# Yen Falls Against Dollar as US Tech Giants Report Strong Earnings

US Core PCE Data Meets Expectations

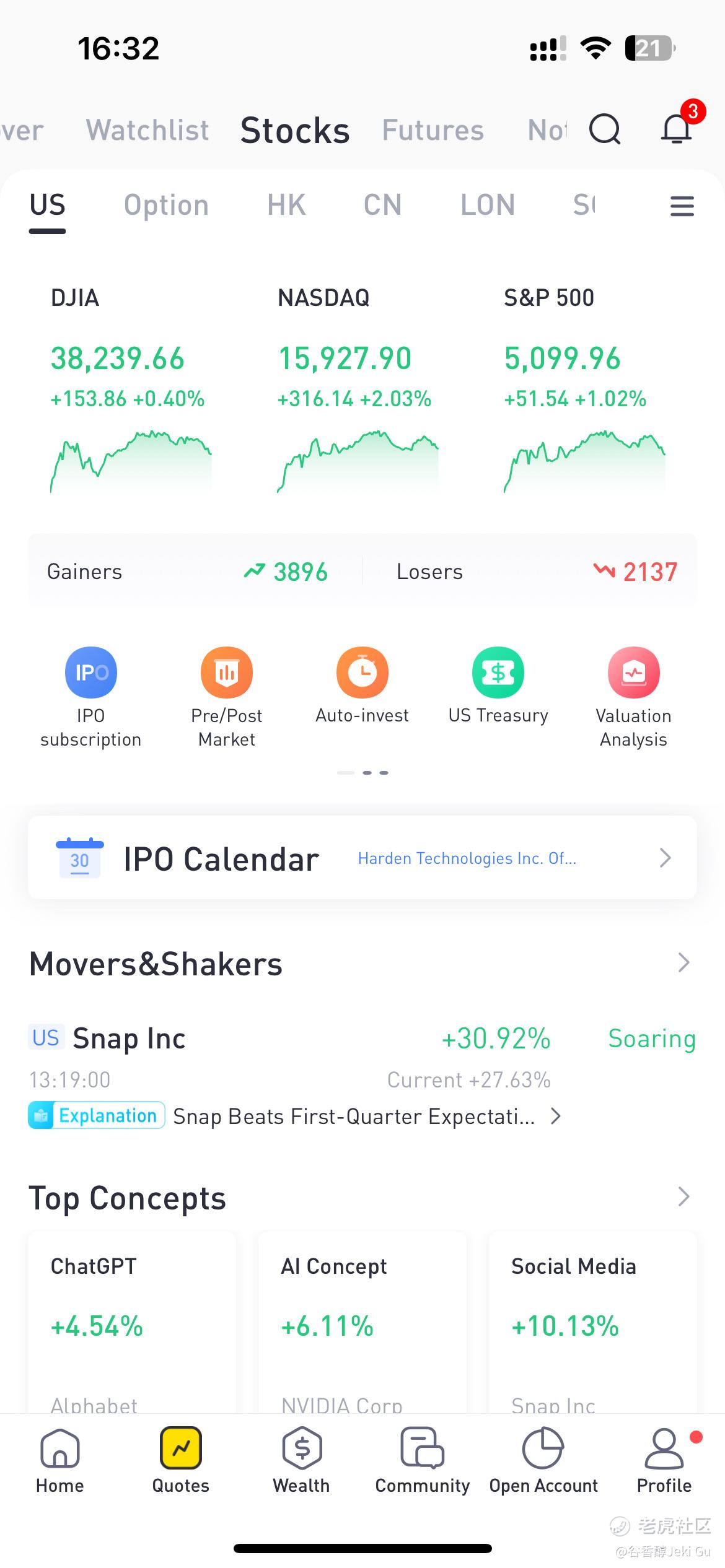

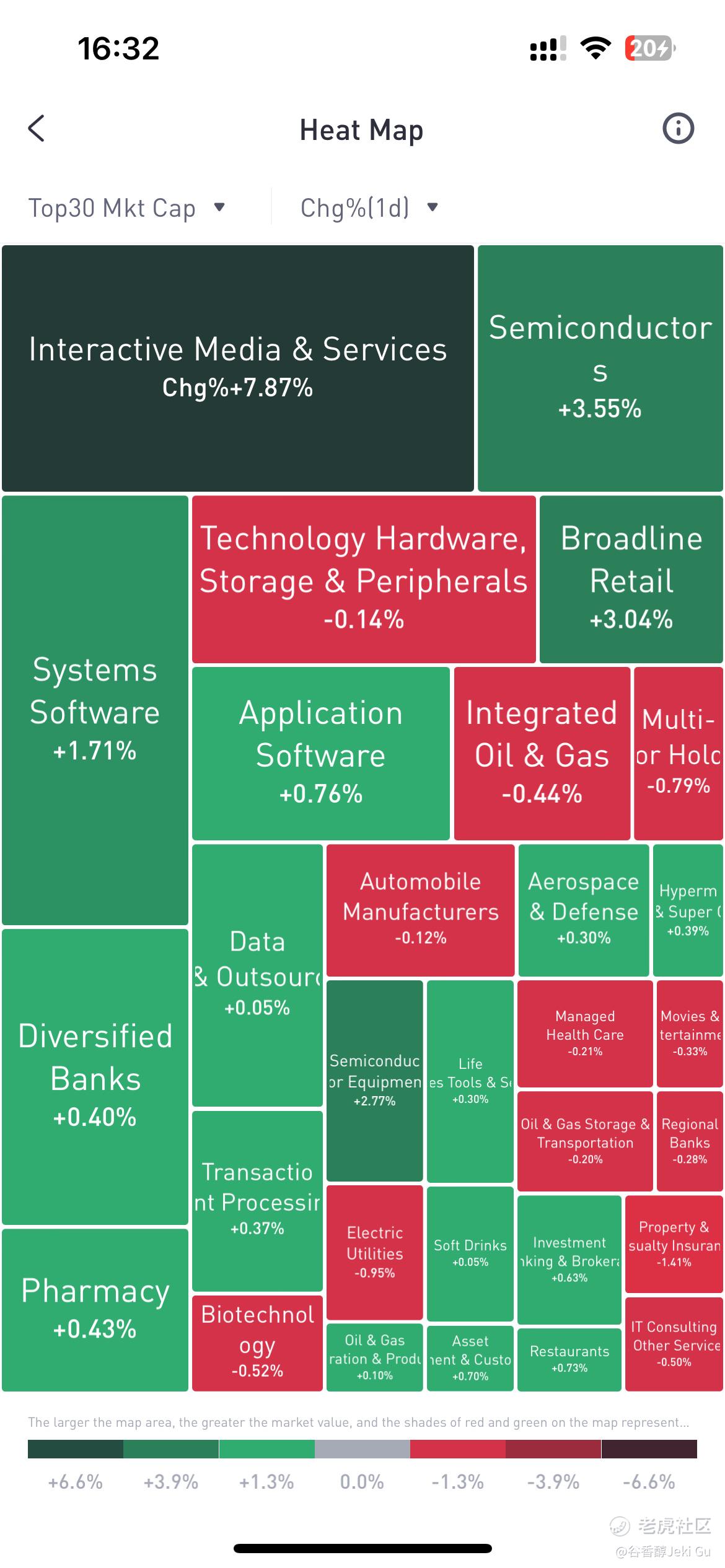

The latest US core personal consumption price index (PCE) for March, released on Friday, came in line with expectations. This, coupled with positive earnings reports from tech giants Alphabet (Google's parent company) and Microsoft, boosted all three major US stock indexes on the day. The Dow Jones Industrial Average rose 0.40%, the S&P 500 rose 1.02%, and the tech-heavy Nasdaq rose 2.03%, outperforming the other two indexes. Among sectors, six of the 11 S&P 500 sectors rose, with the communication services and technology sectors leading the gains, rising 4.70% and 1.85%, respectively. All three major US stock indexes rose for the week, with the Dow Jones Industrial Average up 0.67% for its second straight weekly gain, the S&P 500 up 2.67%, and the Nasdaq up 4.23%, marking the biggest weekly gains for both indexes since November.

