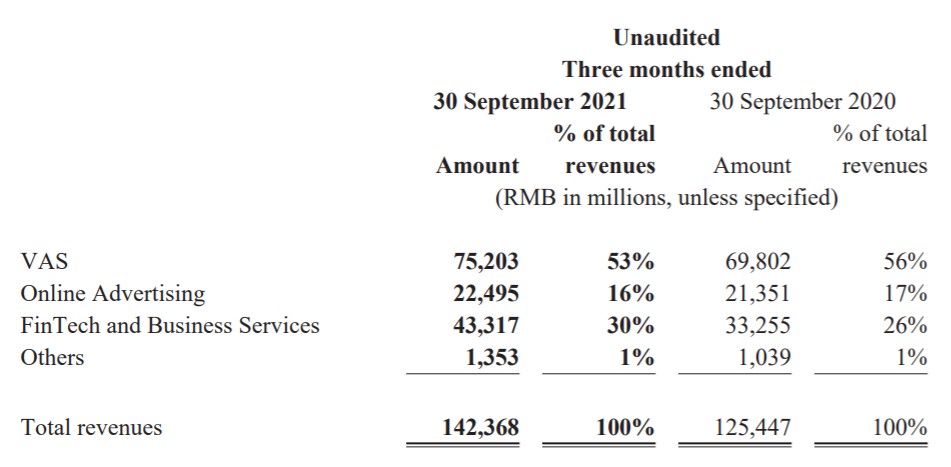

Tencent revenues increased by 13% to RMB142.4 billion for the third quarter of 2021 on a year-on-year basis.

– Revenues from VAS2 increased by 8% to RMB75.2 billion for the third quarter of 2021 on a year-on-year basis. Domestic Games revenues grew by 5% to RMB33.6 billion, driven by games including Honour of Kings, Call of Duty Mobile, and Moonlight Blade Mobile. International Games revenues grew by 20% to RMB11.3 billion, or 28% in constant currency terms, due to robust performance of games including Valorant and Clash of Clans. Social Networks revenues grew by 7% to RMB30.3 billion, driven by relatively rapid growth from video and music subscription services, as well as moderate growth from live streaming and in-game item sales.

– Revenues from Online Advertising increased by 5% to RMB22.5 billion for the third quarter of 2021 on a year-on-year basis, reflecting resilience of advertiser categories such as consumer staples and Internet services, as well as consolidation of Bitauto’s advertising revenue, which was largely offset by weakness in categories including education, insurance and games. Social and Others Advertising revenues grew by 7% to RMB19.0 billion, driven by advertising revenue growth from Weixin Mini Programs and Weixin Official Accounts. Media Advertising revenues decreased by 4% to RMB3.5 billion, primarily due to lower advertising revenues from Tencent News app.

– Revenues from FinTech and Business Services increased by 30% to RMB43.3 billion for the third quarter of 2021 on a year-on-year basis. FinTech Services revenue growth primarily reflected increasing commercial payment volume. Business Services revenues increased healthily year-on-year, due to factors including increased digitalisation of traditional industries and videolisation of the Internet industry, as well as consolidation of Bitauto’s Business Services revenue.