【桥水观点】为何美国总是例外?论美股表现优异的本质驱动因素

Some of the largest drivers of US equity outperformance cannot be counted upon going forward. A lot depends on the ability of US tech to deliver and AI to unleash productivity across sectors.

未来美国股市表现优异的一些最大驱动因素已无法依靠。很大程度上取决于美国科技的交付能力以及人工智能在各个行业释放生产力的能力。

We are coming off a decade of extraordinary US equity outperformance. An investment of $1 in the S&P 500 in 2010 is now worth more than $6, and the US has outperformed the rest of the world by several hundred percentage points over that period. In these Observations, we break down this S&P 500 outperformance into its key drivers to lay the foundation for the forward outlook.

我们刚刚经历了美国股市表现最为优异的十年。2010 年在标准普尔 500 指数上投资 1 美元,现在价值超过 6 美元,而且在此期间,美国的表现比世界其他地区高出数百个百分点。在这些观察中,我们将标准普尔 500 指数的优异表现分解为关键驱动因素,为未来展望奠定基础。

-

US equity outperformance has been driven by a combination of (a) faster revenue growth, (b) bigger margin expansion, and (c) rising P/E multiples—in roughly equal proportion. The returns for an unhedged global investor have been further juiced up by (d) the stronger US dollar over this window.

-

The overarching forces behind many of these supports are the US having significantly better-run companies and a more favorable fiscal and policy backdrop:

美国股市的优异表现是由以下因素共同推动的:

(a) 收入增长加快、

(b) 利润率扩大,以及

(c) 市盈率上升——比例大致相等。在此期间,

(d) 美元走强进一步提高了未对冲全球投资者的回报。

这些支持因素背后的主要力量是美国拥有经营状况明显更好的公司以及更有利的财政和政策背景:

-

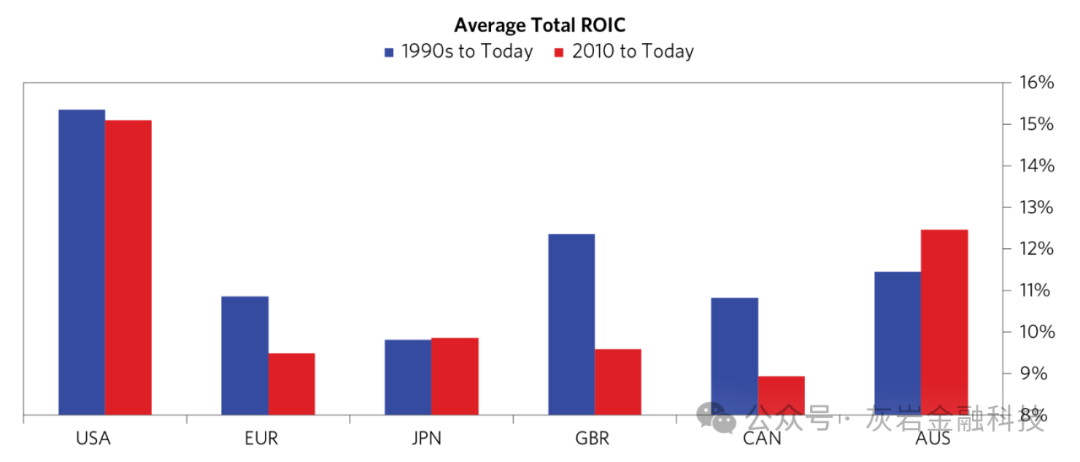

US companies are more innovative, more efficiently run, better at deploying capital, and have a more shareholder-friendly orientation than their developed world peers. This has manifested clearly in their generating a significantly higher return on invested capital (ROIC), which has allowed them to pay out a bigger share of their profits to shareholders without sacrificing revenue growth as well as to experience higher margins and multiple expansions.

-

与发达国家的同行相比,美国公司更具创新性、运营效率更高、资本配置更佳,而且更注重股东利益。这明显体现在它们产生的投资资本回报率 (ROIC) 明显更高,这使得它们能够在不牺牲收入增长的情况下向股东派发更大比例的利润,并实现更高的利润率和多次扩张。

-

This was enabled and amplified by a more favorable pro-corporate environment in the US (bigger support from outsourcing, deregulation, lower taxes, etc.) along with a larger fiscal deficit at the macro level that allowed US corporate profit margins to surge as corporations were able to collect higher revenues from the household sector without paying correspondingly higher wages.

-

这是因为美国拥有对企业更加宽容的环境(外包、放松管制、降低税收等提供的更大支持),加上宏观层面的财政赤字扩大,使得美国企业利润率飙升,因为企业能够从家庭部门收取更高的收入,而无需支付相应更高的工资。

-

While at a headline level, tech has had an outsize impact, from a sector composition perspective, this is not just a tech story. The US outperformance is broad-based across sectors and companies, as the factors noted above were true across the board. That said:

-

虽然从美股总体市值来看,科技股产生了巨大影响,但从行业构成的角度来看,这不仅仅只是由于科技股所驱动而已。美国股市的优异表现是各行业和各公司的普遍现象,因为上述因素是普遍存在的。话虽如此:

-

Tech has punched well above its weight and accounts for more than half of the US outperformance versus developed world peers over the past decade. That mostly looks to be a more dominant manifestation of drivers just discussed. These companies are the best in the world at deploying capital and have also benefited disproportionately from this environment due to outsourcing, being recipients of the fiscal spending, and achieving unprecedented levels of concentration and dominance.

