Sure, here is a translation of the given text into English:

## US Core CPI Hits Lowest in 3 Years, Boosting Stock Markets and Gold Prices

**US April Core CPI Hits Lowest Year-over-Year Increase in 3 Years**

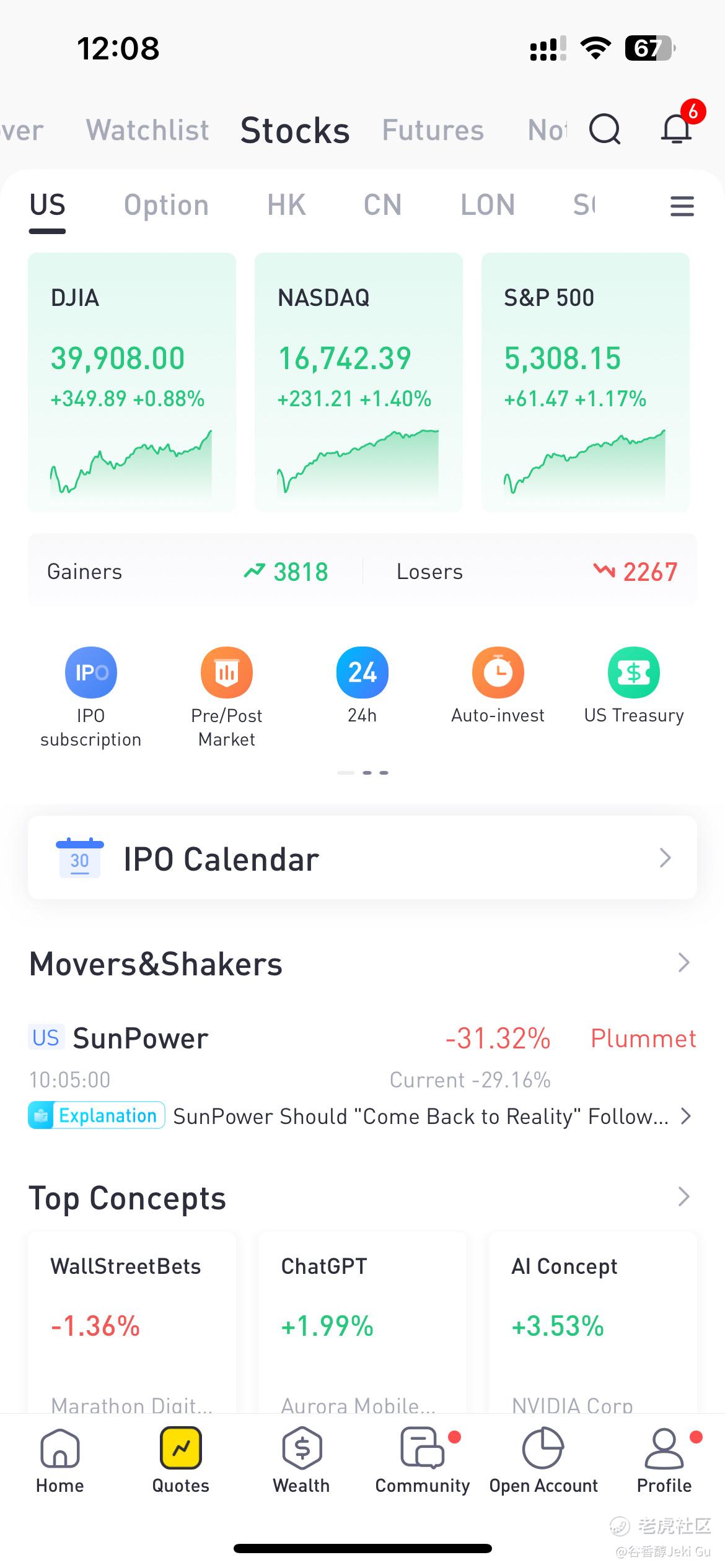

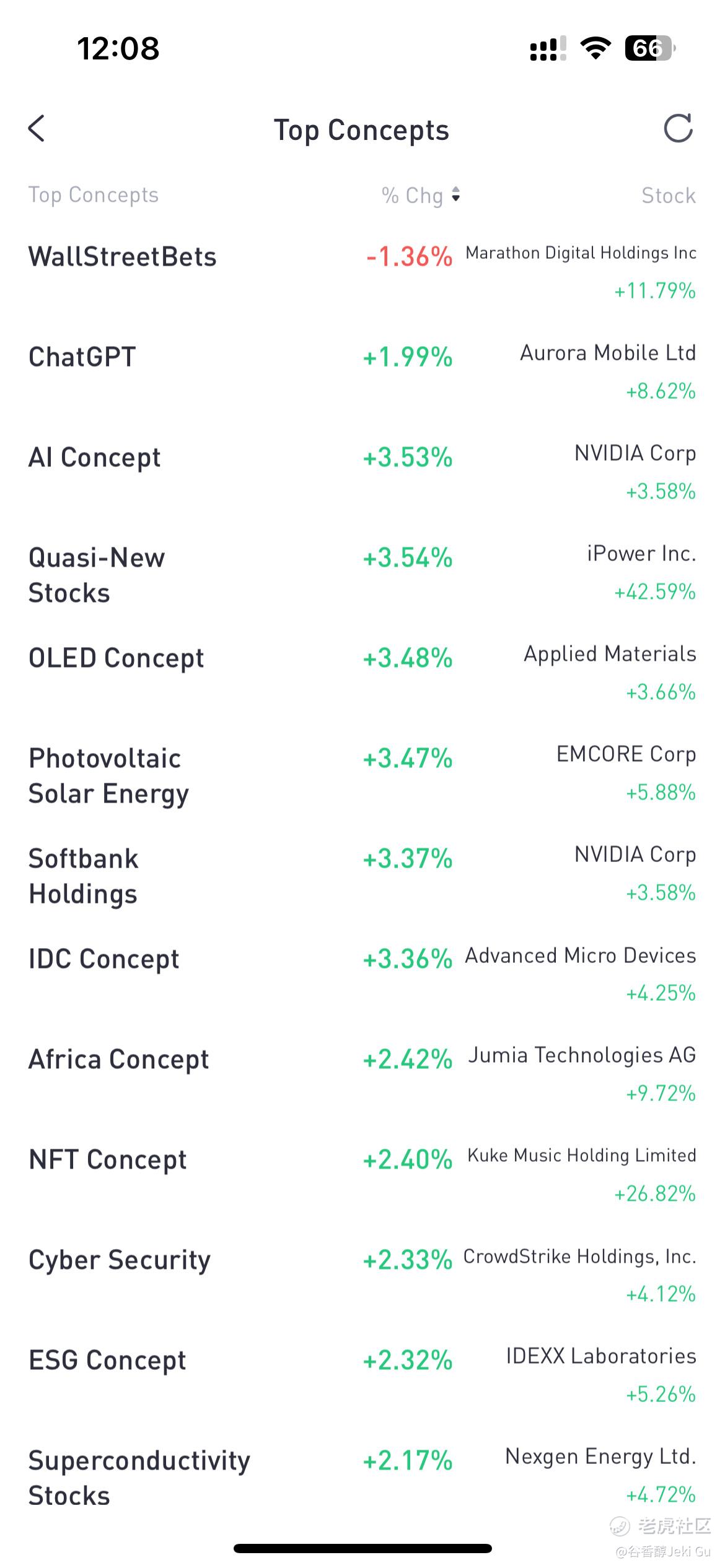

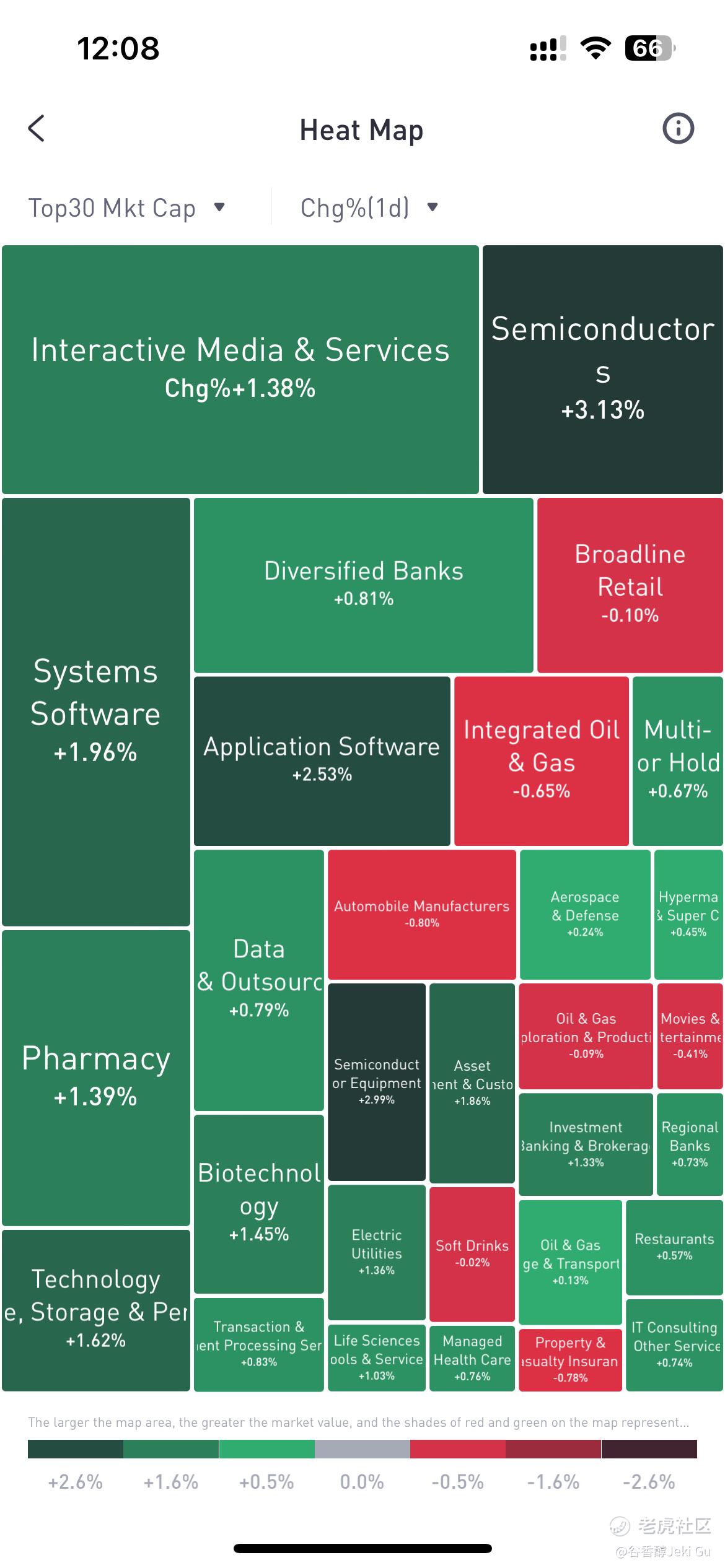

Data released on Wednesday showed that US inflation cooled as expected, reigniting investor enthusiasm for the Federal Reserve to start cutting interest rates. Boosted by optimism, all three major US stock indices closed higher, with the Dow Jones up 0.88%, the S&P 500 up 1.17%, and the Nasdaq up 1.40%. All three indices set new record highs at the close. Large-cap tech stocks rose across the board, with AMD up over 15%, Dell up over 11%, AMD up over 4%, and Nvidia up over 3%.

**Inflation Cools as US Core CPI Hits Lowest in 3 Years**

Data released by the Labor Department on Wednesday showed that despite continued increases in housing costs, prices for goods such as new and used cars accelerated downward, and service cost growth also slowed significantly, driving US inflation to cool. The US Consumer Price Index (CPI) rose 3.4% year-over-year in April, below the 3.5% in March, and rose 0.3% month-over-month, below market expectations. Excluding food and energy, the US core CPI rose 3.6% year-over-year in April, the smallest increase in nearly three years.

