Chinese e-commerce platform Pinduoduo Inc missed Wall Street expectations for quarterly revenue on Tuesday, hit by tough competition from larger rivals like Alibaba and JD.Com to tap into the pandemic-driven online shopping surge.

Total revenue was 23.05 billion yuan ($3.56 billion)in the second quarter ended June 30. Analysts on average expected revenue of 26.44 billion yuan, according to IBES data from Refinitiv.

Q2 2021 Pinduoduo Inc Earnings Conference Call

Second Quarter 2021 Highlights

- Total revenues in the quarter were RMB23,046.2 million(US$3,569.4 million), an increase of 89% from RMB12,193.3 millionin the same quarter of 2020.

- Average monthly active users in the quarter was 738.5 million, an increase of 30% from 568.8 million in the same quarter of 2020.

- Active buyers in the twelve-month period endedJune 30, 2021was 849.9 million, an increase of 24% from 683.2 million in the twelve-month period endedJune 30, 2020.

- Operating profit in the quarter wasRMB1,997.5 million(US$309.4 million), compared with operating loss ofRMB1,639.6 millionin the same quarter of 2020.Non-GAAP operating profit in the quarter wasRMB3,185.2 million(US$493.3 million), compared with non-GAAP operating loss ofRMB725.1 millionin the same quarter of 2020.

- Net income attributable to ordinary shareholders in the quarter wasRMB2,414.6 million(US$374.0 million), compared with net loss ofRMB899.3 millionin the same quarter of 2020.Non-GAAP net income attributable to ordinary shareholders in the quarter wasRMB4,125.3 million(US$638.9 million), compared with non-GAAP net loss ofRMB77.2 millionin the same quarter of 2020.

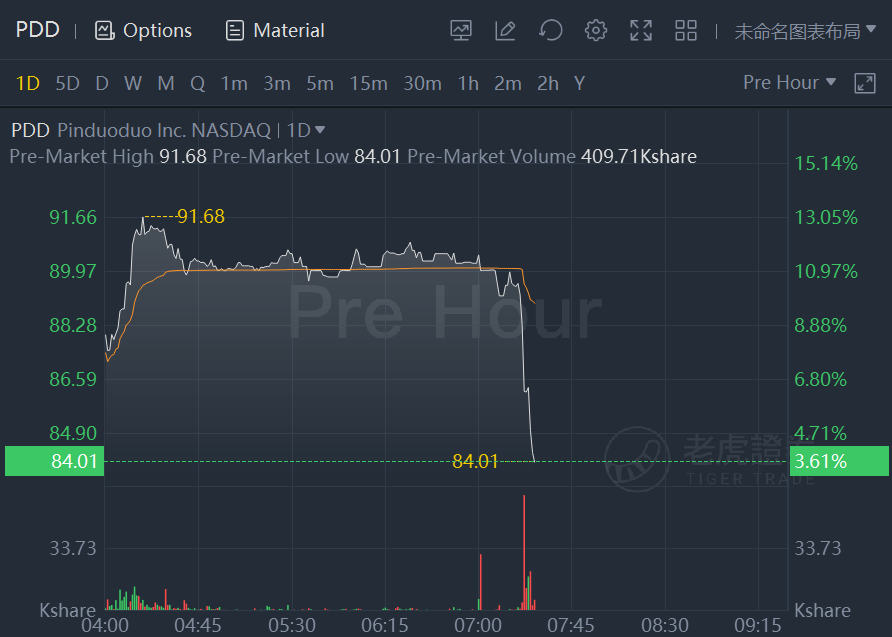

Pinduoduo shares were back to $84.01, up 3.6%.

“Agriculture has long been at the core of Pinduoduo’s corporate mission and strategy and the '10 Billion Agriculture Initiative' we announced today is a way for us to deepen our support for agricultural modernization and rural vitalization,” saidLei Chen, Chairman and CEO ofPinduoduo, who will oversee the initiative. “Investing in agriculture pays off for everyone because agriculture is the nexus of food security and quality, public health and environmental sustainability.”