-

科技股的表现展现了其超凡实力,过去十年,美国股市表现优于发达国家股市的一半以上都归功于科技股。这主要是刚才讨论的驱动因素的更主要体现。这些公司在资本配置方面是全球最优秀的,而且由于外包、财政支出的接受者以及前所未有的集中度和主导地位,它们也从这种环境中获得了不成比例的收益。

-

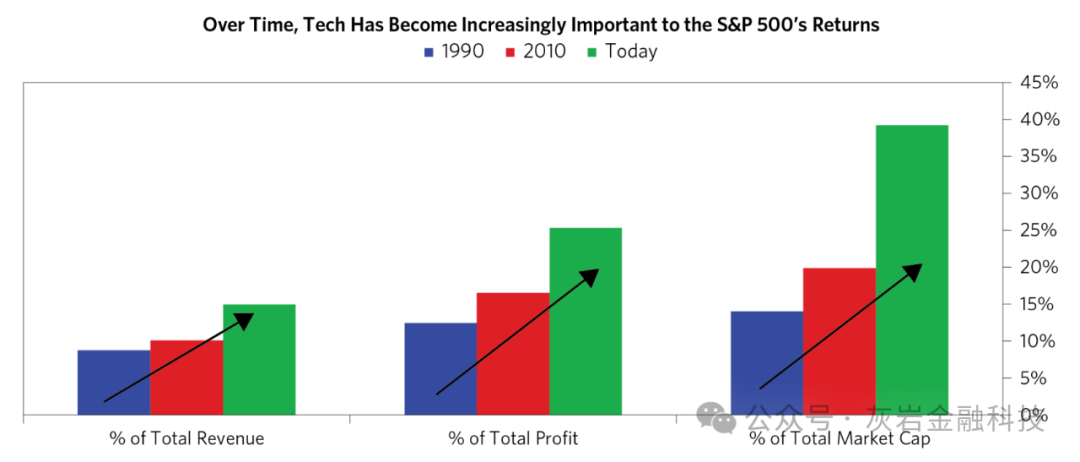

The weight of the tech sector within the S&P 500 has grown from 20% to 40% over the past decade, as US business market share has shifted from less efficient corporations (like newspapers, brick and mortar stores, and onsite tech hardware vendors) to more efficiently run businesses (like online advertisers, e-commerce, and cloud providers) that are better at deploying capital and as a result also trade at a valuation premium. This rising share has also had a material impact on the rise in margins and P/E multiples for the aggregate index.

-

过去十年,随着美国企业市场份额从效率较低的企业(如报纸、实体店和现场技术硬件供应商)转向运营效率更高的企业(如在线广告商、电子商务和云服务提供商),这些企业更善于部署资本,因此估值也更高,科技板块在标普 500 指数中的权重从 20% 增长到 40%。科技板块份额的上升也对综合指数利润率和市盈率的上升产生了重大影响。

-

On the other hand, major indices in Europe and the UK were hurt from lacking tech as well as from being overweight sectors like utilities and resources, which fared worse than the aggregate economy.

-

另一方面,欧洲和英国的主要指数因缺乏科技股以及公用事业和资源等板块权重过高而受到影响,这些板块的表现差于总体经济。

-

The above dynamics led to higher realized returns for investors in US equities because this earnings outperformance was not priced in at the start of the decade. Over this period, US companies saw about twice as much multiple expansion as their peers, driven by a stronger upgrade to the longer-term earnings growth expectations as well as a bigger compression in equity risk premiums. It is typical, following a period of outperformance, for investors to pile in, chasing the winners and extrapolating past success.

-

上述市场动态导致美国股票投资者的锁取得的实际回报更高,因为这种盈利表现在本世纪初并未被计入价格。在此期间,美国公司的市盈率扩张幅度是同行的两倍左右,这得益于对长期盈利增长预期的更强劲上调以及股票风险溢价的更大压缩。在一段表现优异的时期之后,投资者通常会大举入市,追逐赢家并推断过去的成功。

-

So today, strong US EPS growth outperformance is already reflected in the prices, at a time when many of the largest drivers of backward-looking US equity outperformance cannot be counted on to repeat going forward (from globalization to tax cuts to the massive fiscal support for profits). A lot now boils down to the ability of the US tech sector to deliver and AI to unleash a broad productivity impact across sectors. The bar for continued outperformance is high—but the potential is also there, as discussed by co-CIO Greg Jensen here and in yesterday’s videocast with GIC.

-

因此,如今,强劲的美国每股收益增长表现已经充分反映在美股股价中,而此时许多推动美国股市表现优异的最大因素(从全球化到减税,再到大规模的财政支持利润)都无法指望在未来重现。现在很多问题都归结于美国科技行业能否实现目标,以及人工智能能否在各个行业产生广泛的生产力影响。持续优异表现的门槛很高,但潜力也很大,正如联合首席信息官 Greg Jensen 在这里以及昨天与 GIC 的视频广播中所讨论的那样。

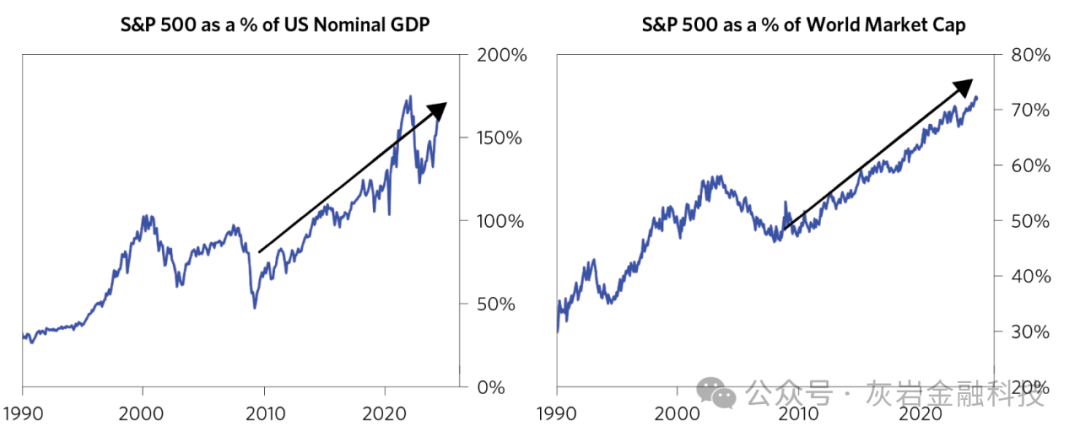

On the back of these spectacular returns, US equity market capitalization is at a record level in relation to the US economy and now makes up 70% of all global equities.