**Market Expectations for Fed Rate Cuts Rise, Likely to Support Continued US Stock Market Rebound**

The US April CPI data was closely watched by the market as it will provide important guidance for the Fed's next monetary policy direction. After the release of the CPI, data from the CME Group's "FedWatch tool" showed that market traders' expectations for the Fed to cut rates in September rose from around 60% to around 76%.

Looking back at the recent trend of the US stock market, after hitting new highs in mid-April, the US stock market experienced a correction, but market sentiment improved in May, and the US stock market resumed its upward trend. Analysts believe that one of the important reasons for this volatility is the market's wavering expectations for US inflation data and the Fed's policy outlook. Now that US inflation has cooled as expected, it may support a continued rebound in the US stock market while boosting market confidence.

**European Stock Markets Rise Collectively on Day 15**

The rise in expectations for a Fed rate cut also boosted optimism in European markets. At the same time, the latest data showed that eurozone GDP grew 0.4% year-on-year in the first quarter, seasonally adjusted, better than market expectations, and all three major European stock indices rose on Wednesday. The UK's FTSE 100 index rose 0.21%, the French CAC 40 index rose 0.17%, and the German DAX index rose 0.82%.

**US Commercial Crude Oil Inventories Decline More Than Expected Last Week, International Oil Prices Rise on Day 15**

On the oil front, the latest data showed that US commercial crude oil inventories fell by 2.5 million barrels last week, far exceeding market expectations. International oil prices rose on Wednesday, with the New York Mercantile Exchange's June light sweet crude futures contract settling at $78.63 per barrel, up 0.78%, and the July London Brent crude futures contract settling at $82.75 per barrel, up 0.45%.

**Dollar Index and US Treasury Yields Fall, International Gold Prices Rise Over 1% on Day 15**

In addition, as expectations for a Fed rate cut rose, the dollar index fell 0.64% on Wednesday, hitting a new five-week low, and US Treasury yields also fell. The attractiveness of gold to investors increased, and gold prices rose accordingly. The NYMEX June gold futures contract rose 1.48% to settle at $2,394.90 per ounce.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。