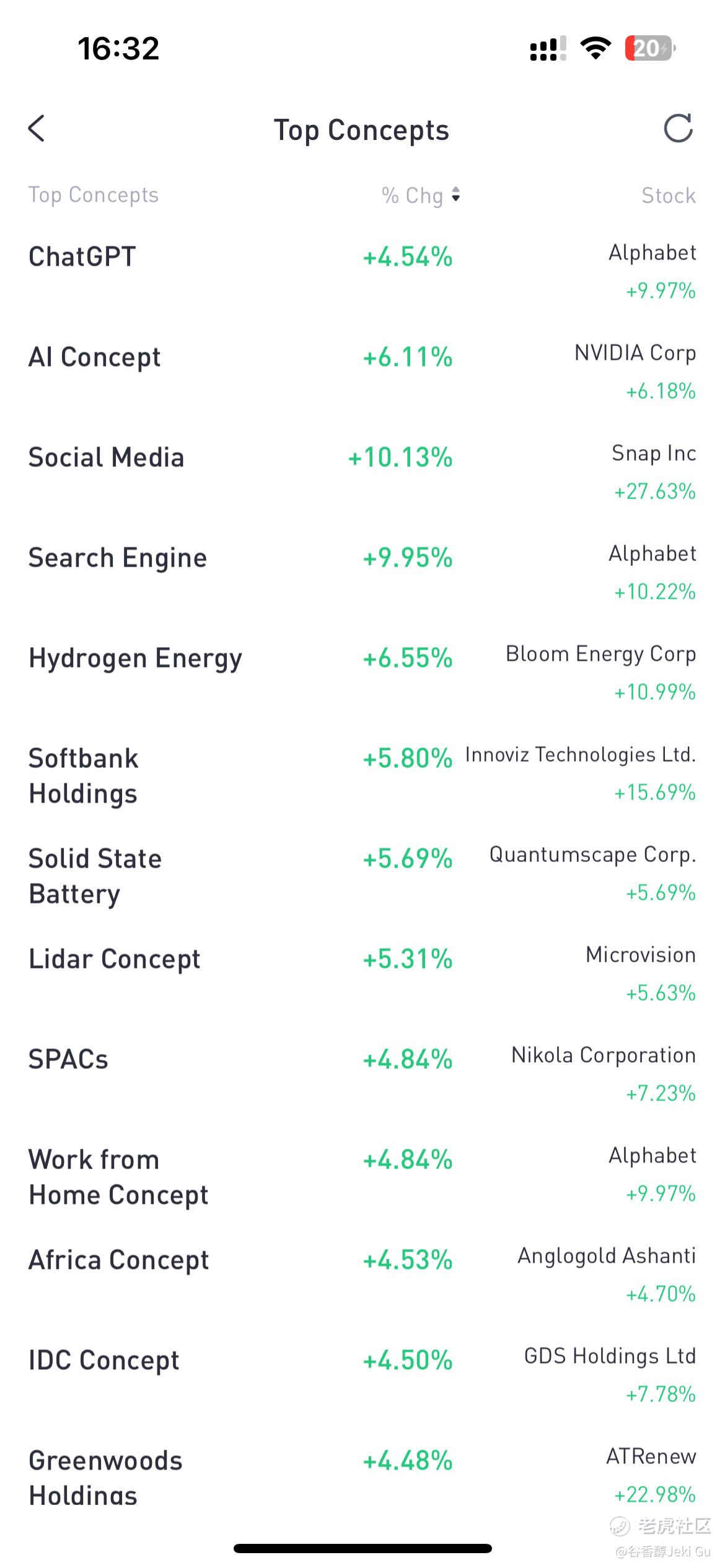

US Tech Giants Report Strong Earnings, AI Heat Continues

After the market closed on Thursday, several tech giants reported strong earnings. Alphabet, Google's parent company, saw its first-quarter revenue grow 15% year-over-year and its net income jump 57%. The company also announced its first-ever dividend and said it would buy back an additional $700 billion in stock. Its shares closed up 9.97% on Friday. Microsoft's third-quarter revenue beat expectations, driven by strong growth in its cloud services business, which is benefiting from artificial intelligence (AI). Its shares closed up 1.82% on Friday. The earnings reports from Alphabet and Microsoft suggest that the AI-driven rally in tech stocks is still going strong.

US Core PCE Rises 2.8% Year-over-Year

Data-wise, the latest data from the US Commerce Department, released on Friday, showed that the core PCE index, which excludes volatile food and energy prices, rose 0.3% month-over-month and 2.8% year-over-year in March. Analysts said the data, a key inflation gauge for the Federal Reserve, suggests that inflation showed little sign of slowing in March, adding to concerns about price pressures, but is unlikely to change market expectations that the Fed will not cut rates before September. The Fed is scheduled to hold a monetary policy meeting next week, and markets are widely expecting the Fed to keep rates on hold.

Bank of Japan Keeps Policy Unchanged, Yen Falls to Fresh 34-Year Low Against Dollar

In the currency market, the Bank of Japan decided to keep its current monetary policy unchanged at its meeting on Friday, suggesting that it will maintain its easy monetary policy. As expectations of quantitative tightening were not mentioned, the yen sell-off intensified again in the foreign exchange market. Following the news, the yen-dollar exchange rate fell sharply in the New York forex market on Friday, breaking through the 158 yen-per-dollar level for the first time since June 1990, again setting a new low in about 34 years. In addition, the US core PCE index for March showed no signs of slowing inflation, and the dollar index extended its gains during the day, pushing the yen lower. The yen-dollar exchange rate closed at 158.33 yen per dollar on Friday.

Oil Prices Rise on Friday

In oil, market concerns about tensions in the Middle East supported oil prices on Friday, ending two straight weeks of declines in global oil prices. Light sweet crude for June delivery on the New York Mercantile Exchange rose 0.34% to settle at $88.66 a barrel, while Brent crude for June delivery on the ICE Futures Europe exchange rose 0.55% to settle at $92.20 a barrel. For the week, the light sweet crude main contract on the New York Mercantile Exchange rose 0.85%, while the Brent crude main contract rose 2.53%.

Gold Prices Rise on Friday

On Friday, gold prices held on to the previous day's gains as the US core PCE index for March showed US inflation rose in line with expectations. Gold for June delivery on the New York Mercantile Exchange settled at $2,347.20 an ounce, up 0.20% on the day. However, it fell 2.76% for the week.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。