经济不确定,库存积压:运动健身消费品上市公司如何应对消费疲软?

两个月前,猫总梳理了一份市值在 10 亿美元以上的运动健身消费品上市公司列表。一共 41 家公司,囊括了运动鞋服品牌厂商、经销商、代工厂、食品饮料品牌厂商以及健身器械制造和健身房运营商行业。现在一眨眼一个季度过去了,大多数公司也已经发布了最新季度的财报数据,正好回头来看看,这些公司和上个季度比起来都有哪些变化。

TL;DR 全部收录公司总市值环比下降 6.4%; 宏观经济形势增添了经营的不确定性,通胀压力导致成本上涨,消费者支出收紧,零售商库存积压,使需求疲软; 多数运动鞋服厂商表示库存水平仍高于正常水平,消费疲软使得库存周转受阻,企业正在积极采取促销和控制采购等措施以降低库存; 消费者更加注重产品的价值和功能,购买决策变得更加理性。

免责声明:本文提及的股票标的不构成投资建议,过去表现不代表未来,购买可能导致亏损,投资须谨慎、独立判断。信息准确性有限,读者应核实、考虑其他可靠信息来源。本文信息来源可能不准确或不完整,对此不负责任。前瞻性陈述仅代表作者观点,未来结果可能不同,依赖前瞻性陈述导致的损失不负责任。

整体市值变化

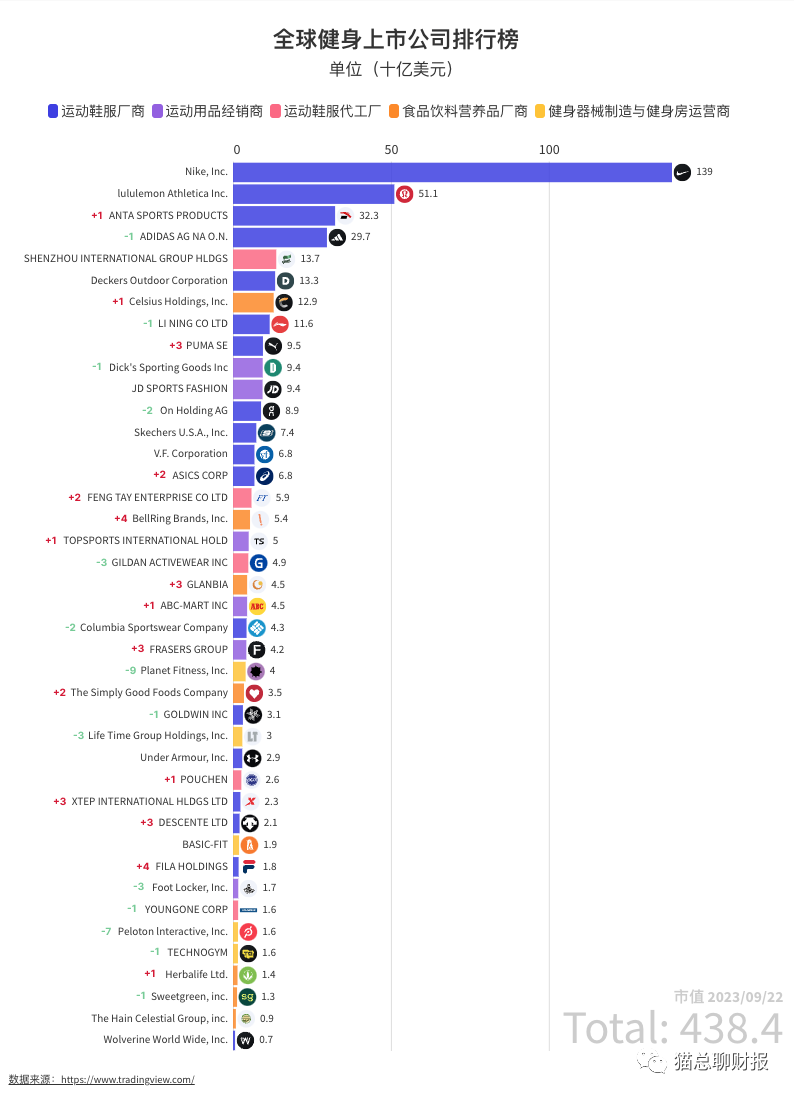

以 2023/9/22 截止的公司市值与上次统计排名时(2023/07/11)相比, 全部收录的 41 家上市公司总市值从 4684 亿美元降到 4384 亿美元,环比下跌 6.4%,这意味着在这一时间段里,这些公司的市值整体出现了较大幅度的下降。