在这些惊人回报的推动下,美国股票市值相对于美国经济达到了创纪录的水平,目前占全球股票总额的 70%。

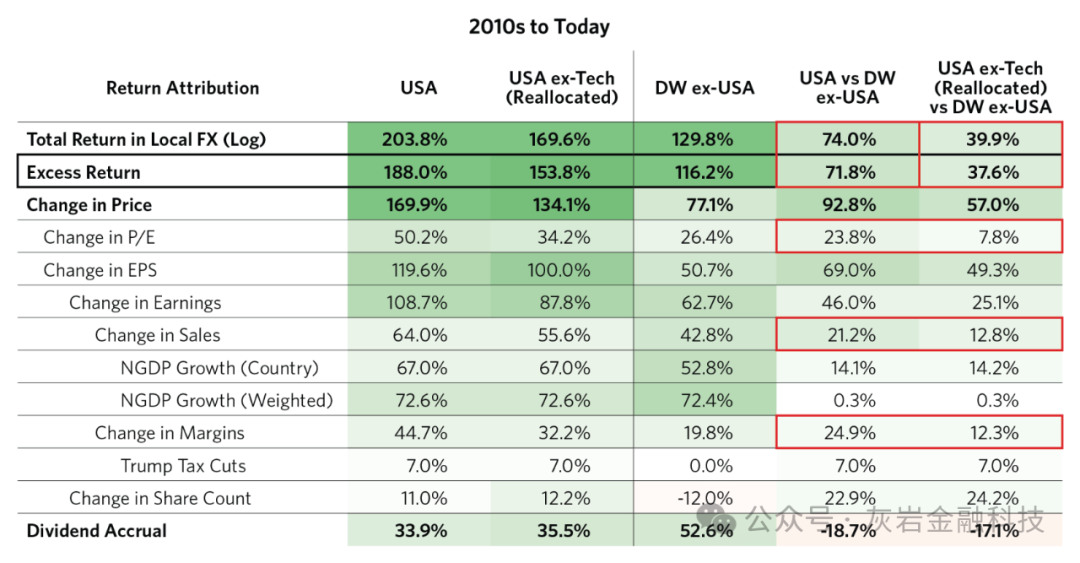

The next table breaks down US equity returns, developed world equity returns, and the difference into the major drivers, which highlights that US outperformance was massive with roughly equal contributions from sales, margins, and multiples. The strengthening US dollar also improved the returns for global unhedged investors holding the S&P 500.

下表将美国股票回报率、发达国家股票回报率以及主要驱动因素之间的差异进行了细分,其中突出表明,美国的表现非常出色,销售额、利润率和市盈率的贡献大致相等。美元走强也提高了持有标普 500 指数的全球未对冲投资者的回报。

Attributing US Equity Returns since 2010 in More Detail

Delving further into this attribution, the drivers are common to the tech as well non-tech sectors, and in many cases manifest in a bigger way for tech:

更详细地分析 2010 年以来美国股票回报的归因

进一步深入研究这一归因,可以发现科技和非科技行业的驱动因素是相同的,而且在很多情况下,科技行业的驱动因素更为显著:

-

While the technology sector has had an outsize impact, US outperformance has been broad across sectors. The US outperformances in sales and margin growth were roughly half due to the US tech sector and half due to other sectors, and the impact on P/E expansion was even higher for tech. But this is not just a tech story. In the table below, the last column demonstrates that even if the S&P 500 had no tech, it would still have outperformed meaningfully.

-

虽然科技行业产生了巨大影响,但美国股市的优异表现遍及各个行业。美国销售额和利润率增长的优异表现大约一半归功于美国科技行业,另一半归功于其他行业,科技行业对市盈率扩张的影响甚至更大。但这不仅仅是科技行业的故事。在下表中,最后一栏显示,即使标普 500 指数中没有科技行业,其表现仍将显著优于其他行业。

-

Stronger sales growth was not just driven by US economic outperformance. While having a larger exposure to the US economy was a benefit for US companies, as shown below, there was less of a difference between the GDP growth rates facing companies in the US and elsewhere (revenue weighted NGDP growth row). This is because multinational companies domiciled around the world sell to many of the same customers globally. So, the revenue growth outperformance was more driven by US companies gaining market share. Being overweight tech was a sizable contributor to this, as US tech sector grew significantly faster than other sectors. Conversely, other countries were weighed down by being overweight sectors losing market share in the global economy, such as industrials and utilities.

-

更强劲的销售增长不仅仅是由美国经济的出色表现推动的。虽然对美国经济有更大敞口对美国公司有利,但如下图所示,美国公司和其他地区公司面临的 GDP 增长率差异较小(收入加权 NGDP 增长行)。这是因为遍布全球的跨国公司向全球许多相同的客户销售产品。因此,收入增长优异表现更多是由美国公司获得市场份额所推动的。科技股过重是其中一个重要因素,因为美国科技行业的增长速度远远快于其他行业。相反,其他国家则因过重的行业(如工业和公用事业)在全球经济中失去市场份额而受到拖累。

-

Stronger US margin growth was from a combination of more efficient capital deployment and a more favorable policy backdrop. US companies in aggregate captured a larger share of the economic pie, with profit margins especially supported by an expansionary fiscal policy. Trump tax cuts added about 7% to the S&P’s earnings. This is where having a larger exposure to the US economy especially benefited US companies.

-

美国利润率增长强劲,得益于更高效的资本配置和更有利的政策环境。美国公司总体上占据了经济蛋糕的更大份额,利润率尤其受到扩张性财政政策的支持。特朗普减税政策使标普的收益增加了约 7%。这是美国公司对美国经济的更大敞口尤其受益的地方。

-

US companies saw about twice as much multiple expansion as their peers. This was from a combination of an up-revision in long-term cash flow expectations as well as compression in risk premiums. Once again, tech had an outsize impact.

-

Faster net buybacks in the US were roughly offset by foreign companies paying higher dividends.

-

美国公司的市盈率比同行高出一倍左右。这是长期现金流预期上调和风险溢价压缩的综合结果。科技再次发挥了巨大影响。

美国更快的净回购速度大致被外国公司支付更高的股息所抵消。

Next, we walk through some color behind these supports—profit margins, the role played by tech, the drivers of P/E expansion—and take a look at what’s priced in.

