- U.S. initial weekly jobless claims fall

- Services industry growth slows

- Qualcomm, Roku slump on weak forecasts

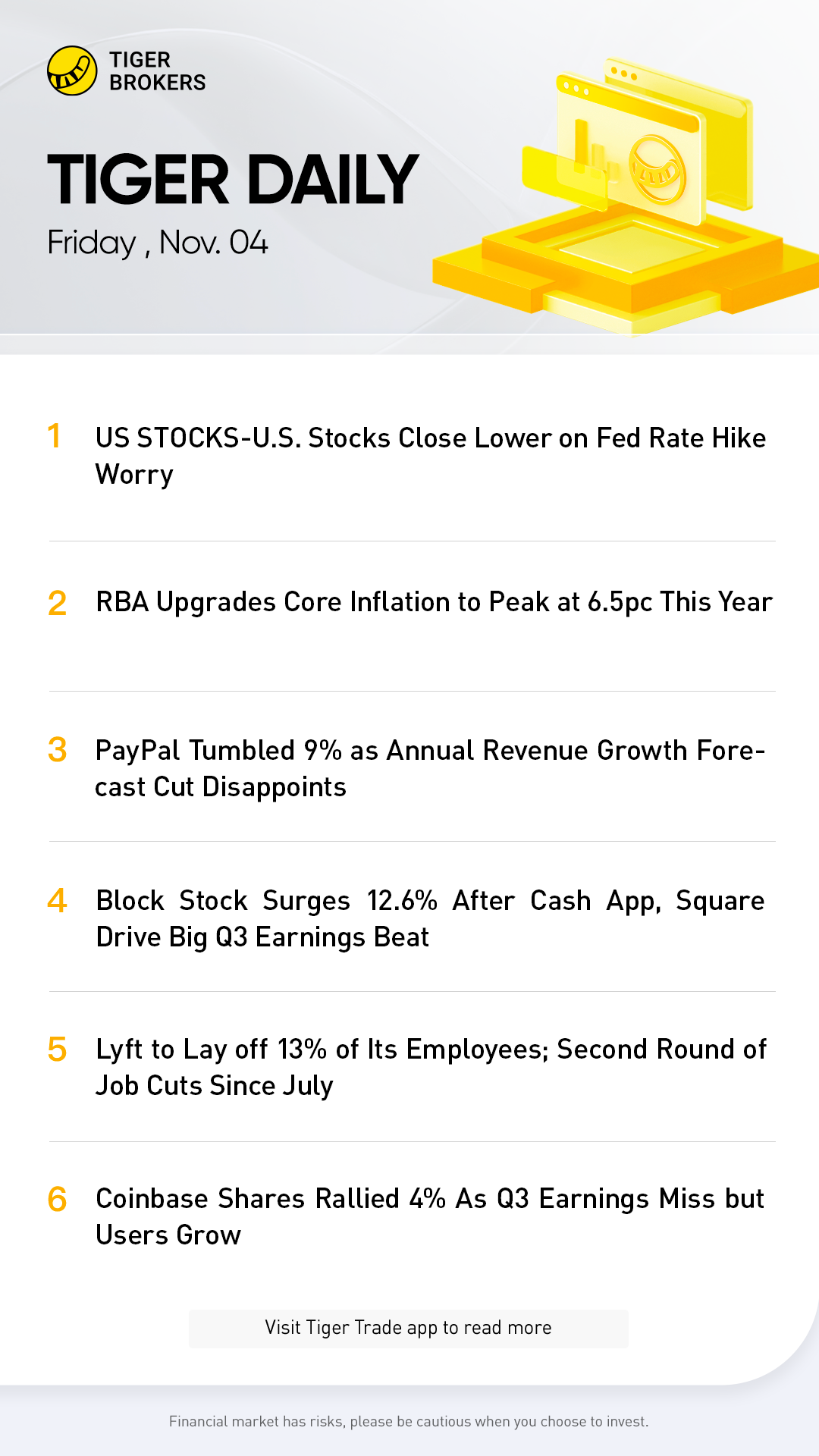

U.S. stocks closed lower for a fourth consecutive session on Thursday as economic data did little to alter expectations the Federal Reserve would continue raising interest rates for longer than previously thought.

Following the Federal Reserve's statement on Wednesday, comments from Fed Chair Jerome Powell that it was "very premature" to be thinking about pausing its rate hikes sent stocks lower as U.S. bond yields and the U.S. dollar rose, a pattern that extended into Thursday.

Economic data on Thursday showed a labor market that continues to stay strong, although a separate report showed growth in the services sector slowed in October, keeping the Fed on its aggressive interest rate hike path.

"Years ago the Fed’s job was to take away the punch bowl and that balance is always a very difficult transition, you want the economy to slow to keep inflation from getting out of hand but you want enough earnings to support stock prices," said Rick Meckler, partner at Cherry Lane Investments in New Vernon, New Jersey.

"It is about the rate of change as much as the change so when the rate of change starts to slow ... that almost becomes a positive even though in absolute terms we are going to continue to see higher rates and higher rates means more competition for stocks and lower multiples."

According to preliminary data, the S&P 500 lost 40.23 points, or 1.04%, to end at 3,720.44 points, while the Nasdaq Composite lost 181.15 points, or 1.73%, to 10,342.97. The Dow Jones Industrial Average fell 148.42 points, or 0.47%, to 31,995.61.

While traders are roughly evenly split between the odds of a 50 basis-point and 75 basis-point rate hike in December, the peak Fed funds rate is seen climbing to at least 5%, compared with a prior view of 4.50%-4.75% rise.

Investors will closely eye the nonfarm payrolls report due on Friday for signs the Fed's rate hikes are beginning to have a notable impact on slowing the economy.

The climb in yields weighed on megacap growth companies such as Apple Inc and Alphabet Inc, which pulled down the technology and communication services sectors as the worst-performing on the session.

Losses were curbed on the Dow thanks to gains in industrials including Boeing Co and heavy equipment maker Caterpillar Inc.

Qualcomm Inc and Roku Inc lost ground after their holiday quarter forecasts fell below expectations.

With roughly 80% of S&P 500 having reported earnings, the expected growth rate is 4.7%, according to Refinitiv data, up slightly from the 4.5% at the start of October.