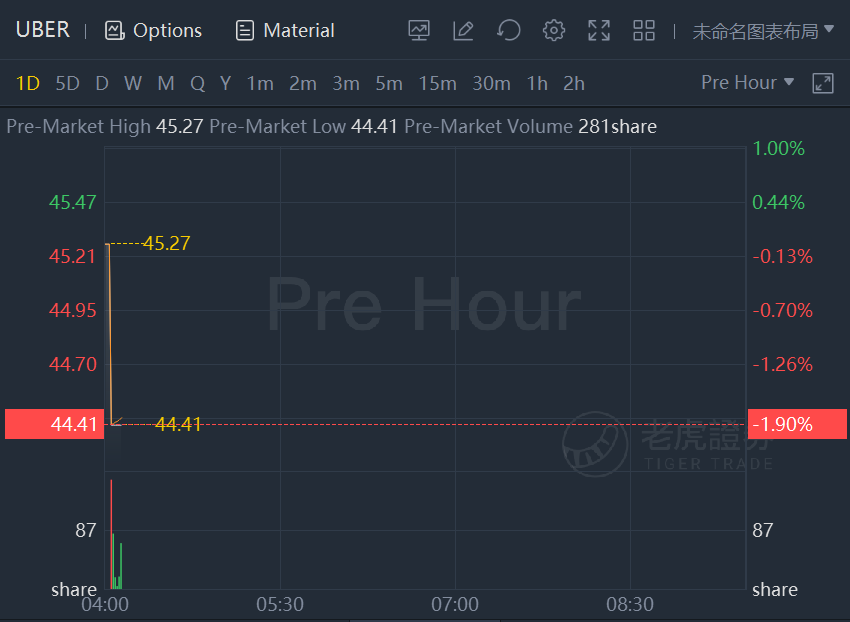

Uber stock fell nearly 2% in premarket trading after posting its first profitable quarter.

For the quarter, Uber reported revenue of $4.8 billion, up 72% from a year ago, and ahead of the Street consensus forecast of $4.4 billion. Gross bookings were $23.1 billion, up 57% from a year ago, and in line with the company’s recent guidance of $22.8 billion to $23.2 billion.

Adjusted Ebitda, or earnings before interest, taxes, depreciation, and amortization, was $8 million, marking the company’s first profitable quarter as a public company by that metric. The company had been projecting a range of plus or minus $25 million.

The mobility segment, mostly ride sharing, had adjusted Ebitda of $544 million. For the delivery segment, adjusted Ebitda was a loss of $12 million.

For the December quarter, Uber is projecting gross bookings of $25 billion to $26 billion, bracketing the Street consensus call of $25.3 billion. The company sees adjusted Ebitda for the quarter ranging from $25 million to $75 million, a little below the Street’s call of $104 million.

Under generally accepted accounting principles, the company had a loss in the quarter of $2.4 billion, due largely to a $3.2 billion unrealized pretax loss on its stake in the China-based ride-sharing company Didi, as well as $281 million in stock-based compensation expense.

Monthly active users rose 40% from a year ago to 109 million. Trips were up 39% to 1.64 billion. Gross bookings were up 67% for ride sharing, 50% for delivery, and 39% for the company’s freight unit. Revenue in the quarter was up 62% for mobility, 97% for delivery, and 40% for freight.

Uber said revenue was up 66% in the U.S. and Canada, 29% in Latin America, 80% in Europe, the Middle East and Africa, and 131% in the Asia Pacific region.

“Our early and decisive investments in driver growth are still paying dividends, with drivers steadily returning to the platform, leading to further improvement in the consumer experience,” Uber CEO Dara Khosrowshahi said in a statement. “This is especially important as Mobility reignites. Mobility Gross Bookings are up 18 percent over just the last two months and this Halloween weekend surpassed 2019 levels.”

Uber CFO Nelson Chai added in a statement that the company’s core restaurant delivery business was profitable in the quarter on an adjusted Ebitda basis for the first time, bringing the full delivery segment “close to breakeven.”