“We continued to deliver strong execution in the quarter. Our total revenues, excluding contribution from merchandise sales, for the second quarter 2021 increased 73% from the prior year,” saidTony Ma, Vice President of Finance ofPinduoduo. “Agriculture remains our strategic priority, and we are committed to patient and continued investment in agriculture.”

Second Quarter 2021 Unaudited Financial Results

Total revenues were RMB23,046.2 million(US$3,569.4 million), an increase of 89% fromRMB12,193.3 millionin the same quarter of 2020. The increase was primarily due to an increase in revenues from online marketing services.

- Revenues from online marketing services and others were RMB18,080.4 million(US$2,800.3 million), an increase of 64% fromRMB11,054.7 millionin the same quarter of 2020.

- Revenues from transaction services were RMB3,007.6 million(US$465.8 million), an increase of 164% fromRMB1,138.6 millionin the same quarter of 2020.

- Revenues from merchandise sales were RMB1,958.2 million(US$303.3 million), an increase ofRMB1,958.2 millionfrom nil in the same quarter of 2020.

Total costs of revenues were RMB7,897.9 million(US$1,223.2 million), an increase of 197% fromRMB2,662.1 millionin the same quarter of 2020. The increase was mainly due to costs attributable to merchandise sales, higher cost of payment processing fees, cloud services fees, and delivery and storage fees.

Total operating expenses were RMB13,150.9 million(US$2,036.8 million), compared withRMB11,170.8 millionin the same quarter of 2020.

- Sales and marketing expenses were RMB10,387.9 million(US$1,608.9 million), an increase of 14% fromRMB9,113.6 millionin the same quarter of 2020, mainly due to an increase in promotion and coupon expenses.

- General and administrative expenses were RMB434.2 million(US$67.2 million), an increase of 10% fromRMB394.8 millionin the same quarter of 2020.

- Research and development expenses were RMB2,328.8 million(US$360.7 million), an increase of 40% fromRMB1,662.4 millionin the same quarter of 2020. The increase was primarily due to an increase in headcount and the recruitment of more experienced R&D personnel and an increase in R&D-related cloud services expenses.

Operating profit in the quarter wasRMB1,997.5 million(US$309.4 million), compared with operating loss ofRMB1,639.6 millionin the same quarter of 2020.Non-GAAP operating profit in the quarter wasRMB3,185.2 million(US$493.3 million), compared with non-GAAP operating loss ofRMB725.1 millionin the same quarter of 2020.

Net income attributable to ordinary shareholders in the quarter wasRMB2,414.6 million(US$374.0 million), compared with net loss ofRMB899.3 millionin the same quarter of 2020.Non-GAAP net income attributable to ordinary shareholders in the quarter wasRMB4,125.3 million(US$638.9 million), compared with non-GAAP net loss ofRMB77.2 millionin the same quarter of 2020.

Basic earnings per ADS was RMB1.93(US$0.30) and diluted earnings per ADS was RMB1.69(US$0.27), compared with basic and diluted net loss per ADS ofRMB0.75in the same quarter of 2020.Non-GAAP diluted earnings per ADS was RMB2.85(US$0.44), compared with non-GAAP diluted net loss per ADS ofRMB0.06in the same quarter of 2020.

Net cash flow provided by operating activities was RMB7,371.2 million(US$1,141.7 million), compared withRMB5,495.3 millionin the same quarter of 2020, primarily due to an increase in online marketing services revenues.

Cash, cash equivalents and short-term investmentswere RMB 92.2 billion(US$14.3 billion) as ofJune 30, 2021, compared withRMB87.0 billionas ofDecember 31, 2020.

Recent Development

As ofJuly 31, 2021,US$773.7 millionof the 0% convertible bonds due in 2024 have been converted into newly issued ADSs.