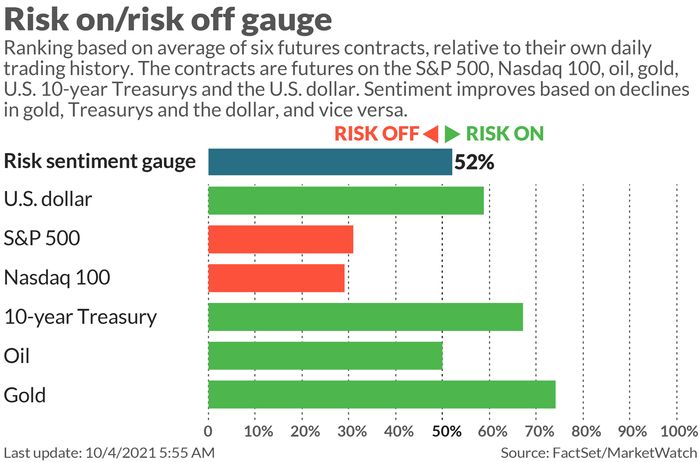

A risk-off Monday is brewing to start the week, with stock futures lower and the 10-year yield edging back toward 1.5%.

There’s a lot for investors to think about, such as the start of earnings season that’s just about a week away, assome analysts look under the hood of the third quarter and don’t like what they see. That’s thanks to inflationary pressures, supply-chain hassles, COVID-19 pandemic quarantines, etc.

And we’ll get jobs numbers at the end of the week that are expected to be strong, and the Federal Reserve will definitely be watching. So a jittery market is understandable.

Ourcall of the daycomes from Mike Wilson, chief investment officer at Morgan Stanley, who offers a bucket of reasons to stay defensive on this market.

“Large-cap quality leadership since March is signaling what we believe is about to happen — decelerating growth and tightening financial conditions. The question for many investors now is whether the price action has already discounted these fundamental outcomes. The short answer, in our view, is no,” said Wilson, in a Sunday note to clients.

Wilson’s list of reasons includes China growth problems that will likely stem from troubled property giant Evergrande (more on that below) — not completely priced into it. And then there’s the surprising speed at which the Fed expects to be done tapering — by mid next year — a “clearly hawkish shift.” The subsequent market fallout — bonds and yields up, equities down — is telling, he said.

“In short, higher real rates should mean lower equity prices. Secondarily, they may also mean value over growth even as the overall equity market goes lower. This makes for a doubly difficult investment environment given how most investors are positioned,” he said.

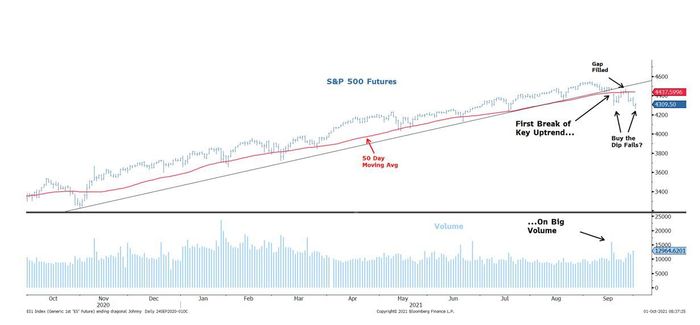

One last defensive signal came from a surprising challenge recently to that “buy-the-dip” strategy — “the most powerful offset to a material correction in the S&P 500 this year,” said Wilson.

“After the Evergrande dip and rally, stocks have probed lower and taken out the prior lows, making this the first time that buying the dip hasn’t worked, simultaneously violating important technical support,” he said, providing the following chart.

As for what to do with all this, Wilson said the team has favored a “barbell” of defensive sectors — healthcare and staples that should hold up as earnings revisions start to see pressure from decelerating growth and rising costs. Add financials, which benefit from a rising interest-rate environment.

Consumer discretionary stocks, meanwhile, are “especially vulnerable to a payback in demand from last year’s overconsumption.” In that realm, Wilson likes services over goods for pent-up demand remaining, while some tech stocks are at risk from a work-from-home dynamic that’s fading. Semiconductors are the biggest worry, he said.

The buzz

A busy enough week of data starts with factory orders later, and ends with payroll numbers. Economists are expecting a big jump for September, of around 485,000, after August fell well short.

More Fed troubles? Vice Chair Richard Clarida traded stocks just ahead of a central bank statement about the pandemic,Bloomberg reported.

TeslaTSLA,+0.81%shares are getting a bump from record delivery numbers — 241,300 vehicles — in the three months ending in September, ahead of 139,593 a year ago and above forecasts, the electric-car makersaid Saturday.

While Chinese mainland markets are closed until Friday, Hong Kong’s Hang Seng IndexHSI,-2.19%fell 2.1% as shares of troubled China Evergrande3333,-3.91%were suspendedafter it said it may sell its property-management unit.

