# Elon Musk Says Model 2 Scheduled for Early 2025 Release, Gold Prices Fall to Lowest in Nearly 20 Days

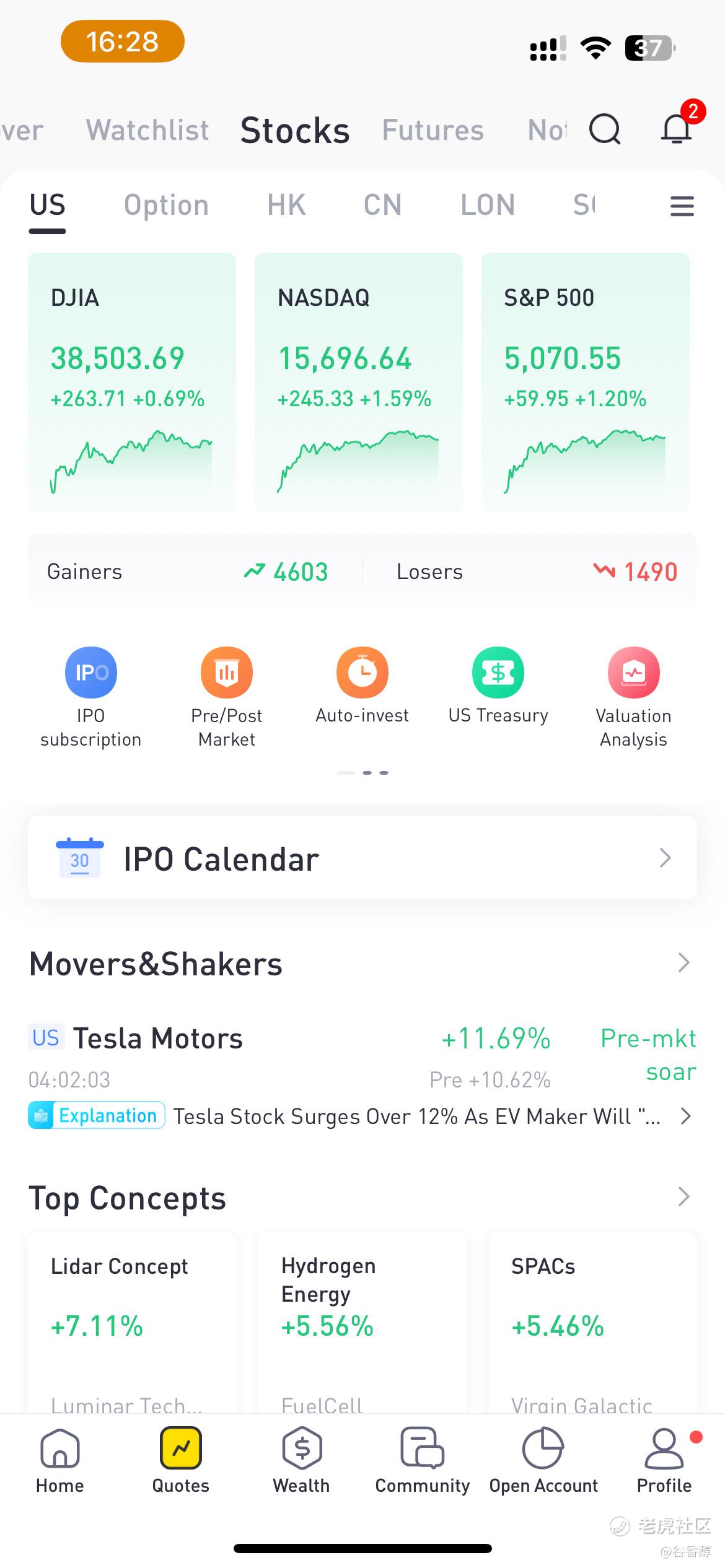

US Manufacturing PMI Falls Below Expectations, Stocks Rise

The latest Markit manufacturing PMI for the US in April came in below expectations and the previous month's figure, at 49.9, falling below the breakeven line.

The US services and composite PMIs for April also fell to new five-month and four-month lows, respectively.

The bad news for the real economy, on the other hand, eased market concerns about the Fed delaying rate cuts, causing Treasury yields to fall and the three major US stock indexes to close up on the day.