接下来,我们将深入分析这些支撑因素背后的一些情况——利润率、技术所发挥的作用、市盈率扩张的驱动因素,并看看价格已经反映了哪些因素。

Profits

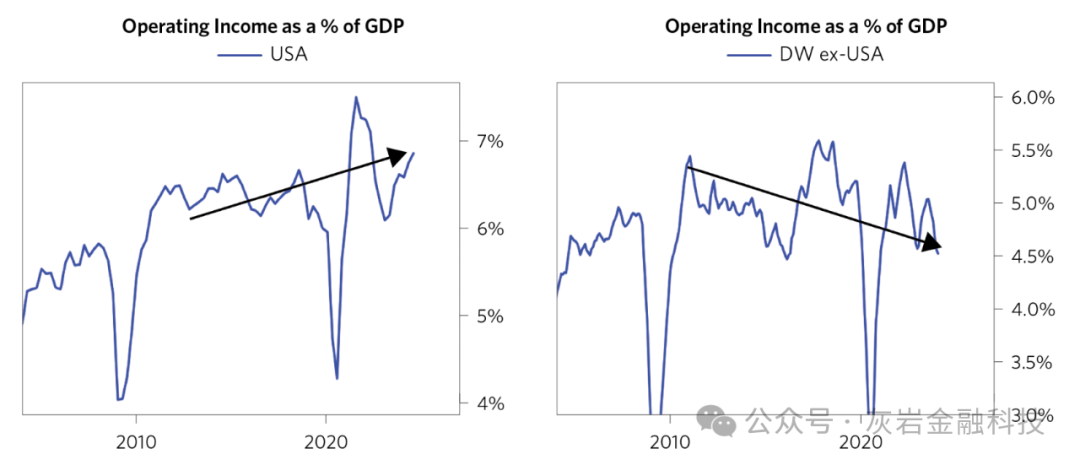

A big driver of the US outperformance has been the better profit growth from US companies. Over the past decade, the non-financials’ profit share of the total economy has risen to new highs in the US while falling to more normal levels elsewhere.

企业利润增长

美国表现优异的一大推动力是美国企业利润增长较快。过去十年,美国非金融企业利润占整个经济的比重已升至新高,而其他地区则降至更正常的水平。

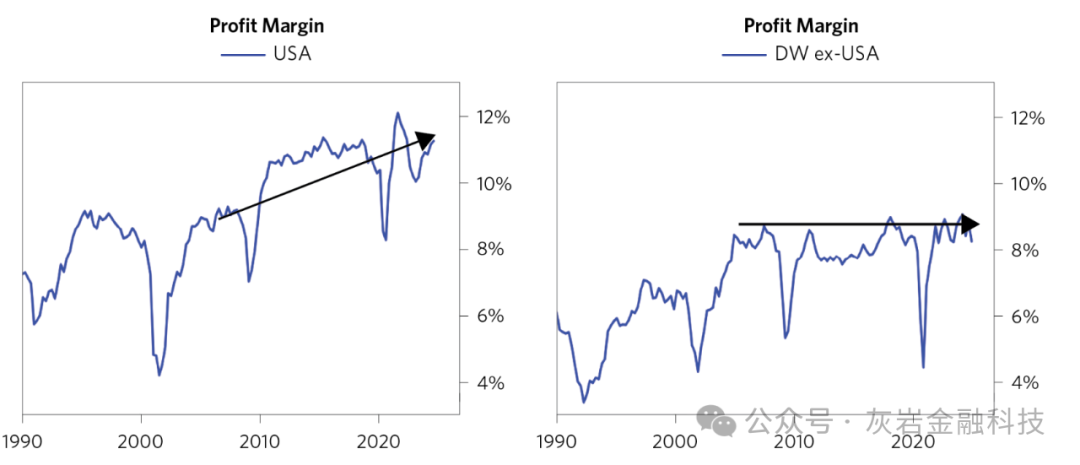

On top of a faster pace of revenue growth, US corporate profit margins have also expanded to new highs while companies outside the US have experienced flat—and lower—profit margins.

除了收入增长速度加快之外,美国企业的利润率也扩大到新高,而美国以外企业的利润率则持平,甚至下降。

In terms of drivers, US companies in general are significantly more efficient in deploying capital.

The attributions mechanically highlight how US companies were able to grow their sales at a faster pace, saw better margin outcomes, and returned a larger amount of cash to shareholders: at the core of this is the fact that US companies deploy capital more efficiently. The measure below looks at the subsequent earnings generated per unit of capital deployed (across capex and acquisitions)—our version of “return on invested capital,” which suggests the clear advantage the US has enjoyed over time. This is a function of several variables, including higher innovation, more efficient operations, a more shareholder-friendly orientation as well as a more supportive pro-corporate environment.

在驱动因素方面,美国公司在资本配置方面总体上效率更高。

这些因素机械地强调了美国公司如何能够以更快的速度增长销售额、实现更好的利润率,并向股东返还更多现金:其核心是美国公司更有效地配置资本。下面的指标考察了随后每单位资本部署产生的收益(包括资本支出和收购)——我们的“投资资本回报率”,这表明美国长期以来享有明显的优势。