其中一大亮点是逆势增长的安踏,市值达到 323 亿美元,环比增长 16.47%,超过 Adidas 进入整个榜单的 TOP 3。

从这个阶段股价涨幅来看,环比上涨前三名分别是:ASICS(+21.50%),康宝莱(+16.49%),安踏(+16.47%),下跌前三名分别是:Peloton(-45.96%),Wolverine World Wide(-38.21%),Planet Fitness(-35.42%)。

详细数据可以点击这里查看。

宏观经济及市场变化

整体来看,多数公司表示宏观经济形势增添了经营的不确定性。通胀压力导致成本上涨,同时消费者支出收紧,零售商库存积压,使需求疲软。中国方面,虽然疫情放开带来恢复,但复苏相对缓慢。

PUMA 表示全球宏观经济环境存在不确定性,疫情后的中国经济复苏也存在不确定性。

When we now look at 2023 for the remainder of the year, I think it's clear when we look at the market, the market remains challenging. The macroeconomic are still what it is, the volatility in the retail environment is also there, and I think despite China’s economic recovery, it's clear from a direction, the speed and the path it's taking is not clear. These are the same challenges and risks which we already saw in H1, and in that H1 we were able to show at PUMA that we have a continued brand momentum, are able to deliver sales and EBIT on expectation, and were able to normalise our inventory back to normal levels. [1]

安踏对于下半年的经营环境,持谨慎乐观态度。

The Chinese government launched a series of economic stimulus measures. We believe that in the future, they can supplement the driving force of economic growth and boost consumption. So concerning the operating environment of the second half, we are cautiously optimistic. [2]

李宁认为虽然市场正在逐步复苏,但经营环境仍有压力,消费复苏相对缓慢。

This year, although the market is gradually recovering, operating environment is still under pressure and recovery of consumption is relatively slow. In face of the less-than-expected end-user environment, the company has actively launched countermeasures.[3]

迪克体育用品表示服装行业整体销售有所放缓

We saw tremendous growth in team sports and in footwear. And you're correct, apparel did soften. The one thing I want to point out about apparel is that the softening was at an industry level, we did continue to gain market share. And importantly, our Nike apparel business was extremely positive, very strong. And our flagship vertical brands were also very strong. So we're very optimistic and bullish about apparel going forward.[4]

申洲国际认为当前外需增⻑疲软、内需复苏缓慢,以及零售端去库存叠加,成为当前行业发展最大的挑战。

当前全球经济增⻑放缓,地缘政治冲突持续,国际间之产业分工模式存在重新调整之风险,全球产业布局向区域化、本土化方向加速重塑。外需增⻑疲软、内需复苏缓慢,以及零售端去库存之叠加影响,成为了当前行业发展之最大挑战。主要发达经济体之通胀虽有见顶回落,但仍处于高位,发达经济体之货币政策紧缩效应显现,持续加息后的高利率抑制了消费增⻑,在货币政策调向之前,海外市场之消费需 求仍将持续承压。从中国市场来看,市场需求在疫情管控放开后正逐步恢复,但疫情之后续影响尚未完全消除, ⻘年人就业压力较大,居⺠收入预期之信心尚待恢复,消费持续增⻑的动能存在一定挑战。[5]

Basic Fit 表示能源成本对俱乐部营运有较大负面影响

Besides rising costs due to a growing club network, other club operating costs were as expected, impacted by a strong increase in energy costs. On average, energy cost per club were double the amount of a year ago [6]

库存以及产能变化

从库存和产能角度看,多数运动鞋服厂商表示库存水平仍高于正常水平,受宏观经济增速放缓和通胀压力的影响,消费疲软使得库存周转受阻,企业正在积极采取促销和控制采购等措施以降低库存。