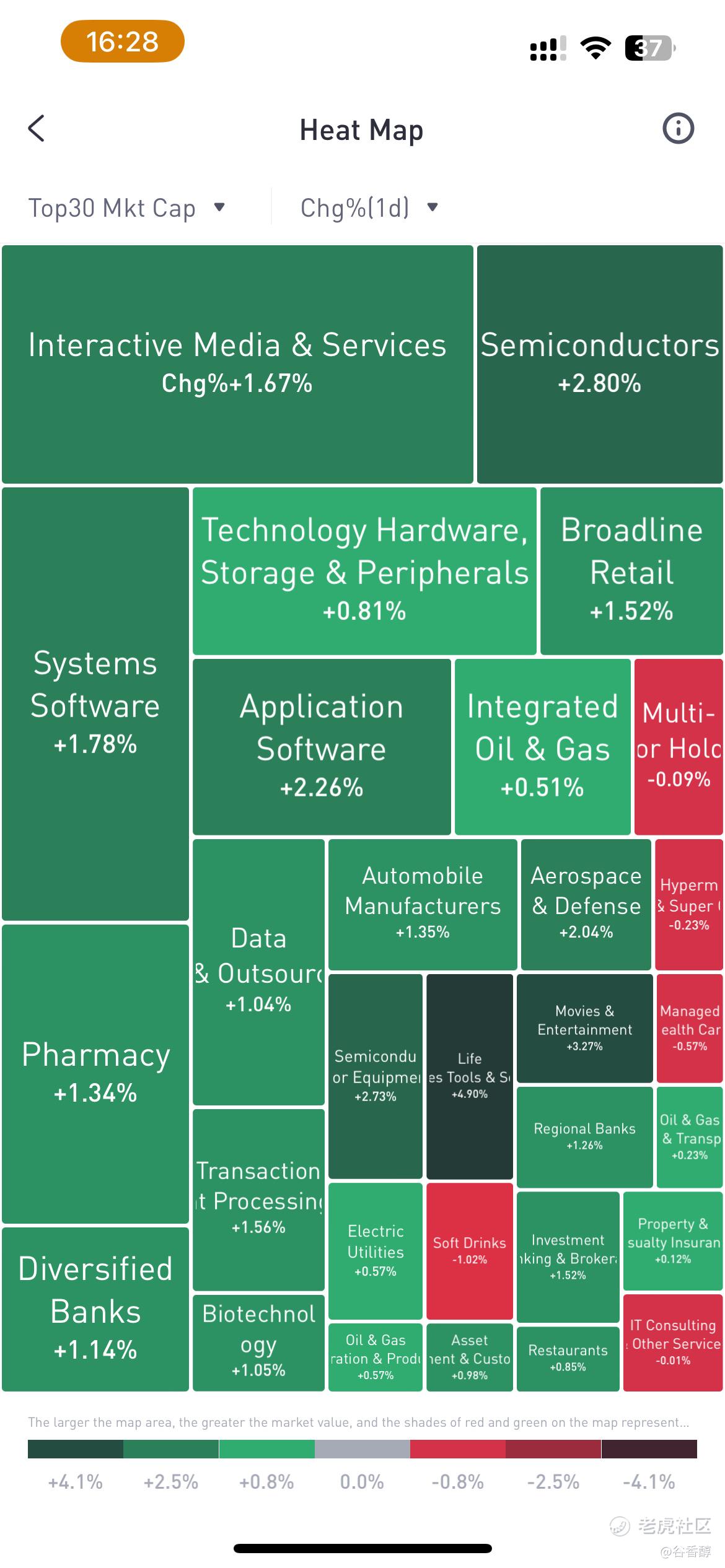

By the close, the Dow was up 0.69%, the S&P 500 was up 1.20%, and the Nasdaq was up 1.59%.

