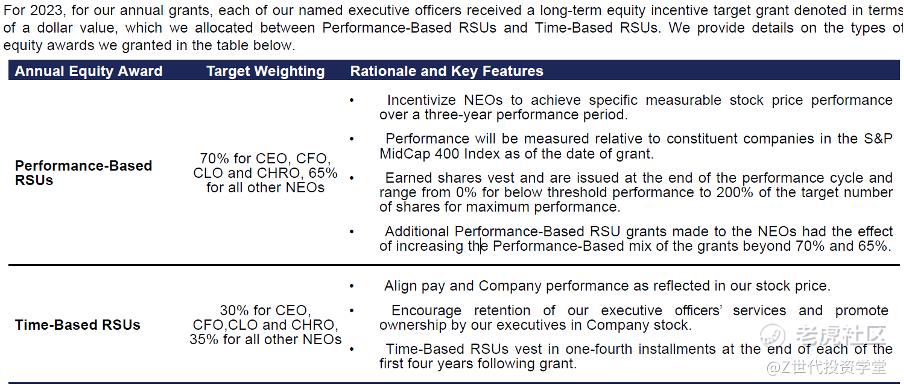

In terms of management incentives, leadership is rewarded based on metrics such as performance relative to the MidCap 400 Index. Management has implemented an efficient capital allocation framework, with 25% allocated to net capex, 25% to M&A, and 50% returned to shareholders. In November 2021, the company introduced a $1.0 billion repurchase program for its outstanding shares of common stock and equivalents.

Business Model

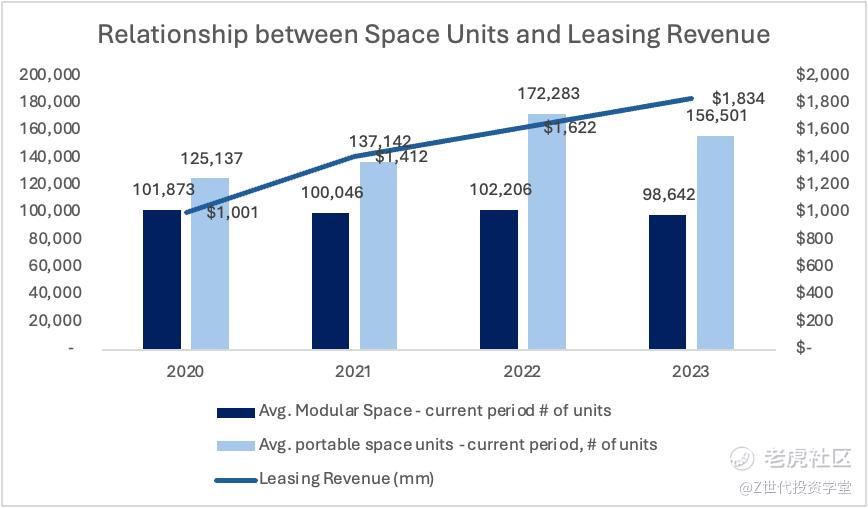

WSC derives its revenue primarily from two segments. First, it generates income from leasing modular space units (including Value-Added Products, or VAPS) and portable storage solutions. The business currently operates 156,000 modular space units and 212,000 portable storage units, representing approximately $3.4 billion and 130 million square feet of relocatable commercial space. These units come equipped with "Ready to Work" solutions, known as VAPS. VAPS refers to items like furniture, steps, ramps, and basic appliances that equip an empty temporary space. Customers pay for VAPS in addition to the monthly rent of the unit. As of December 2023, around 99,000 modular space units and 151,000 portable storage units were on rent.

Second, WSC offers ancillary services, covering delivery, installation, and removal of units. Since the business leases its spaces, WSC’s revenue is generally predictable, with the modular space segment having an average lease duration of 37 months in 2023 and the storage segment averaging 38 months.

