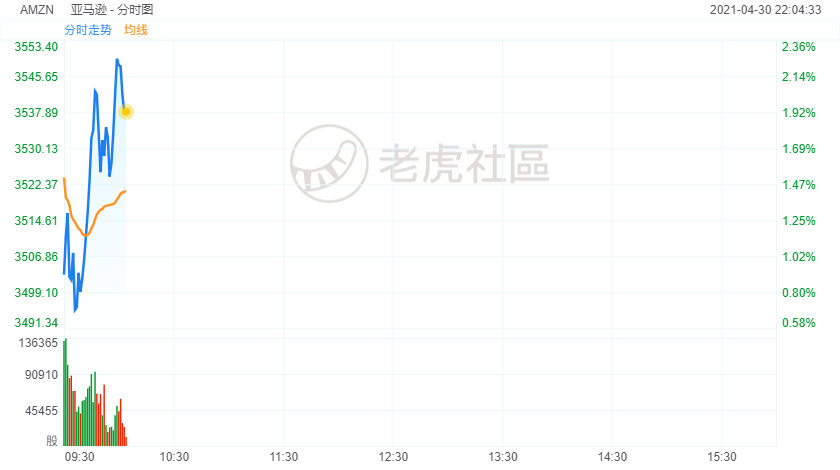

Amazon once rose 2.4%, setting a record high in intraday trading.

Here’s what analysts are saying about Amazon tripling profits

Swiss Bank UBS raises its price target as the COVID-19 pandemic caused boom in demand for home deliveries, helping Amazon triple profits

The COVID-19 pandemic has caused a boom in demand for home deliveries, which has helped AmazonAMZN,+1.75%triple its first-quarter profits.

The online retailer’s stock has risen 46% the past year and some analysts think it could still have further to go.

Michael Lasser, an analyst at Swiss bank UBSUBS,-0.92%,has lifted his price target for Amazon to $4,350 from $4,150, writing: “With broad-based strength across e-commerce & AWS, Amazon’s Q1 ’21 earnings report demonstrates why it remains the industry leader.”

Amazon’s pandemic profits top previous 3 years of earnings

Shyam Patil, an analyst from Susquehanna Financial Group, remains positive on Amazon.

“Business trends remain strong and should continue to do so throughout 2021,” he wrote. “Ultimately, we see AMZN as a long-term secular grower underpinned by its strong e-commerce, cloud, and advertising businesses.”

Should you buy Amazon stock? Analysts prefer it over other Big Tech companies

Trip Chowdhry, an analyst at Global Equities Research, noted the “solid results” and reiterated his view that Andy Jassy, who will replace founder Jeff Bezos as chief executive, will be a good boss.

Jassy currently runs Amazon Web Services, which Chowdhry says is benefiting from secular growth trends. “So many of you were panicked about CEO Transition,” he wrote. “Andy Jassy is a much better CEO than Jeff Bezos.”