考虑外部环境的不确定性,Nike 在上半年谨慎减少进货量。

And so we made a decision to tighten our first half buys and continue the trend that we had done in the second half. But we are expecting retail sales to continue a trend, so retail sales to the consumer to continue a trend of growth versus the prior year. And actually, when we look at the first half and the second half of next year, we're actually planning for a fairly consistent level of retail sales growth to the consumer.[7]

lululemon 表示尽管运营效率还未完全优化,库存周转率也稍低于历史正常水平,但⻓期目标是使库存周转率恢复正常。

We still have some degree of elevated airfreight in our inventory balance on a cost basis. And so I would say not completely optimized and turns are a little bit slower than history, and our goal over the longer term would to get those inventory turns back to normalized historical rates. So still some opportunity, but I think the team has done a nice job in navigating what was a really dynamic supply chain and positioning inventory so that we were able to capitalize on the demand upside that we saw and experienced. [8]

Adidas 表示北美市场整体存在大量库存,不仅仅是自身品牌,也包括竞争对手。

Going over to business. I think you have probably seen all the numbers already, but we'll repeat them quickly. It was a quarter where I said or we said we think we were happy with the development. We're starting with the biggest problem, that's North America. As you can see, minus 16% in the quarter, minus 18% for the first half. Needless to say, you know this. There is still a lot of inventory in the market, not only ours, but also ours. And the problem is, of course, some of that inventory is not great. That means that the sell-through is slow, and we have to work through that for a while and that because of that, also the discounts are high in general and also of our products. [9]

德克斯户外表示由于经销商提前收货造成 UGG 美国批发业务面临挑战。

As expected, this decline resulted from lapping earlier wholesale shipping patterns over the last couple of years in the U.S. UGG was able to offset this challenging compare in the U.S. with the strength of the brand's international regions.[10]

斯凯奇表示美国批发业务营收下降是由于经销商库存问题造成的。

The domestic wholesale decrease was due to inventory-related issues impacting many of our partners. In addition, it is worth noting that we faced a difficult comparison to a particularly strong quarter last year, where we grew 30%. We saw strength in our international wholesale business, increasing 10% as we grew in almost every market. [11]

迪克体育用品表示影响毛利率的主要问题是高库存缩水以及有组织的盗窃问题。

Two key factors impacted our second quarter gross margin relative to our original expectations. The first was the impact of higher inventory shrink. Organized retail crime and theft in general, an increasingly serious issue impacting many retailers. Based on the results from our most recent physical inventory cycle, the impact of theft on our shrink was meaningful to both our Q2 results and our go-forward expectations for the balance of the year. We are doing everything we can to address the problem and keep our stores, teammates, and athletes safe.[12]

经销商及渠道变化

从经销商和渠道角度看,老牌运动鞋服品牌商开始重新审视并调整经销商渠道渠道与自有渠道之间的关系,新晋品牌则根据自身情况积极布局 DTC 以及经销商渠道。另一方面,能量饮料生产商通过与大型经销商和新合作伙伴的战略联盟,正在快速拓展销售渠道。

Nike 表示将在经销商未充分覆盖的细分市场开设品牌直营店。同时,多品牌经销商也发挥着非常重要的作用。

We augment that with owned retail, where we are building out stores, NIKE stores in segments that are currently underserved by our wholesale partners. We would say women's is one of those cases and Jordan being another. So we're selectively opening new doors. And then multi-brand wholesale partners play a really important role. And as I said in my remarks, there's different segments. So we spent a lot of focus and attention, and we've talked a lot over the last couple of years about the larger multi-brand partners like DICK's and JD and Foot Locker and Sports Direct. [13]

德克斯户外表示 HOKA 品牌将主要通过 DTC 渠道来满足增⻓。

We prefer that HOKA satisfies upside through the brand's DTC business, which is what we saw happen this quarter. … So we're managing that tightly by purpose. But again, as I say, raising awareness at a high level, and seeing the brand interest coming directly to our DTC business is super exciting for us. Obviously, it's our most profitable sale.[14]

昂跑表示经销商渠道贡献的营收占比进一步提升。

General Sporting Goods, Run Specialty and Department Stores continue to be our largest wholesale channels, all of which saw greater than 50% growth. Net sales generated by the wholesale sales channel as a percentage of net sales increased to 65.2% for the six-month period ended June 30, 2023, from 64.1% for the six-month period ended June 30, 2022. [15]

Foot Locker 计划在 2026 年实现 40% 的营收来自非 Nike 品牌

We also continue to see outperformance from brands like Puma, Crocs, ASICS and Brooks as our customers are seeking out other brands with us. As a result, in line with our strategy, the diversity of our brand mix beyond our top brand Nike increased to 36% from 31% last year, making good progress towards our goal of over 40% by 2026.[16]