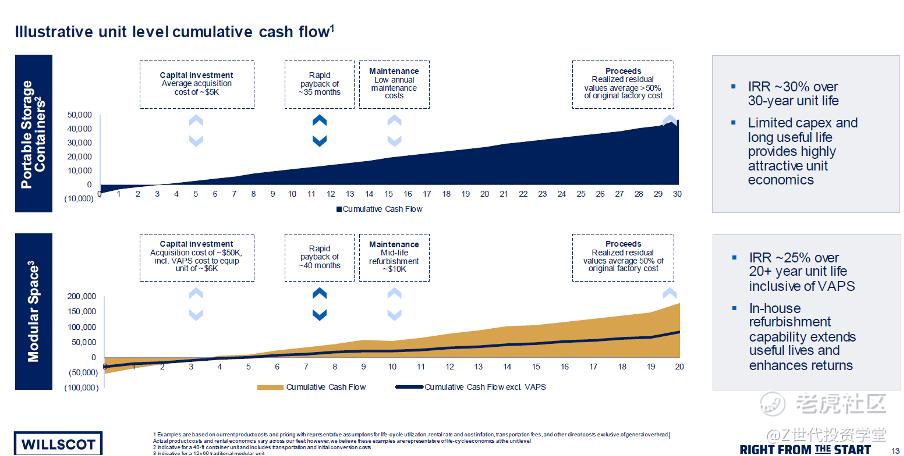

Beyond its predictable revenue stream, the unit economics of WSC are attractive. The company employs refurbishment capabilities, allowing it to extend the lifetime of its assets by 20-30 years, cycling through up to seven different customers. Additionally, WSC can extend the asset life by another 10 years through full refurbishment, which costs only 20-30% of the price of a new unit. In contrast, competitors like McGrath can only extend their asset lifetimes by less than 18 years. This lowers WSC's capital expenditures and results in a higher return on invested capital (ROIC) compared to its competitors.

In addition, the business promotes the concept of circularity, which focuses on minimizing waste and maximizing resource efficiency. WSC achieves this by prioritizing refurbishments, leveraging its industry-leading refurbishment capabilities.

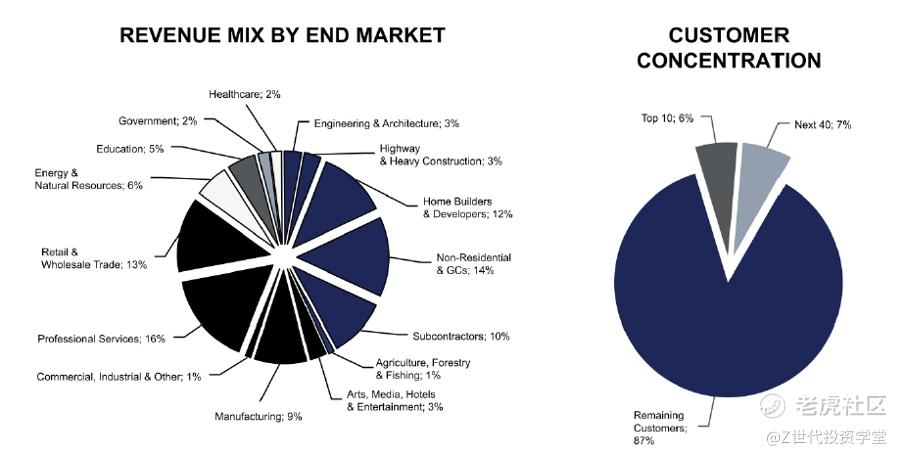

Based on WSC's current customer demographics, the majority of its consumers come from the Commercial sector (44%) and the Construction & Infrastructure sector (42%). Notable examples include supplying modular units for Facebook data centers, providing storage for Target’s remodeling projects, and supporting tour events like the PGA.

