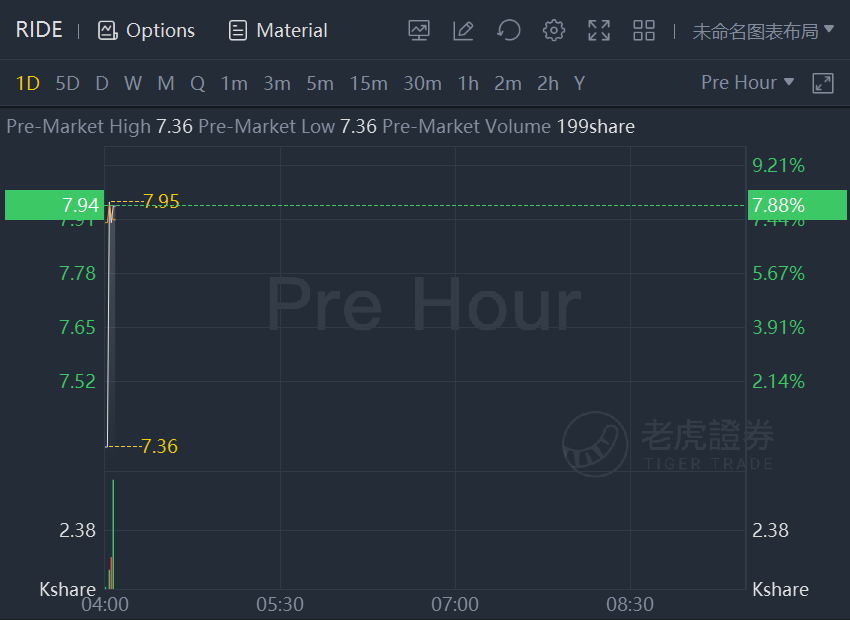

Lordstown shares jumped nearly 8% in premarket trading on nearing deal to sell Ohio car plant to Taiwan’s Foxconn.

Lordstown Motors Corp., the electric-truck startup that acquired an Ohio car factory from General Motors Co., is near an agreement to sell the highly politicized plant to Taiwan’s Foxconn Technology Group after owning it less than two years, people familiar with the matter said.

The companies are set to announce the deal as soon as this week, said the people, who asked not to be named as the transaction isn’t yet public. They didn’t disclose its value. Lordstown Motors struck a deal with GM in late 2019 to buy the plant the automaker had founded in 1966.

The sale would help embattled Lordstown Motors raise cash and realize the benefits of large-scale manufacturing much faster by building multiple models in the same facility. For technology giant Foxconn, a partner of Apple Inc., the plant represents the first automotive manufacturing footprint in the U.S. as the company accelerates a push into electric vehicles.

A Lordstown Motors spokesperson declined to comment. Foxconn representatives didn’t immediately respond to requests for comment.

Selling the plant and operating in parallel with Foxconn could make sense for Lordstown Motors. The company is working to get its Endurance pickup truck ready for production. Even if the truck finds customers, it is still a challenge for Lordstown Motors to fully utilize the entire plant.

The Ohio facility was engineered to build well more than 300,000 of the now-defunct Chevrolet Cruze compact car per year, before GM stopped building the vehicle in March 2019. Lordstown Motors stepped in to purchase the facility after GM decided to shut it down.

The plant’s closure was a liability for U.S. President Donald Trump, who a year earlier went so far as to discourage rally-goers from selling their homes because of all the jobs he would bring back to the area. Democrats seized on the development as a symbol of unfulfilled promises made to voters in a key battleground state.

Lordstown Motors has had to re-establish its footing after ousting founder Steve Burns in June amid claims that he overstated future sale orders. The company has been under investigation by the Securities and Exchange Commission and the Justice Department after an internal probe concluded that prior management had misstated preorders for the Endurance. The company had also had warned that its status as a going concern was in doubt. Burns was replaced and the company has been working to raise money and find partners.

Burns’s successor, newly appointed Chief Executive Officer Dan Ninivaggi, said in an interview last month that he was looking for partners who wanted to work with his company to use the assembly plant’s massive production scale to full advantage.

“The key to unlocking financial potential is maximizing the value of the Lordstown facility,” Ninivaggi said at the time. “We are exploring a number of alternatives. It could take a number of different forms. That is Job One for me.”

Foxconn, the world’s largest assembler of iPhones, is hoping to replicate its smartphone success by building clients’ electric vehicles from the chassis on up. It is rapidly expanding its EV business at a time that major tech companies from Apple to Xiaomi Corp. are heavily investing in technologies for next-generation mobility.

Over the past year, Foxconn has launched a open EV platform, inked a manufacturing deal with Fisker Inc., and formed a partnership with Thailand’s state-owned conglomerate PTT Pcl.

Earlier this year, Chairman Young Liu of Foxconn’s flagship unit Hon Hai Precision Industry Co. said the company was considering creating an EV manufacturing facility in Wisconsin as its first U.S. automotive outpost. With Foxconn bulking up its auto muscle, it is seen as a contender in the race to make electric vehicles for Apple.

Foxconn has had a controversial history of bringing its manufacturing muscle to the U.S. The Taiwanese company originally committed to investing $10 billion in a high-tech manufacturing facility in Wisconsin in exchange for billions of dollars in possible subsidies, in a project championed by then President Trump. That vision was never realized and Liu said earlier this year he’s trying to figure out what to make at the location.