燃力士对与百事的合作关系非常满意,并继续看好未来的增⻓空间。

We have been extremely happy with our PepsiCo partnership and see a long runway of growth ahead across a variety of channels, including expanded retail, convenience and foodservice. As highlighted in our earnings supplement for the 4-week period ending per IRI SPINS, total energy data ending June 18, 2023, as stated in MULOC, Celsius maintains the #3 energy drink position in the U.S. and now has an 8.6% market share, which doubled from the prior year's share of 4.3%. [17]

消费者购买习惯变化

从消费者购买习惯变化来看,多数公司表示消费者更加注重产品的价值和功能,购买决策变得更加理性。较低收入阶层的购买力受到压力,对高价产品的购买变得更加谨慎。但是对于运动和健身相关的主要产品,消费者仍保持较高的关注度。

Nike 认为中国市场 Z 世代是最活跃的一代人,中产对于健康和保健投入更多关注。

And looking ahead, we're optimistic about NIKE's brand, Jordan's brand, the momentum we have as well we think it's the structural tailwinds in the region make us optimistic over the long term. Gen Z is the most active generation. There's a growing middle class, increased focus on health and wellness, so a very energizing visit and makes us very confident about our brands and our business in China. [18]

PUMA 表示将在中国市场的品牌定位方面,投入更多在运动品牌属性方面,而不是过度依赖生活方式概念

For us a strong rebound in China we laid out a clear strategy. We said we also need to strengthen our credibility as global sports brand, we’re too dependent as a lifestyle brand. We have the resources local-for-local on the design development and sourcing side and we need to use it more to design and develop the right product for the Chinese consumer. And we said we need to re-engage and re-excite our consumers online and offline, and strengthen our organization. [19]

迪克体育用品认为运动产品已从可选消费品变成消费者重要和必需的类目。

I think what we used to consider as a discretionary category has become something that's very important to them and something they're voting with their wallet that they want to maintain a healthy, active lifestyle, team sports, running, walking, all of these things.[20]

Foot Locker 认为低收入消费者在开支上更为谨慎和价值导向,他们的购买决策更看重价格和价值。

Looking back to March, when we outlined our Lace Up plan and our longer-term targets, we were coming off a strong holiday and had not yet seen the full weight of the macro environment on our lower income consumer. This became much more evident through the second quarter, including a weaker start to back-to-school. The store traffic and conversion challenges we began to see in late Q1 persisted through the second quarter as our customers remained cautious with their discretionary dollars. As a result, we promoted more heavily than initially planned to better compete for a share of our customers' wallet and manage our inventory levels. And while we see our customers respond to newness, they remain value focused. And as a result, we continue to utilize increased promotions to support the business.[21]

华利集团认为鞋履属于生活必需品及易耗品,不太担心运动鞋销售需求下滑的问题

鞋履属于生活必需品及易耗品,特别是近些年的消费趋势看,运动鞋的着装场景和人群都在扩大,公司不太担心运动鞋销售需求下滑的问题。公司的客户主要是国际品牌运动鞋,客户在欧美市场的占比高。根据部分品牌已发布的财报来看,大多数品牌在北美、欧洲区域的增⻓都还不错。但是考虑到 2023 年全球经济形势的不确定性,我们也会综合评估各品牌预告订单的准确度,会密切关注全球经济形势以及各品牌的业绩情况。[22]

魔爪饮料表示为部分抵消通胀压力而实施的价格调整措施并未对消费者需求造成重大影响。

In conclusion, I would like to summarize some recent positive points. First, the energy category continues to grow globally. Second, we are pleased to report that our pricing actions, which have been implemented to partially mitigate inflationary pressures have not significantly impacted consumer demand. Third, our AFF flavor facility in Ireland is now providing a large number of flavors to our EMEA region, enabling better service levels and lower landed costs to our EMEA region. [23]

燃力士表示公司正在受益于⻝品饮料行业中三大最快增⻓趋势:更健康、更加功能化和针对健身人群。

Celsius is really capitalizing on 3 of the fastest-growing trends in food and beverage. So everyone wants better for you, but they don't want to sacrifice flavor. So we deliver on that, with 7 essential vitamins, and great flavor combinations. Probably some of the most innovative flavors in the industry. And then when you look at functionality, we delivered on that. And consumers want more out of the foods and beverages they consume. And then fitness is heat, cool, sexy premium and align with today's health-minded consumer. And that's in our DNA, and that's who we are. So Celsius Live Fit, and Essential Energy inside and outside the gym. [24]

