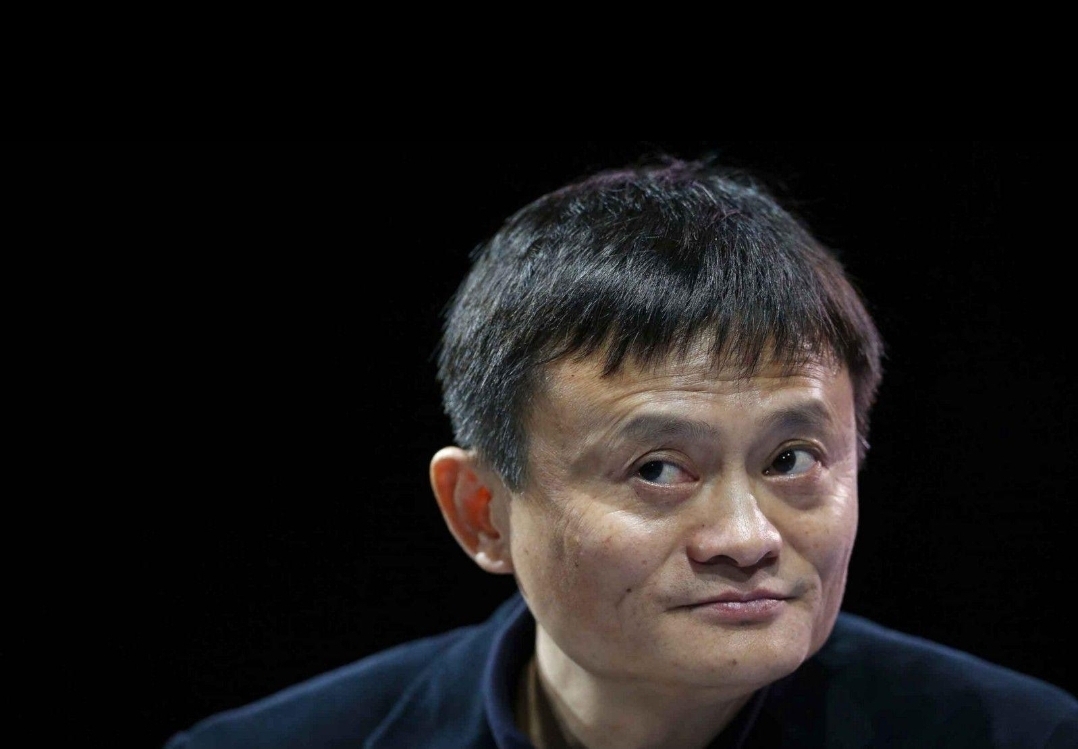

Buy or Sell Alibaba?

Last week, we saw $BABA share price dropped 6.2% after the Chinese e-commerce giant reported its Q4 2021 financial results. In this post, I will share my opinion of Alibaba.

Alibaba Group posted an operating loss of 7.7 billion yuan; the first since the Group went public in 2014. The loss came after Alibaba was fined 18.2 billion yuan for engaging in monopolistic business practices.

As an investor, I ignore such one-off operating loss when calculating the intrinsic value of a company. I like the fact that Alibaba would have reported a 48% year on year increase in operating income without the fine.

On revenue, Alibaba reported 187.4 billion yuan (US$28.6illion) for Q4 2021; up 64% year on year.

A quick calculation of Alibaba's intrinsic value shows that the company has a fair value of US$319.26. At the time of this writing, the company trades at US$211.73. A 31.68% discount for the e-commerce retail giant looks pretty attractive.

Moreover, Alibaba has a wide business moat with several business sectors. It is not difficult to recognise more than 1 of them below.

While China's population is set to grow at about 6% per year for the next 10 years, Alibaba has to continue spending on innovation and acquisition in order to retain its market share. Rivals such as JD.com ($JD) and Meituan (HKSE 3690) are also investing heavily in the highly competitive retail space. Perhaps, Alibaba's future acquisitions and new innovations should also be a point to note in deciding whether or not to invest in the company.

I would definitely grab some of Alibaba at such attractive discount. This is only my opinion for sharing purpose. Investors should exercise caution and do your own due diligence before deciding whether to buy any shares.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 何安迪·2021-05-18看好阿里巴巴 [666] [666]3举报

- 33_Tiger·2021-05-18buy on dip3举报