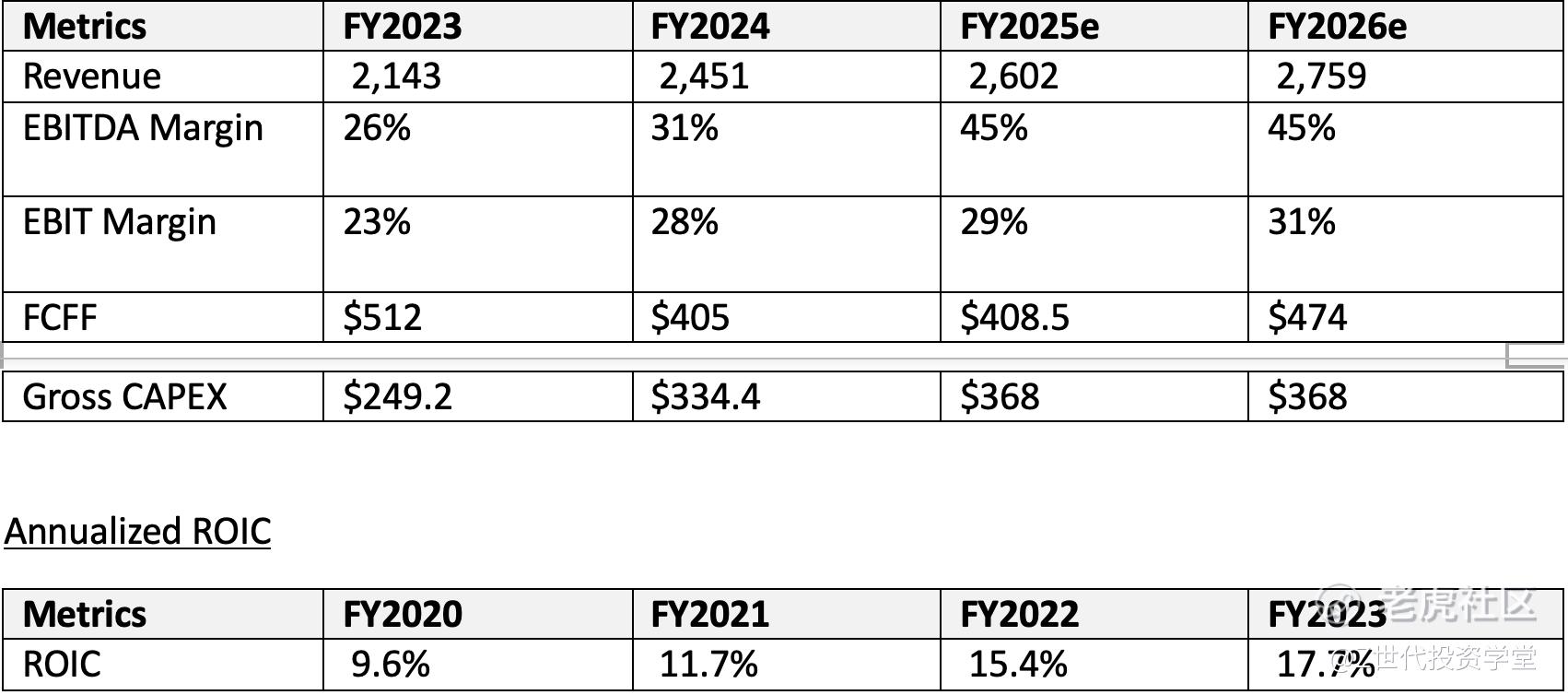

Financials

Economic Moat

In the modular space industry, customers prioritize the safety and functionality of the rooms or buildings provided to them. This concern increases their willingness to pay higher prices to offset the perceived risks of uncertainty, which can be more costly than the price of the product itself. Customers would rather pay a premium than face poor quality, delays, or other issues that could significantly impact commercial or construction projects.

Operating in a relatively non-price-sensitive market, WSC has the ability to raise prices without alienating customers. In fact, prices have steadily increased over the past 10 years. When trust is a key factor, customers tend to favor reputable, industry-leading companies. This is evident in WSC’s performance, as revenue has increased even though the number of units sold has declined.

Industry Overview

The modular space and portable storage industry focuses on providing space efficiently and effectively. Key industry tailwinds include the rise in commercial applications, urbanization, infrastructure development, economic growth, and increased institutional use. In the U.S., where urbanization and population growth are driving demand, housing and office space are consistently needed. Modular solutions meet these needs in a fast and scalable way.

