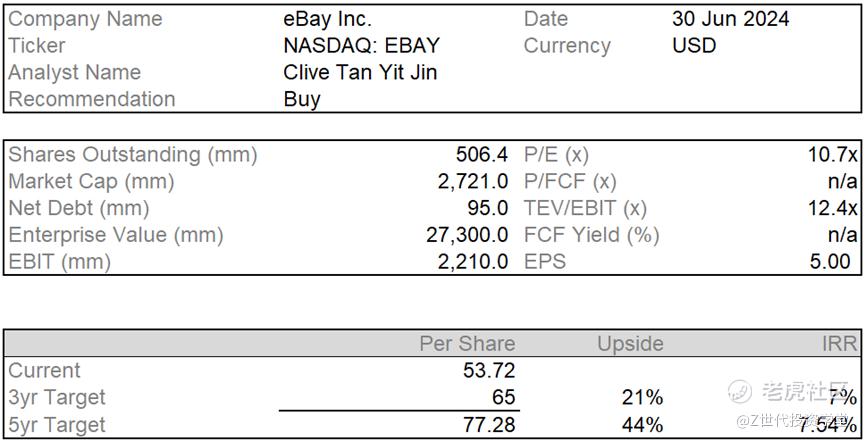

Initial Report (part1): eBay (NASDAQ:EBAY), 44% 5-yr Potential Upside (EIP, Clive TAN Yitjin)

In this report, I provide my thoughts on why eBay is not outdated, and why despite the domination of ecommerce giants like Amazon and Alibaba, eBay is still a solid pick.

Background

eBay, an e-commerce giant, was founded on September 3, 1995, by Pierre Omidyar as AuctionWeb, a part of a larger personal site. Initially, it was a hobby for Omidyar, but it quickly became a business when he started charging users due to the high traffic on his site. One of the first items sold was a broken laser pointer, which was bought by a collector of broken laser pointers, showcasing the diverse range of interests eBay could cater to. The company officially changed its name to eBay in 1997 and went public in 1998, a move that would solidify its place in the e-commerce industry.

eBay's business model is unique and has evolved over time. It operates on a platform that allows individuals and businesses to sell and buy a wide variety of goods and services. The company generates revenue by charging sellers a fee for listing items and taking a commission on sales. It also earns through advertising and its affiliate marketing programs, which I will go through in later sections. eBay's business model has been successful due to its low fee structure, which attracts a large number of sellers, and its reputation system, which builds trust among users.

Strategically, eBay has focused on leveraging technology to enhance the marketplace experience for its customers. This includes a commitment to AI and machine learning to improve search and recommendation systems, and a user-friendly mobile app to increase accessibility. eBay's strategy also involves diversifying its revenue streams and expanding its global presence, which is evident from its operations in 190 markets worldwide. The company has also been focusing on sustainability, with initiatives aimed at reducing its carbon footprint and promoting eco-friendly products.

In recent years, eBay has strategically transformed itself from a mature company with stagnant growth. By refocusing on its core business, divesting non-key assets such as StubHub and eBay Classifieds, and actively returning equity to shareholders through dividends and share buybacks, eBay aimed to optimize its financial position. However, the global impact of the Covid-19 pandemic in 2020 unexpectedly revitalized eBay's core operations. The company's agile and strategic moves are poised to unlock substantial value for its shareholders moving forward.

Industry Overview

At a first glance, eBay might seem like another ecommerce player. However, I believe that eBay’s business model and consumer base is fundamentally different from other players like Amazon, Alibaba etc. For instance, Amazon is more of a traditional online retailer while eBay is a pure marketplace play. In my opinion, a more accurate comparison for eBay would have to be Etsy, although their consumer bases are also quite different, as they both serve separate niches - albeit with some overlap. So, let’s break down eBay’s business model, and then compare this with Amazon, as well as Etsy.

eBay

eBay has one reportable segment - Marketplace, which includes their online marketplace located at www.ebay.com, its localized counterparts and the eBay suite of mobile apps.

Net revenues primarily include final value fees, feature fees, fees to promote listings, payment service fees, listing fees, and store subscription fees from sellers on our platforms. Our net revenues also include revenues from the sale of advertisements, revenue sharing arrangements and shipping fees. Our net revenues are reduced by incentives, including discounts, coupons and rewards, provided to our customers.

The company reported net revenue of 10.1 billion as of 31 dec 2023, up 3% from 2022. Split between US and international revenue is 50-50.

Another key metric for ecommerce companies is gross merchandise value (GMV), which is a measure of the total value of merchandise sold on the platform within a certain time period. GMV in 2023 was 73.2b, take rate was 13.81%, and has been increasing, from 13.25% in 2022 and 11.93% in 2021. Net revenues continued to outpace GMV during 2023 primarily due to the benefit of a higher take rate. eBay cited expectations that this trend will continue to a lesser extent into 2024. eBay derived a majority of GMV in 2023 from the following product categories: parts & accessories, collectibles, fashion, electronics, and home & garden.

Net revenues increased primarily due to the investment in focus categories and a higher take rate driven by the expansion of promoted listings and payment services and the launch of eBay International Shipping. However, the company noted that the increase in net revenues was partially offset by a reduction in traffic in most markets resulting from geopolitical events, inflationary pressure, foreign exchange rate volatility, elevated interest rates and lower consumer confidence, which negatively impacted discretionary consumer spending during 2023 compared to 2022.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

*请注意,所有这些仅供参考,不应被视为投资建议。如果您选择投资任何股票,您需要自行承担风险。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 妥妥的幸福11·11-25 10:51eBay的独特模式还有潜力,加上投资重点品类,值得关注点赞举报

- 放学别跑_·11-25 10:51eBay还不错👍点赞举报