BellRing 表示消费者对功能性饮料和运动营养产品的兴趣仍然很高,健康、保健和健身的趋势继续推动公司营收增⻓。

The convenient nutrition category grew 14% in Q3 as tailwinds around health and wellness and fitness continue to drive growth. Consumer interest in functional beverages and sports nutrition products continues to be high. Ready-to-drink growth led the category at 21% and ready-to-mix grew 16%. Increased supply is lifting ready-to-drink growth while increased promotion, marketing and distribution are boosting both segments.[25]

Glanbia 表示旗下品牌继续面临减肥类别产品在美国整体低迷的影响, 一些重要的美国零售商正在缩减近期该品类的货架空间。

Despite brand investment and indeed, retailer support for the brand refresh, the diet category and the SlimFast brand has not regained the anticipated momentum. As a result, some key U.S. retailers are reducing category shelf space in the short term, and this will reduce distribution for SlimFast into next year. Undoubtedly, weight management remains a key focus for consumers in the U.S. And given this, we will navigate the current category dynamics by refocusing our efforts and rebasing our investment back to those core meal replacement ready-to-drinks and powder shakes. [26]

Simply Good Foods 认为消费者的消费场景正在从零售渠道向性价比更高的渠道转移。由于人们外出加班的原因代餐产品增⻓比较快,零食属性更多的产品则增速放缓 。他们还表示减肥药能刺激减肥需求,从而带动相关补充膳⻝产品的增长。

The recessionary economy continues to be a concern as shopper traffic shifts away from grocery to more value-oriented channels. …So shakes and Meal Bars, which tend to be meal replacement on-the-go meal replacement, somewhat driven by kind of being on-the-go and being back to work. We've seen those businesses pick up. Where we've seen the slowdown has been in kind of the more snackier portion of the portfolio, snack bars and [ Endulge ]. … So that -- look, the drugs are driving renewed interest in weight management, and that's always a good thing for your business because the challenge as you know from your experience with the brand, the challenge is getting people actually to take interest to action when it comes to how they look and how they feel. [27]

星球健身认为消费者支出受限,但 Z 世代用户在会员基数中的比例大幅增加。

I think we're definitely seeing the impact, as we've discussed from the generational shift with Gen Zs being a big part of the join mix. We think -- and for the first time, Simeon, we're seeing a little bit of softness across all the age generations year-on-year that might be a little bit of --2 So the biggest impact by far is the Gen Z mix within our membership base increasing more dramatically. [28]

Life Time 表示 pickleball 是北美增长最快的运动,会员参与该项目的人数与去年同期相比增长 7 倍。

So, we're rapidly expanding in this space.If you look at the number of members who play pickleball today versus who played at the start of last year, we've seen a 7-fold increase in pickleball. So, we were very proactive, very much in front of this trend. It's the fastest-growing sport in North America, as you probably all know. So, we're really pleased with pickleball.That's been incremental memberships for Life Time, some incremental revenue in terms of private lessons and leagues and things like that.[29]

Basic Fit 表示会员流失率已经恢复到疫情前水平。

As expected, we saw churn rates normalizing the past quarters to pre-COVID level of around 4% per month for the low rate after lifting of COVID measures in 2022.[30]

Peloton 表示因单车召回事件影响会员流失率短期有所提升,预计下个季度恢复正常。

We expected it to be about 1.3%. And then what we did see in the -- related to the Seatpost Recall, was that we did see our churn rate increase a bit in May and June relative to April. And that's a typical seasonality for us. So we do believe that, that was related to the Seatpost Recall.… They should all receive them by the end of September. But we don't know that people will immediately un-pause the moment that they get their Seatpost. But it is really important to understand that just by virtue of not having that paused subscriber base increase, our churn should come down to more like the 1.4% range and perhaps even a little bit better than that. We'll also expect to see a little bit of benefit from seasonality as well.[31]