这是几个变量的函数,包括更高的创新、更高效的运营、更有利于股东的导向以及更有利的亲企业环境。

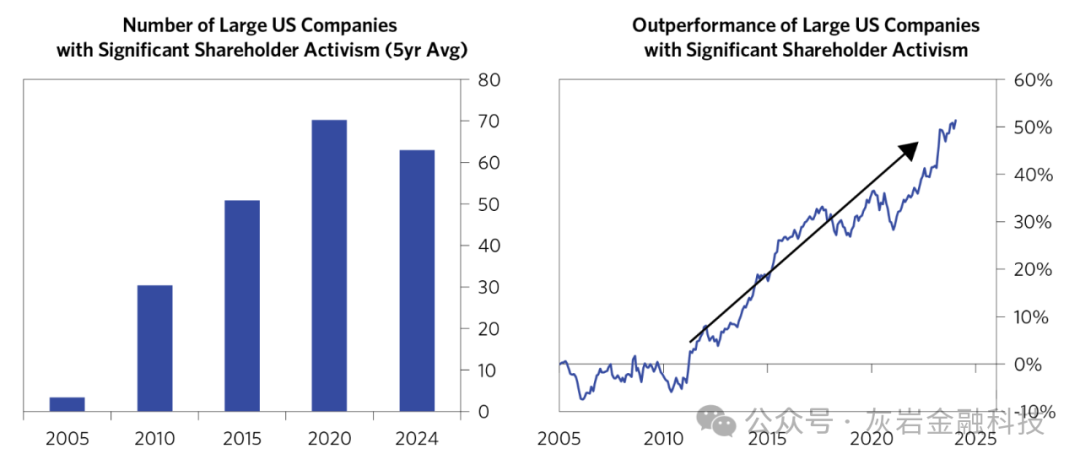

We believe a much more active and dynamic shareholder-focused corporate culture is at the center of the decision-making process in the US. One example of this dynamism in the US is the degree of shareholder activism, which has historically shown a relationship with subsequent realized returns. We have seen other countries like Japan and Korea show more openness toward this recently, but on a level basis, they remain behind.

我们认为,更加积极、更有活力、以股东为中心的企业文化是美国决策过程的核心。美国这种活力的一个例子是股东积极性的程度,从历史上看,这与随后实现的回报有关。我们看到日本和韩国等其他国家最近对此表现出了更大的开放性,但从水平上看,它们仍然落后。

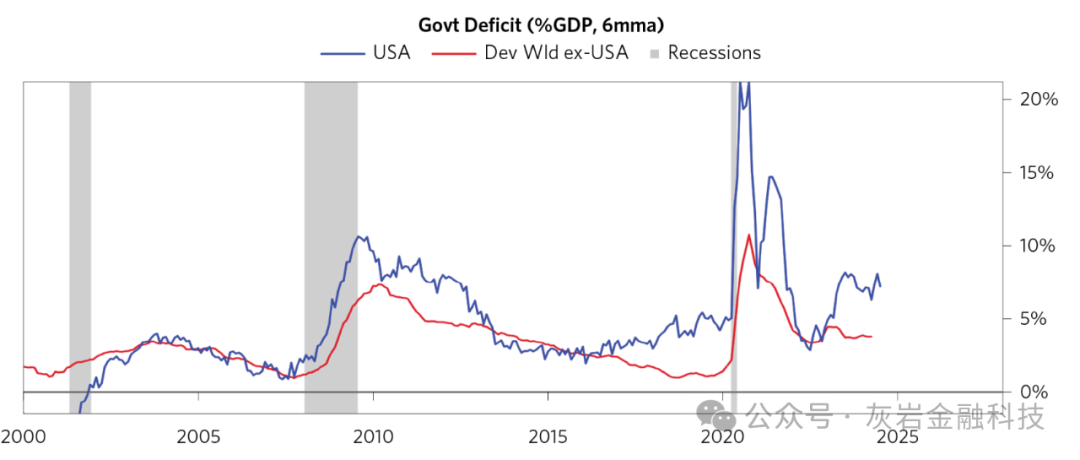

At the same time, the policy backdrop, including fiscal, was equally important.

From a macro perspective at the economy level, total saving across sectors needs to add up to total investment. Therefore, for corporate profits to rise, some other entity must dissave. The sector that has dissaved—i.e., borrowed—most in the US relative to other countries in recent years is the US government. The US government’s large deficits in recent years have been an important driver of why corporate profits could rise to a larger share of the overall economy. Fiscal deficits worked their way through the US economy to support corporate profits in numerous ways. For example, fiscal transfers to households more than offset the loss in private incomes during the COVID shock, allowing households to maintain their spending power despite falling private wages; as a result, US corporations were able to collect higher revenues from the household sector without paying correspondingly higher wages. The most direct channel of fiscal deficits supporting corporate profits was Trump’s corporate tax cuts.

与此同时,包括财政在内的政策背景也同样重要。

从宏观经济角度来看,各部门的总储蓄需要加起来等于总投资。因此,要想提高企业利润,其他实体就必须减少储蓄。近年来,与其他国家相比,美国减少储蓄(即借款)最多的部门是美国政府。近年来,美国政府的巨额赤字是企业利润占整体经济比重上升的重要原因。财政赤字通过多种方式在美国经济中发挥作用,以支持企业利润。

例如,在 COVID 冲击期间,对家庭的财政转移支付超过了私人收入的损失,使家庭在私人工资下降的情况下仍能保持消费能力;因此,美国企业能够从家庭部门收取更高的收入,而无需支付相应的更高工资。财政赤字支持企业利润的最直接渠道是特朗普的企业减税。

