What is the key advantage of specialized and sophisticated "Little Giant" enterprises?

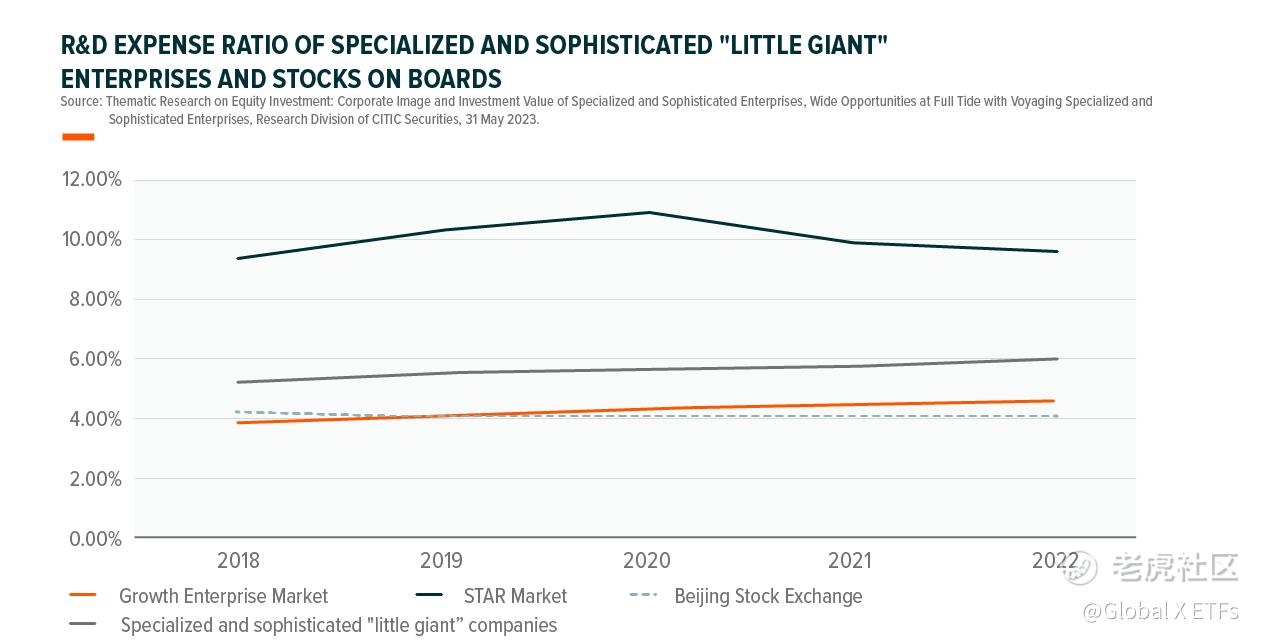

[For Hong Kong Investor Only] The key advantage of specialized and sophisticated "Little Giant" enterprises is their own technological power and their continuous innovation. Most of the "Little Giant" enterprises specialize in niche markets for as long as 16 years on average[1], and the R&D expenses are obviously higher than those of comparable companies.

Putting the 12,000 specialized and sophisticated "little giants" enterprises on the growth gradient of "specialized and sophisticated SMEs - specialized and sophisticated "little giants" enterprises - single champion in the manufacturing industry", the "little giants" are characterized by the following factors The technological volume (total number of patent applications), technological quality (percentage of patents for inventions), technological influence (total number of citations of patents), and technological globalization (total number of PCT patents) of the "little giants" are about 1-3 times higher than that of the specialized and sophisticated SMEs. Compared with the manufacturing industry champions, there is still a gap of nearly 10 times between the "little giants" and them in terms of various indicators. Especially in terms of PCT patents, the average number of PCT patents owned by single champion enterprises is 59, while that of "little giants" is only about 1.65, which is nearly 36 times of the growth space between the two. [2].

[1]: Thematic Research on Equity Investment: Corporate Image and Investment Value of Specialized and Sophisticated Enterprises, Wide Opportunities at Full Tide with Voyaging Specialized and Sophisticated Enterprises, Research Division of CITIC Securities, May 31, 2023.

[2]: Patsnap Issues the 2023 Scientific and Innovation Report for Specialized and Sophisticated "Little Giant” Enterprises , August 24, 2023.

Know more about Global X China Little Giant (2815) and the risk factors: https://www.globalxetfs.com.hk/campaign/china-little-giant-etf/

----

This material is intended for Hong Kong investors only. It is not a solicitation, offer, or recommendation to buy or sell any security or other financial instrument. Investment involves risks. Investors should refer to the Fund's prospectus for details, including the risk factors. Investing in the funds may expose to risks (if applicable) including general investment risk, equity market risk, sector/market concentration risk, active / passive investment management risk, tracking error risk, trading risk, risk in investing financial derivative instruments, securities lending risk, distributions paid out of capital or effectively out of capital risk. Past performance information presented is not indicative of future performance. Issuer: Mirae Asset Global Investments (Hong Kong) Limited. This material has not been reviewed by the Securities and Futures Commission.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。