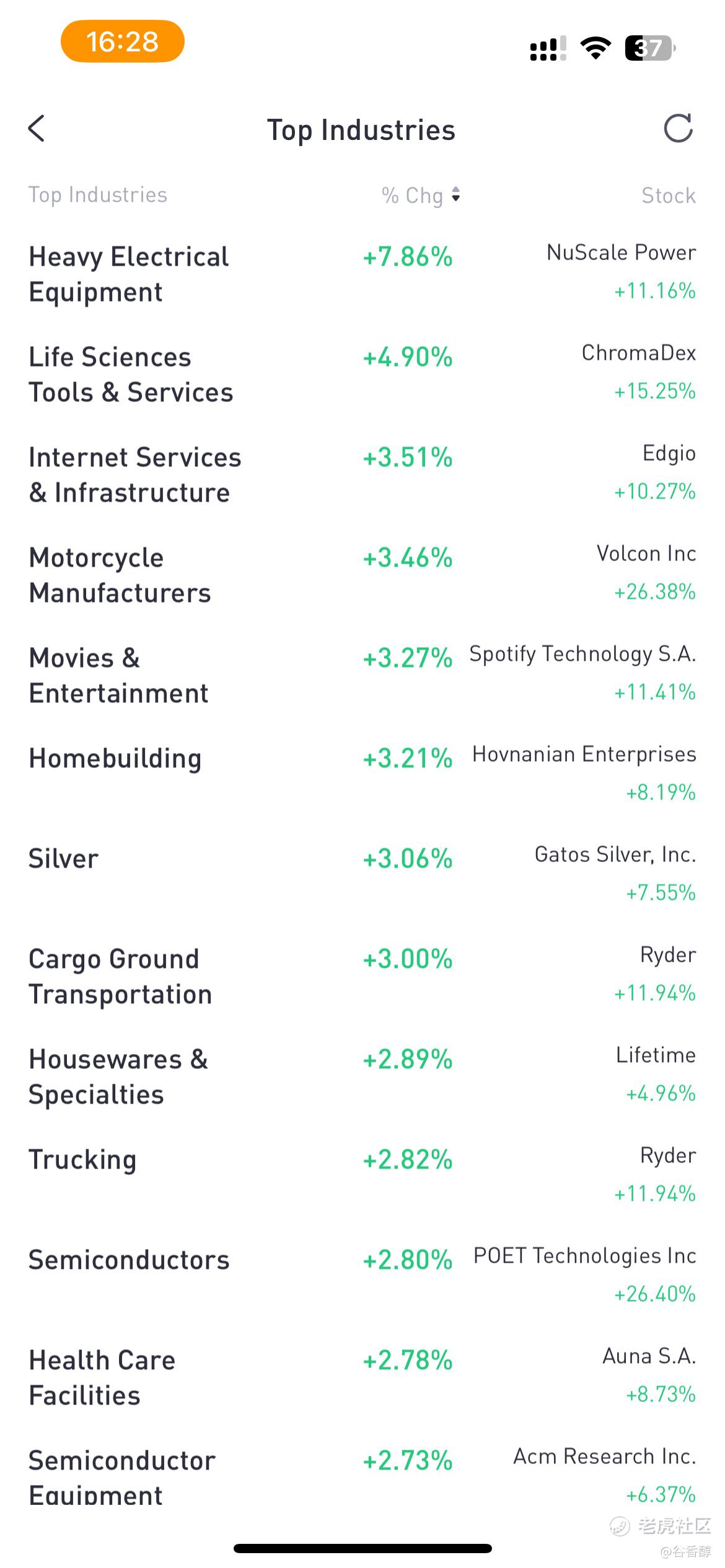

Chip stocks were broadly higher on Tuesday, with Nvidia up 3.65% and Micron Technology up 3.06%.

Tesla Q1 Revenue Slumps, New Model News Sent Shares Soaring

Several US tech giants released earnings this week.

Tesla's Q1 2024 earnings report, released after the market closed on Tuesday, showed a 9% year-over-year decline in revenue, the largest quarterly revenue decline in 12 years, and a 55% year-over-year decline in net income. All key financial metrics missed expectations.

The company also maintained its guidance for "significantly lower" production and deliveries.

Despite the negative earnings report, Musk made it clear on Tesla's earnings call that the more affordable Model 2, previously reported as the Model 2, is scheduled for release in early 2025.

Musk said the new model will be built on existing production lines, eliminating the need for new factories, and did not rule out an earlier release date. He also said he expects Tesla's humanoid robot to be on sale by the end of next year.

Shares of Tesla, which closed up 1.85% on Tuesday, jumped 11.40% in after-hours trading after the news.

European Stocks Rise Across the Board

In Europe, the latest data on Tuesday showed that the eurozone services PMI rose to 52.9, above expectations, and has been above the breakeven line for two consecutive months. The data boosted investor sentiment, and the three major European stock indexes closed higher on the day.

By the close, the UK stock market was up 0.26%, the French stock market was up 0.81%, and the German stock market was up 1.55%.

Oil Prices Rise

In oil futures, easing Middle East geopolitical tensions, a decline in the dollar index, and a rebound in several eurozone PMI data to near one-year highs in April boosted market optimism for the outlook for European oil demand, sending international oil prices higher on Tuesday.

By the close, New York Mercantile Exchange light sweet crude for June delivery rose $1.78 to settle at $83.36 a barrel, and London Brent crude for June delivery rose $1.63 to settle at $88.42 a barrel.

Gold Prices Fall

In precious metals, risk-off sentiment cooled further, as Fed officials have been sending hawkish signals recently, leading the market to expect the Fed's first rate cut to be pushed back to September. These factors put pressure on gold prices, which fell 0.18% on Tuesday to their lowest level in nearly 20 days.

By the close, New York Mercantile Exchange gold futures for June delivery fell $4.10 to settle at $2,342.1 an ounce, down 0.18%.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。