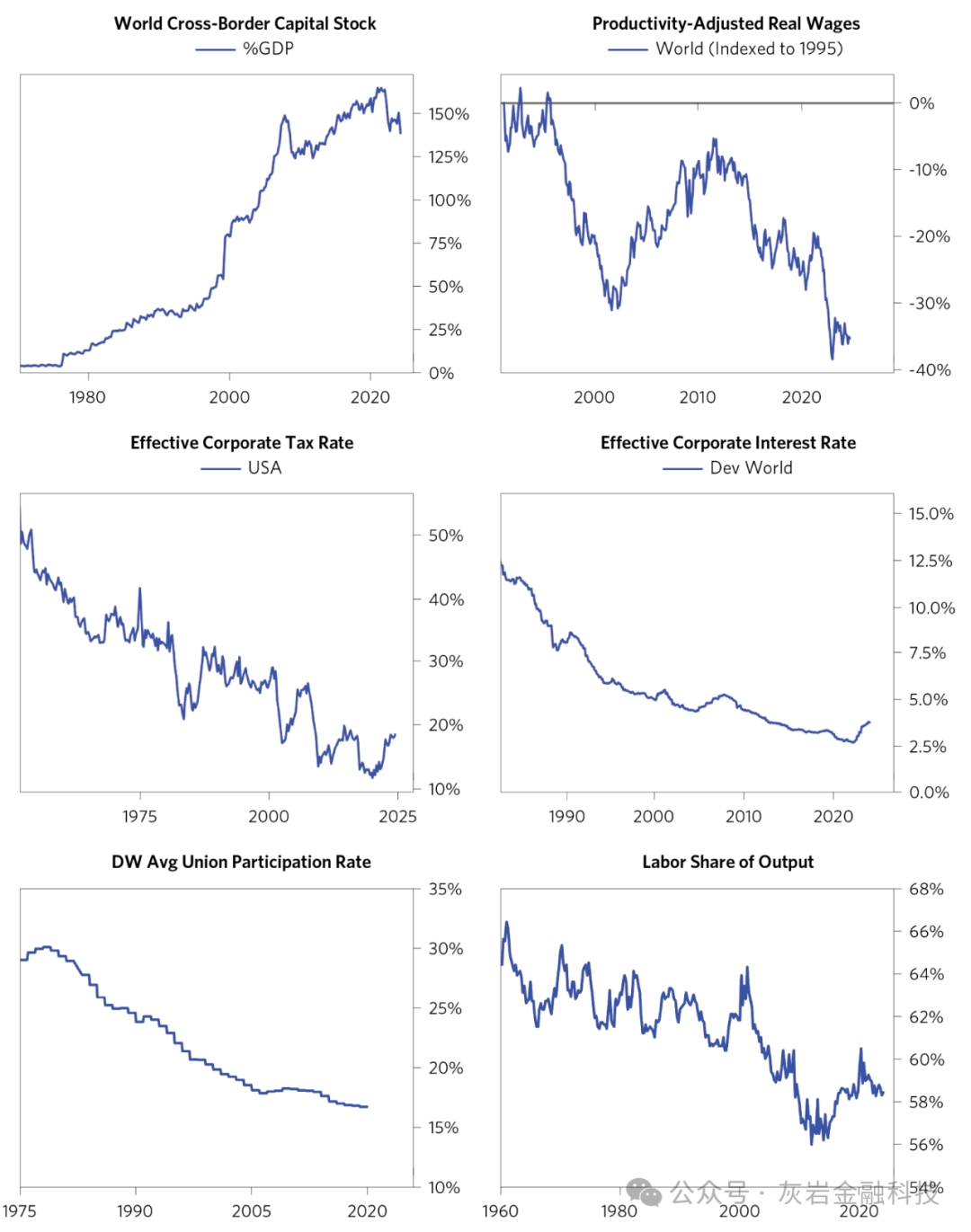

Taking a step back, the panel below highlights the highly supportive backdrop that has allowed US corporate profit margins to expand and concentration to increase over the past several decades. Many of these are unlikely to be another leg of support over the coming years, and some could turn into a drag.

退一步来看,下图重点介绍了过去几十年来美国企业利润率不断扩大、集中度不断提高的强力支持背景。其中许多不太可能在未来几年成为另一根支撑,有些可能会变成拖累。

In summary, US corporate profitability has been supported by both (a) better capital deployment choices by a more competent and better-aligned management, and (b) operating in a more pro-corporate environment, including support from fiscal. Next, we briefly touch the role of tech in this outperformance.

总结来说,美国企业的盈利能力得益于以下两个因素:(a) 更有能力、更协调的管理层做出更好的资本配置选择,以及 (b) 在更有利于企业的环境中运营,包括财政支持。

接下来,我们简要谈谈科技在这种优异表现中的作用。

While the Outperformance Is Broadly True, the Technology Sector Has Played an Outsize Role

虽然总体表现优异,但科技板块发挥了巨大作用

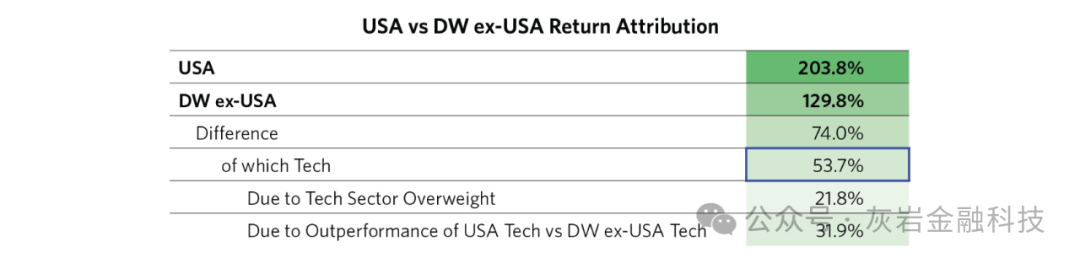

In contribution terms, tech accounted for 54% of the total 74% US equity outperformance since 2010 versus the developed world. Of this, 22% can be attributed to the US index being overweight the tech sector relative to other countries, while 32% can be attributed to US tech radically outperforming global tech companies. So, the S&P 500 benefited from being overweight tech as well as US tech doing far better than what is classified as tech globally.

从贡献角度来看,自 2010 年以来,美国股市相对于发达国家的总体表现好于发达国家,科技股在其中占了 54%。其中,22% 可以归因于美国指数相对于其他国家对科技行业的权重过高,而 32% 可以归因于美国科技行业的表现远远好于全球科技公司。

因此,标普 500 指数受益于对科技行业的权重过高,而美国科技行业的表现也远好于全球科技行业。

The tech sector’s total impact on the S&P 500 has been compounded by (a) sales growing faster than other sectors, (b) having significantly higher profit margins, and (c) trading at higher multiples. Tech has supported the S&P 500 across all channels (revenues, margins, and multiples).

