The logistics arm of Chinese e-commerce giant JD.com started marketing its Hong Kong initial public offering (IPO) to retail investors on Monday at a price range of HK$39.36 to HK$43.36 per share, which could see the firm raise as much as HK$26.4 billion (US$3.4 billion) if the deal is priced at the top end.(Click here To apply for the JD Logistics Shares)

JD Logistics' public offering will run from Monday to Friday. Its shares are expected to begin trading on the Hong Kong bourse's main board on May 28.

JD Logistics plans to sell 609.2 million shares, representing 10 per cent of its enlarged share capital. There is an over-allotment option to sell up to 91.4 million more shares if there is a strong demand.

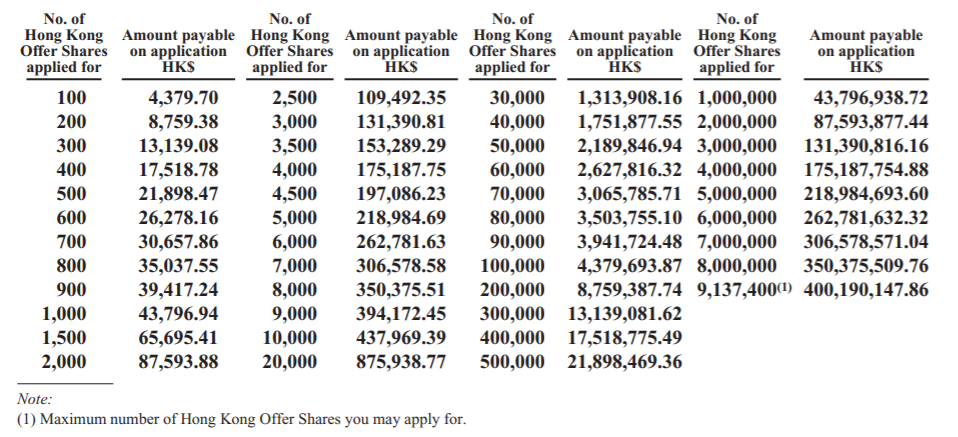

Your application must be for a minimum of 100 Hong Kong Offer Shares and in one of the numbers set out in the table. You are required to pay the amount next to the number you select.

JD Logistics' offering is expected to be the second multibillion-dollar IPO on the Hong Kong bourse this year, after Tencent-backed short video platform Kuaishou Technology raised US$6.2 billion in January. The Kuaishou offering was the biggest IPO globally so far this year.

Eight cornerstone investors have committed to buy a total of US$1.5 billion worth of JD Logistics shares, which would account for about 39 per cent of its global offering if the deal is priced at the top end.

The investors include Softbank, Singapore sovereign wealth fund Temasek Holdings, China Structural Reform Fund and asset managers such as Blackstone, Tiger Global Management and others.

BofA Securities, Goldman Sachs and Haitong International are acting as joint sponsors on the transaction, while UBS is serving as a financial adviser.

Assuming the deal is priced at the top end, JD Logistics' market capitalisation would be HK$264.1 billion, valuing it higher than ZTO Express.

Shanghai-based ZTO, which counts Alibaba Group Holding as one of its shareholders, had a market capitalisation of HK$180.7 billion when it listed in Hong Kong through a secondary listing last September. Alibaba owns the South China Morning Post.

Investors will be keen to learn more about JD Logistics' plan to churn out a profit. The Beijing-based firm said in its prospectus that it expects a bigger net loss for this year, after racking up losses of 2.8 billion yuan (US$435 million) in 2018, 2.2 billion yuan in 2019 and 4 billion yuan in 2020.

"As we currently prioritise growth of our business and expansion of our market share over profitability, there can be significant fluctuations in our profitability profile in the near-to-medium term," the company said in its draft prospectus.

JD Logistics is seeking to differentiate itself from other players, such as ZTO and Yunda Holding, by touting itself as a technology-driven logistic services provider using autonomous mobile robots, sorting robots and self-driving vehicles to enhance delivery speed and accuracy.

Pitching the stock sale with a tech angle could help JD Logistics paint a more positive outlook. This is because competition is particularly keen in the express delivery sector, with reports of some newer players offering services at below cost to grab business.

Over the past three years, the average revenue per parcel for express delivery companies declined by 50 per cent to 60 per cent owing to intensive market competition, according to Charlie Chen, an analyst at China Renaissance.

SF Express, China's top delivery service provider, shocked the market this month after it forecast a first-quarter loss of 1.1 billion yuan, triggering a sell-off of its stock. As of Friday's close, its share price in Shanghai was almost halved from its mid-February peak.

Five players - ZTO, YTO Express, STO Express, SF Express and Yunda Holding - account for nearly 80 per cent of China's express delivery service market.

China is the biggest logistics market in the world in terms of spending, with total logistics spending reaching 14.9 trillion yuan in 2020. That is expected to increase to 19.3 trillion yuan by 2025, according to data from research firm China Insights Consultancy cited in JD Logistics' prospectus.