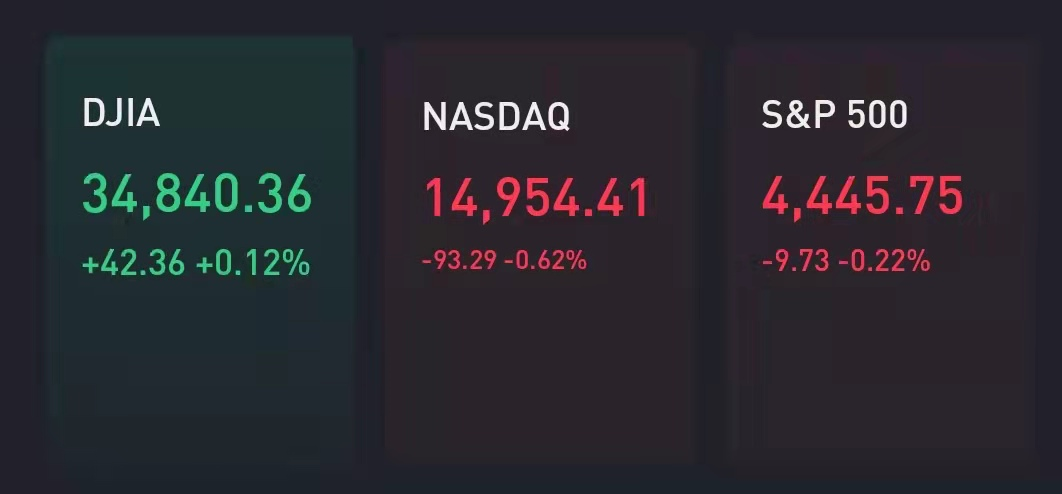

The S&P 500 was under pressure on Monday as traders braced for the final week of a volatile Septe

The broad market index fell by 0.2% and the Nasdaq Composite shed 0.6% as tech stocks showed weakness in premarket trading. Dow Jones Industrial Average rose as energy stocks and bank shares rose.

Alphabet, Apple and Nvidia were lower in early trading, weighing the S&P 500 and Nasdaq.

The retreat for tech stocks came as Treasury yields pushed higher. The 10-year Treasury yield increased on economic optimism and inflation fears, briefly topping 1.5% on Monday. That’s the highest since June and up from 1.30% at the end of August.

“We believe that these [bond market] moves have provided the spark for another ‘Value Rip’ across equity markets. In our view, the direction of longer-term interest rates should remain the #1 driver of market returns, sector rotation & thematic performance in the weeks ahead,” Chris Senyek of Wolfe Research said in a note to clients.

Also weighing on sentiment was a potential government shutdown to end the week.

Stocks linked to the economic comeback led the premarket gains as U.S. Covid cases continued to roll over. There were 114,000 new cases, on average, the last 7 days through Friday, down from a 7-day average of about 160,000 cases at the peak of this latest wave in early September, according to the CDC.

Pfizer CEO Albert Bourla said on Sunday that he thought the U.S. could return to normal “within a year” though annual vaccinations might be needed.

Additionally, the August reading for durable goods orders came in well above expectations on Monday, powered in large part by a jump for the transport sector.

Carnival Corp rose nearly 3% and United Airlines added 1.7% in early trading. Shares of Goldman Sachs rose 2% as higher rates appeared to boost bank stocks.

Exxon Mobil and Occidental Petroleum led gains in the energy sector as WTI crude continued its September run, topping $74 a barrel.

Government shutdown?

Investors are monitoring the progress in Washington as lawmakers try to prevent a government shutdown, a default on U.S. debt and the possible collapse of President Joe Biden’s sweeping economic agenda.

House Speaker Nancy Pelosi said Sunday that she expects the $1 trillion bipartisan infrastructure bill to pass this week, but voting on the legislation may be pushed back from its original Monday timeline.

Congress must pass a new budget by the end of September to avoid a shutdown, and lawmakers must also figure out a way to increase or suspend the debt ceiling in October before the U.S. would default on its debt for the first time.

“DC will start garnering more attention in the coming weeks as the political calculus around passing infrastructure bills and the debt ceiling debate likely guarantees some market moving headlines,” wrote Tavis McCourt, institutional equity strategist at Raymond James.

The blue-chip Dow finished the week 0.6% higher, breaking a three-week losing streak. The S&P 500 rose 0.5% on the week, while the tech-heavy Nasdaq Composite edged up 0.02% last week.

“The market recovery indicated that the buy-the-dip mentality remains,” Mark Hackett, chief of investment research at Nationwide, said in a note.

So far, September is living up to its reputation for volatility and weakness as major averages have all registered modest losses. The S&P 500 is off by 1.5%, on track to post its first negative month since January. The broad equity benchmark is about 2% off its record high from Sept. 2. The Dow is down 1.6% for the month, while the Nasdaq is down 1.4%.

But overall, investors continue to buy the dip for stocks. The S&P 500 fell as much as 4% from its record during the month before turning around. Friday was 224 trading days since the last 5% pullback, the 8th longest streak since 1930, according to Goldman Sachs.

“We continue to exercise caution in the near term, especially as we enter the seasonally weakest part of the year (late September — mid-October),” Larry Adam, CIO at Raymond James, said in a note. “However, given continued robust economic growth, our bias is to hold existing equity exposure or add opportunistically on weakness.”

Elsewhere, bitcoin rebounded about 2% to $43,454 after dropping 5% on Friday. The sell-off came after China’s central bank declared all cryptocurrency-related activities illegal.