排行榜名单调整

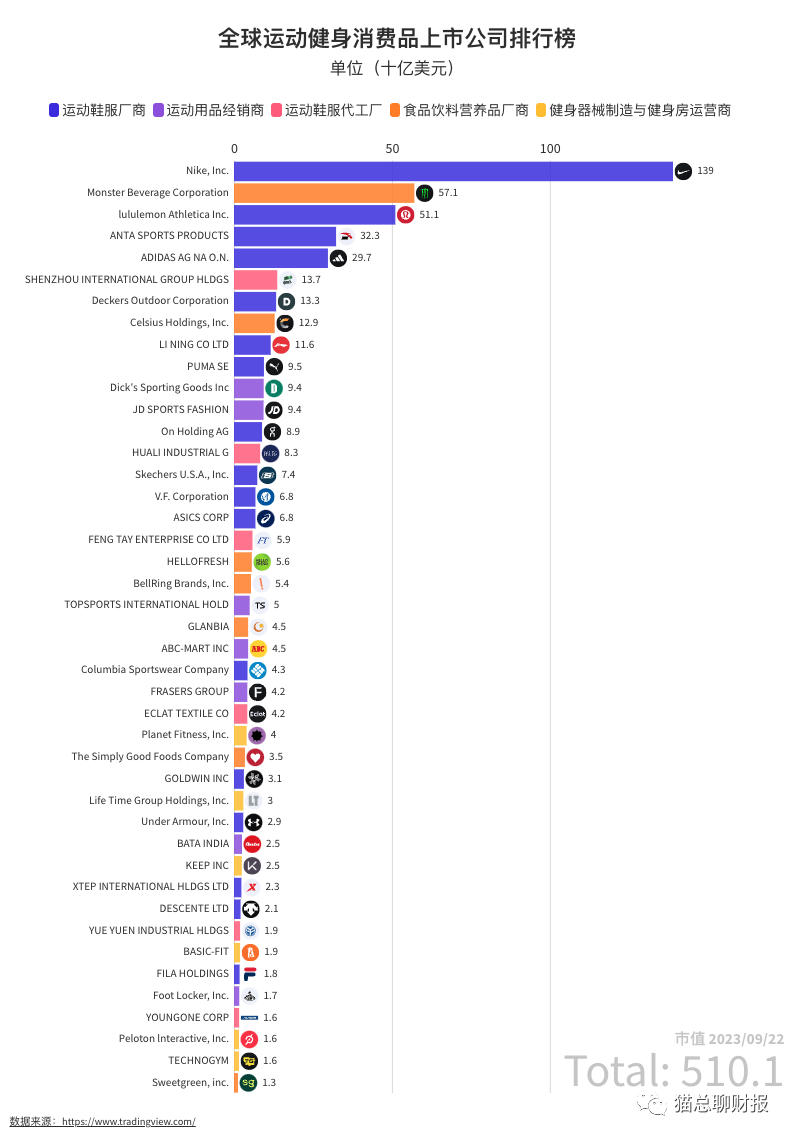

最后再稍微调整一下榜单上的公司,根据最近一段时间的跟踪,发现一些新的相关公司,同时原有榜单上的公司有些也需要下掉,这里介绍一下变动情况。

剔除以下公司:

Wolverine World Wide(WWW):市值缩水到 6 亿美元左右,不到 10 亿美元最低要求,剔除之

GILDAN ACTIVEWEAR(GIL) :虽然公司名带有 activewear,但实际主营业务为白体恤代制造,相关性不高,剔除之

Herbalife(HLF):康宝莱的直销模式存在一定争议,这里剔除出榜单,不跟踪了

Hain Celestial(HAIN):相关性不高,剔除之

宝成国际(9904):替换业务范围更合适的控股子公司裕元工业(551)

新增以下公司:

BATA INDIA(BATAINDIA):印度运动鞋服经销商(市值 2.527b)

儒鸿 ECLAT TEXTILE(1476):lululemon 面料供应商(市值 4.218b)

华利集团(300979):运动鞋代工厂(市值 8.292b)

裕元工业(551):替换宝成国际(市值 1.933b)

魔爪饮料(MNST):能量饮龙头股(市值 57.111b)

Hello Fresh(HFG):德国健康餐供应商(市值 5.632b)

Keep(3650):Keep 这个季度港股新上市,加进来(市值 2.48b)

最后更新一下最新榜单,市值为截止 2023/09/22 折算成美元后的公司市值,以十亿美元为单位。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。