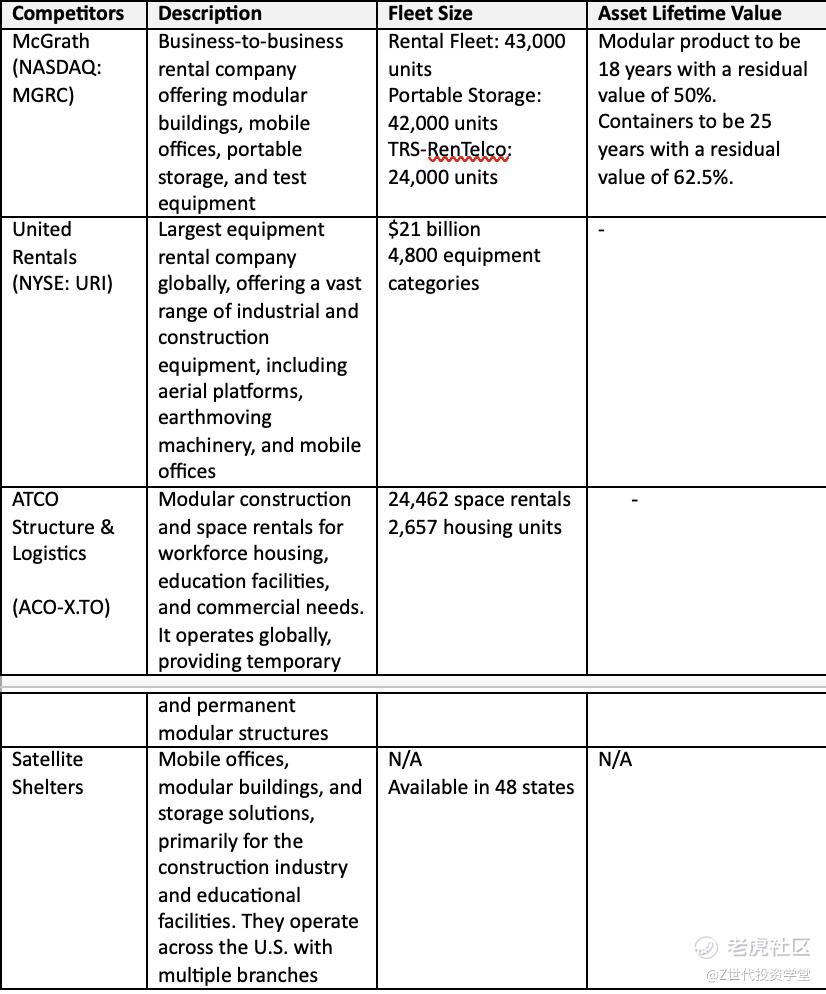

WSC competes based on factors such as customer relationships, availability, delivery speed, price, VAPS, and product quality. Its competitors range from lessors of storage units to providers of mobile offices. While WSC is the market leader in North America, the industry remains highly fragmented. Key competitors include McGrath RentCorp, United Rentals, ATCO Structures & Logistics, and Satellite Shelters. Among these, McGrath is WSC's closest competitor, with a fleet size five times smaller. WSC has greater market penetration in the construction and industrial sectors, while McGrath has a stronger presence in the education sector.

Customers are increasingly seeking a one-stop-shop solution rather than dealing with 5-10 different companies to set up a job site. This approach reduces administrative costs and eliminates the inconvenience of coordinating with multiple suppliers.

Over the years, the modular space and portable storage industry has experienced significant consolidation, partly driven by the pandemic, and I expect this trend to continue. In 2018, WSC acquired ModSpace, a privately owned provider of office trailers, portable storage units, and modular buildings. At the time, ModSpace was WSC's largest competitor in the modular space sector. To strengthen its position in the storage space industry, WSC acquired Mobile Mini in 2020, the leading provider of portable storage solutions in the U.S., UK, and Canada. Today, WSC boasts the broadest and deepest network of locations in North America, allowing for more efficient and faster customer deliveries.

Competitors have also been consolidating. In 2021, McGrath RentCorp acquired Design Space, a leading provider of modular buildings and portable storage in the Western U.S. With a network of 15 branches and over 100 employees, Design Space serves diverse end markets, including construction, government, education, and commercial sectors.

There was also speculation about a potential merger between WSC and McGrath, which attracted significant attention from shareholders. However, this has been put on hold due to concerns raised by the FTC regarding potential monopoly issues.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk. *请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。