科技行业对标普 500 指数的总体影响包括:(a) 销售额增长速度快于其他行业,(b) 利润率明显更高,以及 (c) 市盈率更高。科技行业在所有渠道(收入、利润率和市盈率)上都为标普 500 指数提供了支持。

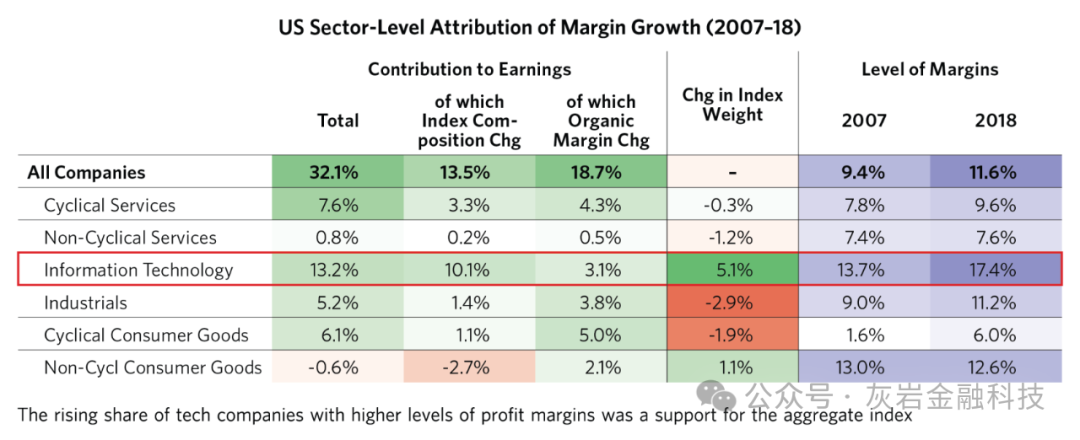

The table below attributes margin growth at the sector level and is based on a bottom-up study done for the select period of 2007-18, when S&P 500 margins expanded a lot. As you can see, in the period of the most rapid pace of margin expansion for the S&P 500, rising earnings market share (even at flat margins) for the tech sector—which had a significantly higher level of profit margins—accounted for 10.1% of its 13.2% margins return impact and was in fact a much bigger deal than the organic margin expansion of companies within the tech sector. This is an example of how the share of output pie moving increasingly toward the more efficient tech sector has been a persistent tailwind for earnings and multiples for the aggregate S&P 500.

下表按行业划分利润率增长情况,基于对 2007-18 年选定时期进行的自下而上研究,当时标普 500 指数成分股的利润率大幅提高。

如投资人所见,在标普 500 指数成分股利润率增长最快的时期,利润率明显较高的科技行业盈利市场份额上升(即使利润率持平)占其 13.2% 利润回报影响的 10.1%

事实上比科技行业内公司的有机利润率增长更为重要。这是一个例子,说明产出份额日益向效率更高的科技行业转移,一直是标普 500 指数成分股盈利和市盈率持续上涨的推动力。

Closer Look at Returns Attribution for Mag 7

进一步了解 Mag 7 股价飙升的归因

Each of the Mag 7 companies has its own story of exceptionalism. At a headline level, these companies generated annual returns in excess of 20%, twice that of the other S&P 500 companies. (Note that the returns shown in the table below are annualized.) A few things to call out:

每家 Mag 7 公司都有着自己的辉煌历史。从总体来看,这些公司的年回报率超过 20%,是其他标准普尔 500 指数公司的两倍。(请注意,下表中显示的回报率是年化回报率。)以下几点值得注意:

-

Most of the earnings outperformance for the individual Mag 7 companies came from their much faster sales growth while maintaining very high level of margins. Also, this was mostly not priced in, as the multiple compression over the window of rapid earnings growth was modest. (If it was mostly priced in, then we would have seen a significant portion of EPS growth accompanied by a reversion of P/Es).

-

个别 Mag 7 公司的大部分盈利表现优异,得益于它们在保持极高利润率的同时,实现了更快的销售增长。此外,这大多没有被计入,因为在快速盈利增长期间,倍数压缩幅度很小。(如果大部分都被计入,那么我们将看到 EPS 增长的很大一部分伴随着市盈率的回归)。

-

There were divergences across these Mag 7 companies. For example, Tesla saw the fastest sales and earnings growth, but from low levels, and some of this growth was diluted due to share issuance and was somewhat priced in (P/E reversion). On the other hand, unlike Tesla, Apple’s buybacks have been a support for its EPS. Finally, the AI champion Nvidia recently has seen a surge in sales and margins growth while maintaining a flat P/E ratio.

-

这些 7 强公司之间存在分歧。例如,特斯拉的销售额和盈利增长最快,但起点较低,而且部分增长因股票发行而被稀释,并在一定程度上被计入价格(市盈率回归)。另一方面,与特斯拉不同,苹果的回购一直是其每股收益的支撑。最后,人工智能冠军英伟达最近销售额和利润率大幅增长,同时市盈率保持平稳。

-

This attribution further emphasizes how big a deal tech’s rapid sales share gains has been for the economy and index, allowing the S&P 500 to command higher margins and valuation multiples overall.

-

这种归因进一步强调了科技公司快速的销售份额增长对经济和指数的重要性,使得标准普尔 500 指数整体上能够获得更高的利润率和估值倍数。

Multiples Expanded, Supporting Returns as Stronger Expectations Got Baked In

随着更强劲的预期被接受,美股市盈率扩大,并以此支撑回报

P/E multiples (or the inverse, equity earnings yields) have embedded in them (1) the effect of the discount rate, which discounts all future cash flows to the present; (2) long-term cash flow growth expectations, reflecting how much earnings are priced to grow in the future; and (3) the risk premium earned by investors for investing in a risky stock (instead of, for example, government bonds). The table below provides a rough attribution of the changes in P/E ratios across countries since 2010.

市盈率(或相反的股票收益率)包含以下因素:

(1)折现率的影响,折现率将所有未来现金流折现到当前水平;

(2)长期现金流增长预期,反映未来收益增长的定价;

(3)投资者投资高风险股票(而不是政府债券等)所获得的风险溢价。

下表粗略归因于 2010 年以来各国市盈率的变化。

It is notable that US P/E ratios rose more than P/E ratios in other countries despite the relative rise in US bond yields over this window. Most of the outperformance boils down to the combination of stronger expectations for future long-term cash flows and compression in risk premiums. It is typical, following a period of outperformance, for investors to chase the winners and extrapolate past success. The fact that US companies delivered superior earnings and price performance over the past decade (which was most pronounced in tech) got priced in via these higher long-term cash flow expectations. This dynamic is what sets a higher hurdle for outperformance looking ahead.