By mid 2022, we may need a new vaccine to fight COVID mutations,said Uğur Şahin, CEO and co-founder of vaccine maker BioNTechBNTX,-2.31%.

A FacebookFB,-4.89%whistleblower said the companyprematurely switched off safeguardsdesigned to stop political disinformation, after last year’s presidential election, paving the way for the deadly Capitol Hill riots in January.

Further on China, U.S. Trade Representative Katherine Tai is expected to say China hasn’t complied with a Phase 1 trade deal reached under former President Donald Trump’s administration, in a speech on Monday.

The global elite has been hiding billions in properties, yachts and other assets for years, according to the “Pandora Papers” report by the International Consortium of Investigative Journalists.

Read:With supply-chain disruptions here to stay, these are the best places to invest

Check out MarketWatch’s new podcast:Best New Ideas in Money, where MarketWatch head of content Jeremy Olshan and economist Stephanie Kelton talk to business, tech and finance leaders about the next phase of money’s evolution. Listenhere.

The markets

U.S. stock futuresES00,+0.03%YM00,+0.01%NQ00,+0.15%have downshifted, led by tech. The yield on the 10-year TreasuryTMUBMUSD10Y,1.486%is up 2 basis points to 1.487%. European stocks are flat. On the energy front, natural-gas pricesNG00,+1.39%are up about 3.5%. Oil markets will be watching the OPEC+ meeting, with Reuters reporting that the group will stand by an existing deal to add 400,000 barrels a day of oil in November.

The chart

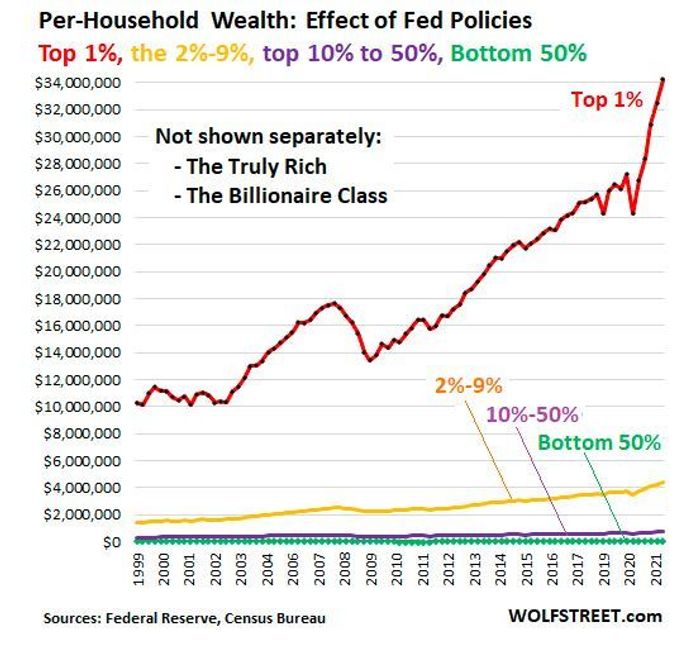

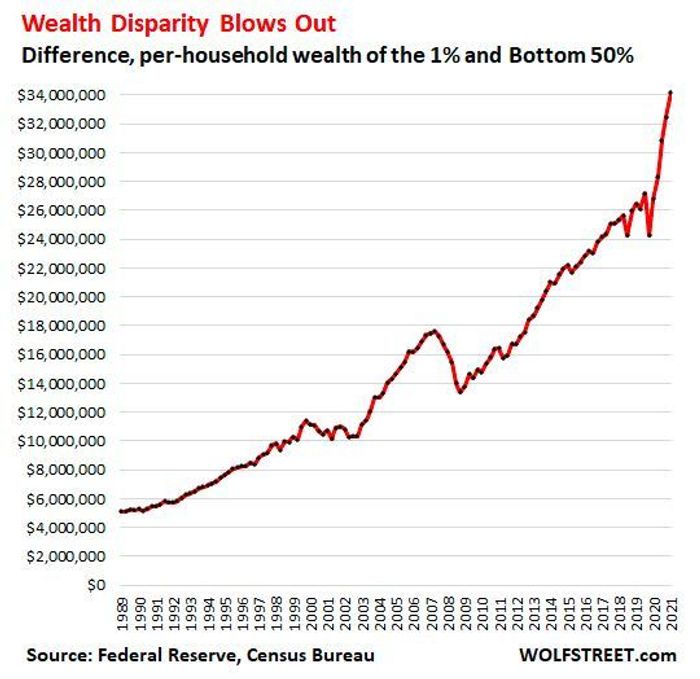

The Wolf Street blog examined detailed second-quarter Fed data on the wealth of households for the 1%, 2%, “next 40%” and “bottom 50%”, that were released Friday. The conclusion is that Fed policy, the blogger said, has “blown out the already gigantic wealth disparity during the pandemic.”

More: “It wasn’t households in general that benefited, but only the richest households with the most assets. The more assets they had, the more they benefited,”said the blogger.

Here’s another look at that: