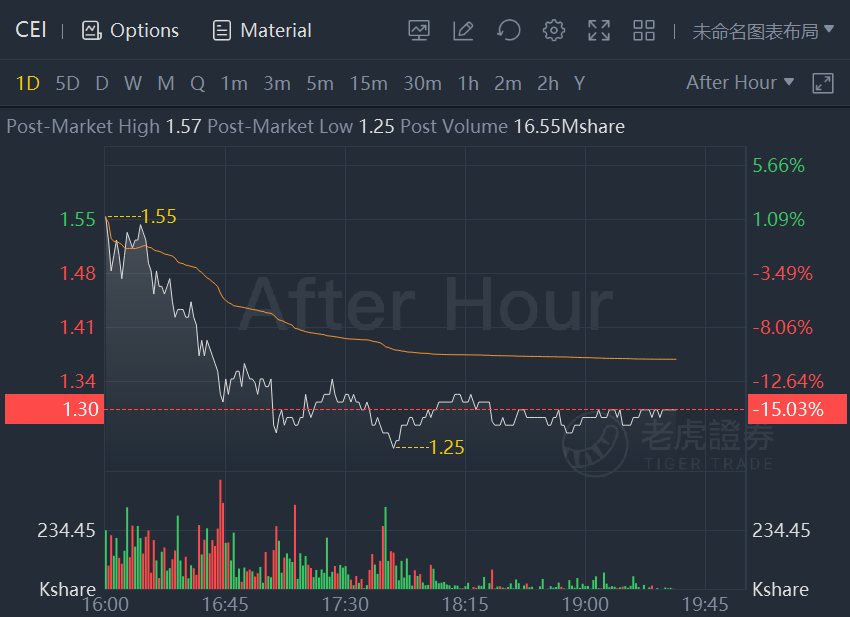

Camber Energy shares continued to plunge 15% after hours following scathing report.

Camber is 'a defunct oil producer that has failed to file financial statements with the SEC since September 2020,' Kerrisdale Capital says.

Camber Energy lost half its value Tuesday after a scathing report from Kerrisdale Capital said the independent oil and gas company was "a defunct oil producer."

Shares of the Houston, Tex. company ended the regular session Tuesday off $1.56, or 51%, at $1.53.

Last week, shares of Camber Energy soared when it became the highest trending name on StockTwits and in the top-5 on the WallStreetBets Reddit thread.

"Camber is a defunct oil producer that has failed to file financial statements with the SEC since September 2020, is in danger of having its stock delisted next month, and just fired its accounting firm in September," Kerrisdale said in its report.

The report said that the company's only real asset is a 73% stake in Viking Energy, "an OTC-traded company with negative book value and a going-concern warning that recently violated the maximum-leverage covenant on one of its loans."

"Nonetheless, Camber’s stock price has increased by 6x over the past month; last week, astonishingly, an average of $1.9 billion worth of Camber shares changed hands every day," the report stated.

Viking Energy Group, owns interests in oil and gas fields in Texas, Louisiana, and Mississippi that collectively contain more than 145 active wells.

The report said that "the most fascinating part of the CEI boondoggle actually has to do with something far more basic: how many shares are there, and why has dilution been spiraling out of control?"

"We believe the market is badly mistaken about Camber’s share count and ignorant of its terrifying capital structure," Kerrisdale said.

Company response

James Doris, Camber's president and CEOs, said in a statement that "we are not involved in, nor do we comment on, the day-to-day trading of the company's common stock."

"I can say, however, that our business relationships are legitimate and that we are firmly committed to improving the organization's capitalization and executing on our growth strategy," he continued.

With respect to the Company's public filings, Doris said "our objective is for the company to become current on or before the expiry of the Initial Cure Period as established by the New York Stock Exchange, which is on or about November 19, 2021."