值得注意的是,尽管美国债券收益率在此期间相对上升,但美国市盈率的涨幅高于其他国家。大部分优异表现归结于对未来长期现金流的预期增强和风险溢价压缩的结合。在一段时间的优异表现之后,投资者通常会追逐赢家并推断过去的成功。美国公司在过去十年中实现了出色的收益和价格表现(在科技领域最为明显),这一事实已通过这些更高的长期现金流预期反映在价格中。这种动态为未来的优异表现设置了更高的门槛。

Going Forward, the Hurdle for Continued US Outperformance Is High, and a Lot Depends on Technology

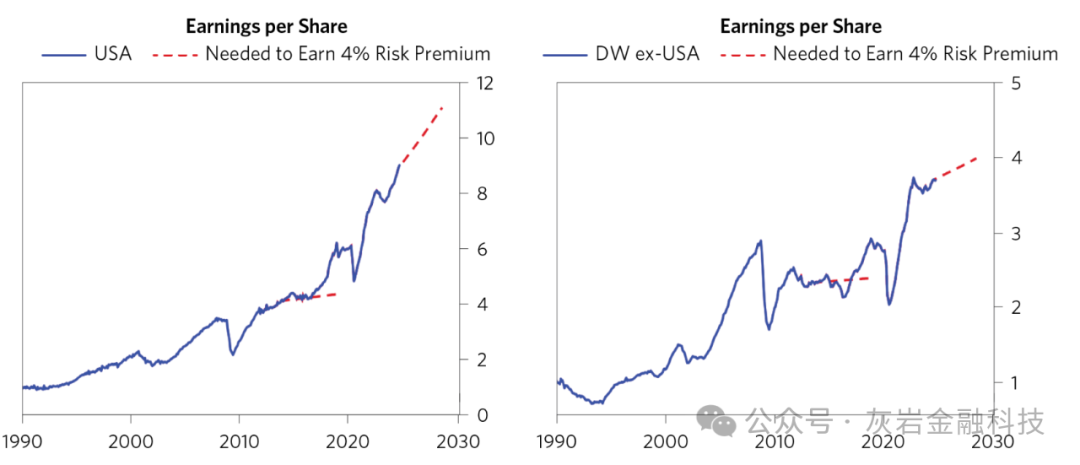

When considering the outlook for the S&P 500 from here, it is important to consider that many of the biggest drivers of the backward-looking returns discussed above (e.g., rising margins, rising P/E ratios, massive fiscal support to profits) are also what sets a high bar for outperformance looking ahead. And while the US continues to have significantly better companies, that’s also a lot more priced-in today versus a decade ago. The dotted lines below show what the EPS growth would need to be for equities to earn a normal 4% risk premium over bonds. As you can see, the expectations today for the US are significantly higher than a decade ago and relative to other equity markets.

展望未来,美国继续保持优异表现的门槛很高,而且很大程度上取决于技术

在考虑标普 500 指数未来的前景时,重要的是要考虑到,上述回顾性回报的许多最大驱动因素(例如,利润率上升、市盈率上升、对利润的大规模财政支持)也为未来的优异表现设定了高标准。尽管美国继续拥有明显更好的公司,但与十年前相比,如今的定价也更高。下面的虚线显示了股票获得高于债券的 4% 正常风险溢价所需的每股收益增长。如您所见,今天对美国的预期明显高于十年前,也高于其他股票市场。

Below, we show the EPS hurdle rate by sector needed to generate a normal level of risk premium for equity investors above the risk-free rate. You can see that US companies need about a 7% EPS growth to clear this hurdle, while other developed equity markets need less than half as much (3%) to achieve the same risk premium. This priced-in hurdle is broad-based across sectors, and with both a higher weight and more aggressive expectations, the burden for outperformance in tech and the Mag 7 specifically is higher than ever. In contrast, even with no earnings growth, Chinese companies should be able to generate a 4% risk premium over Chinese bonds—in other words, a very high risk premium is priced into Chinese stocks today.

下面,我们按行业展示了为股票投资者产生高于无风险利率的正常风险溢价所需的每股收益门槛比率。你可以看到,美国公司需要大约 7% 的每股收益增长才能跨越这一门槛,而其他发达股票市场则需要不到一半的每股收益增长(3%)才能实现相同的风险溢价。这一门槛在各个行业中都已得到充分体现,而且由于权重更高、预期更激进,科技股和 Mag 7 的超额表现负担比以往任何时候都要重。相比之下,即使没有盈利增长,中国公司也应该能够产生比中国债券高 4% 的风险溢价——换句话说,目前中国股票的价格已经反映了非常高的风险溢价。

And at a time when the hurdle is a lot higher, several of the backward-looking supports cannot be counted upon to provide another decade of strong support (from globalization to taxes to fiscal impulse). The next set of charts show how unlike at the start of the previous decade, today we are starting with elevated levels of margins, corporate share of profits, as well as multiples.

在门槛高得多的时候,一些回顾性支持措施无法指望提供下一个十年的强大支持(从全球化到税收再到财政刺激)。下一组图表显示,与上一个十年开始时不同,今天我们的利润率、企业利润份额以及市盈率都处于较高水平。

From here, a lot depends on technology—particularly if the AI revolution could create another leg of US equity outperformance. This matters directly for both (a) US Big Tech directly, which is now more than 30% of the index and has higher expectations as well as (b) how the AI/ML technology broadly unleashes productivity and how much of it gets captured as margins by companies across the various non-tech sectors. So, the bar is high—but continued outperformance is still a possibility. The potential for technology and AI was discussed in more depth in a recent report by co-CIO Greg Jensen.

从现在开始,很多事情都取决于技术——尤其是如果人工智能革命能够再次推动美国股市表现优异。这对以下两方面都有直接影响:

(a) 美国大型科技公司,它们目前占该指数的 30% 以上,并且预期更高;以及

(b) 人工智能/机器学习技术如何广泛释放生产力,以及其中有多少被各个非科技行业的公司视为利润。

因此,门槛很高——但持续优异表现仍有可能。联合首席信息官 Greg Jensen 在最近的一份报告中更深入地讨论了技术和人工智能的潜力。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。