Arm Holdings is the latest company to join the circle of designated early winners from investment in artificial intelligence. The chip designer’s latest earnings have analysts excited over future licensing revenue from AI devices.

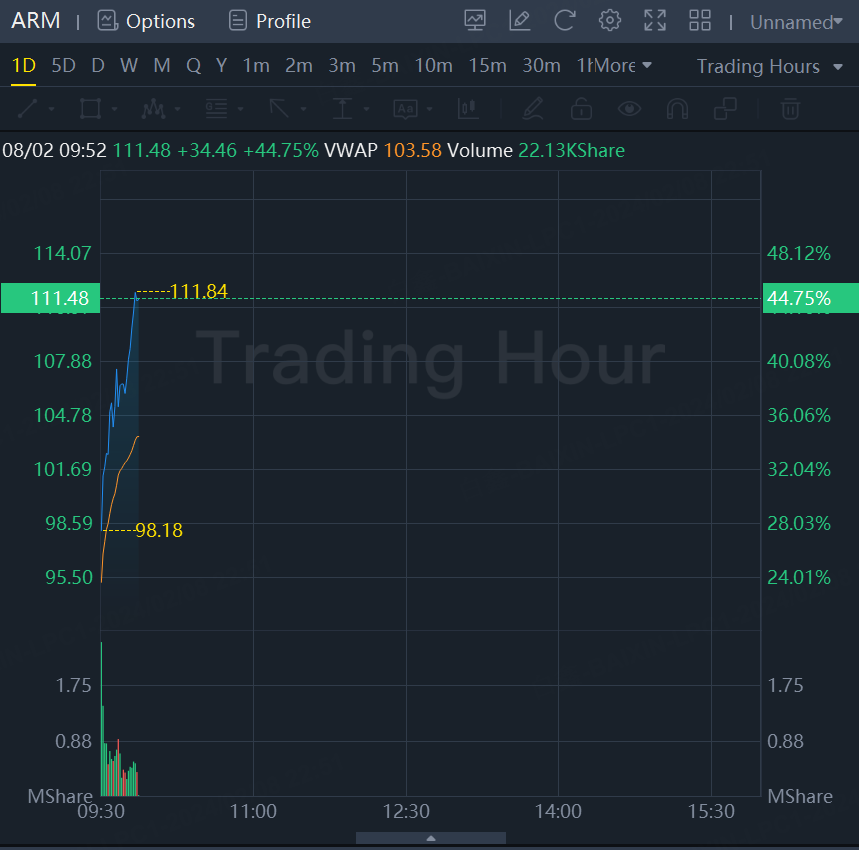

Arm’s American depositary receipts were up 45% at $111.48 in morning trading on Thursday after the company beat expectations for earnings and outlook in its report after the close on Wednesday.

The ADRs have surged since Arm—a U.K.-based company which is majority owned by Japan’s SoftBank Group —returned to the public markets in September 2023 with an initial public offering priced at $51 a share.

The dominance of Arm’s chip designs in the mobile phone market is proving to be a strength as the company said smartphone-related revenue returned to strong growth in the December quarter. However, it also noted the use of its technology in areas such as supercomputers powered by Nvidia chips, and a cloud-server chip from Microsoft.

“Arm looks to be legitimately in the thick of the most talked-about topic in technology: AI, whether on servers, PCs, or smartphones. Just about every company seems to say they are an AI company and most probably are on some level, but it’s still unclear who will benefit with ultimate free cash flow in most cases. Most have concluded Nvidia will (and has), and the Cloud vendors make sense. Now we know of one other,” wrote Guggenheim analyst John DiFucci.

DiFucci raised his price target on Arm ADRs to $93 from $74 and kept a Buy rating on the stock.

Arm was already at a hefty valuation before Wednesday’s results, trading at a forward price-to-earnings multiple of around 58 times according to FactSet. For comparison, Nvidia stock trades at a forward multiple of around 33 times.

However, that isn’t stopping analysts from forecasting further gains for Arm as revenue comes increasingly from the Armv9 chip architecture, which the company said typically generates royalty rates of at least double the previous generation. Arm said chips based on Armv9 technology contributed around 15% of its royalty revenue, up from around 10% the prior quarter.

“Arm is expected to continue to gain market share in data center, networking, and automotive, benefiting from its power-efficiency, ecosystem, and enablement of customization,” wrote KeyBanc analyst John Vinh in a research note.

Vinh raised his target price on Arm ADRs to $120 from $75 previously. The new target implies a price-to-earnings valuation of around 47 times KeyBanc’s forecast for Arm’s earnings in the calendar year of 2025. He rates the ADRs at Overweight.

Among other chip stocks, Nvidia was down 0.1% in morning trading and Advanced Micro Devices was down 0.1%.