Motorola Solutions (NYSE:MSI) has outperformed the market over the past 15 years by 34.66% on an annualized basis.

Buying $1,000 In MSI: 15 years ago, an investor could have purchased 877.19 shares of Motorola Solutions at the time with $1,000. This investment in MSI would have produced an average annual return of 43.03%. Currently, Motorola Solutions has a market capitalization of $42.41 billion.

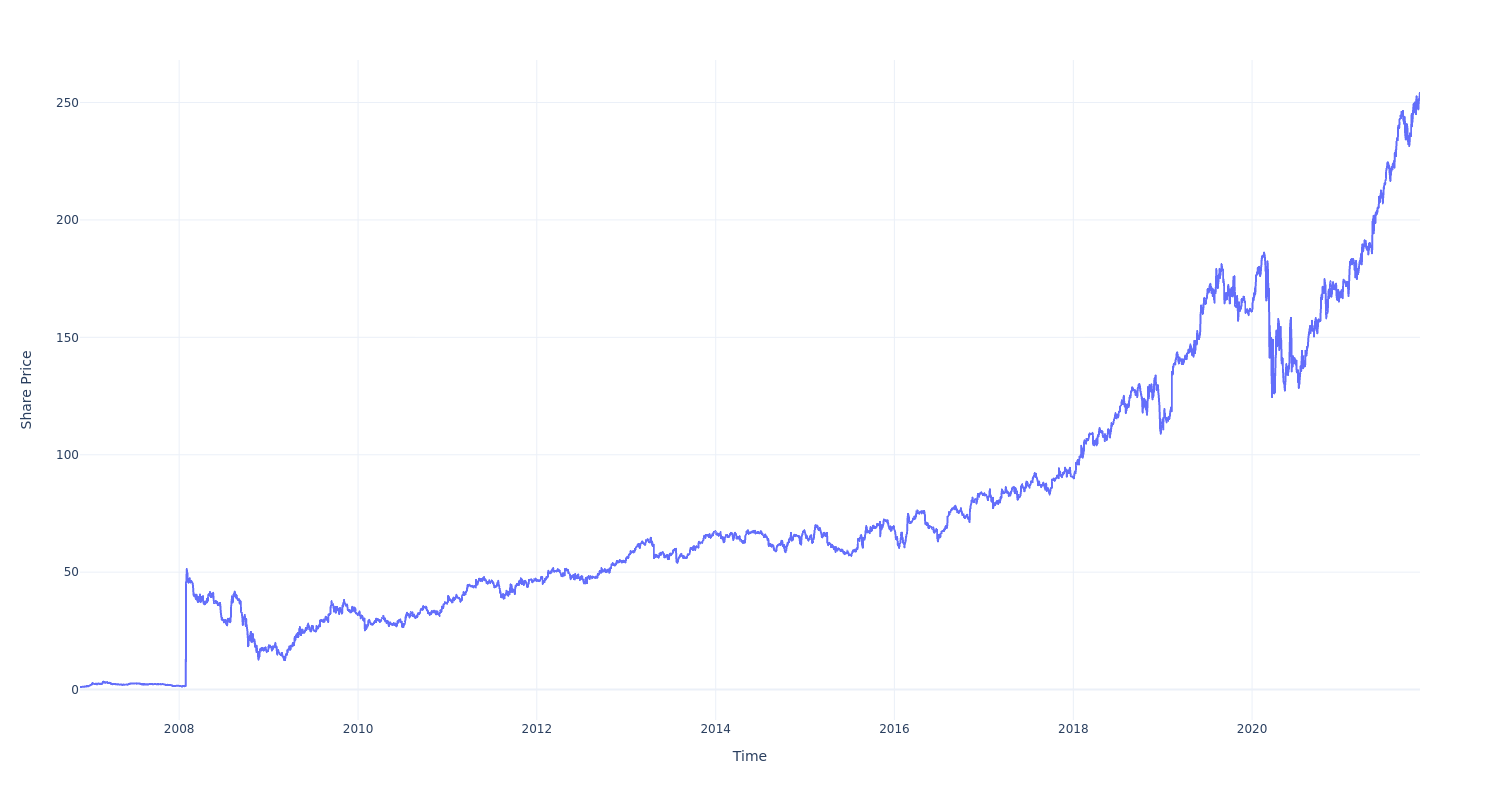

Motorola Solutions's Share Price Over Last 15 Years

This $1,000 investment would be worth $261,350.14 today based on a price of $251.1 for MSI at the time of writing. In other words, you would have more than 20X'd your money.

Finally -- what's the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

You can check out Benzinga's market data in an enhanced view on Benzinga Pro

This article was generated by Benzinga's automated content engine and reviewed by an editor.