U.S. stock futures and oil prices rose, suggesting markets would claw back some losses sparked by worries over the Omicron variant and the unwinding of Federal Reserve stimulus.

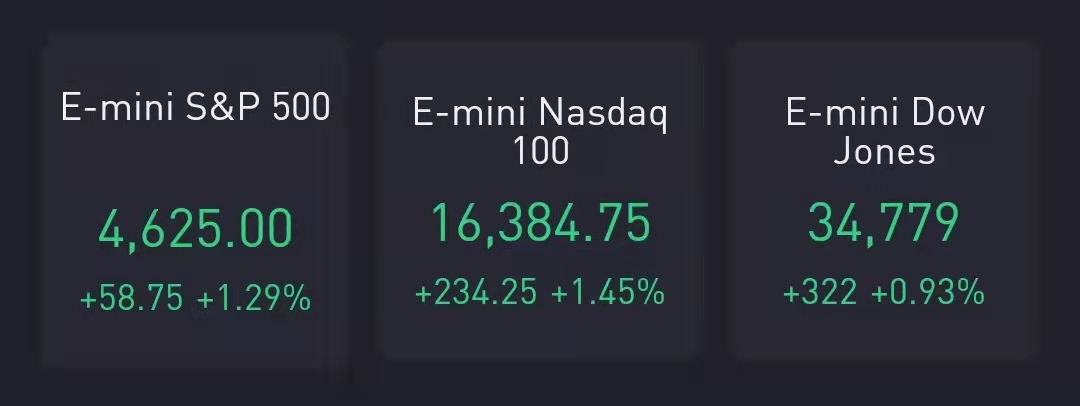

At 8:00 a.m. ET, Dow e-minis were up 322 points, or 0.93%.The S&P 500 e-minis were up 58.75 points, or 1.29%, and Nasdaq 100 e-minis were up 234.25 points, or 1.45%, supported by gains in mega-cap tech giants Amazon.com, Apple, Tesla, Google owner Alphabet, Meta Platforms and Microsoft which added between 1.2% and 2%.

Investors were also awaiting a Fed report, known as the "Beige Book", on current economic conditions to provide further insight into the central bank's stance on inflation. The report is due at 2:00 p.m. ET (1900 GMT).

Powell is also due to testify before a House Financial Services Committee hybrid hearing at 10 a.m. ET.

On the economic data front, November readings on U.S. private payrolls and manufacturing activity will be closely watched later in the day to gauge the health of the American economy.

Stocks making the biggest moves premarket:

NIO,Xpeng Motors and Li Auto — Three Chinese electric vehicle manufacturers deliver brilliant data.NIO delivered 10,878 vehicles in November 2021, increasing by 105.6% year-over-year;Li Auto delivered 13,485 Li ONEs in November 2021, representing a 190.2% year-over-year increase;XPeng delivered 15,613 vehicles in November 2021, a 270% increase year-over-year.NIO added 3.4%,XPeng rose 3.5%,Li Auto jumped 5%.

Salesforce — Shares of the software giant dropped more than 6% in premarket trading despite a better-than-expected third-quarter earnings report. The company's fourth-quarter guidance missed analysts' expectations. Salesforce also announced it promoted Bret Taylor to the role of co-CEO, alongside Marc Benioff.

Altimeter Growth — Shareholders voted in favour of the merger between Grab and listed shell company Altimeter Growth Corp, paving the way for the ride-hailing and delivery giant to list in the US on Thursday (Dec 2).Altimeter Growth surged 9% in premarket trading.

Merck — Merck & Co Inc gained 1.5% in premarket trade after a panel of advisers to the U.S. Food and Drug Administration narrowly voted to recommend the agency authorize the drugmaker's antiviral pill to treat COVID-19.

Box — Shares of Box rose more than 10% in early morning trading after the company’s quarterly financial results beat on the top and bottom lines. Box posted earnings of 22 cents per share on revenue of $224 million versus the Refinitv consensus estimate of 21 cents per share on revenue of $218.5 million, according to Refinitiv. The company’s fourth-quarter and full-year revenue and earnings also topped estimates.

Hewlett Packard Enterprise — Shares of Hewlett Packard Enterprise fell about 2% in the premarket after missing analyst expectations for its quarterly revenue. The company reported revenue of $7.35 billion, below the Refinitiv consensus forecast of $7.38 billion. However, Hewlett Packard Enterprise posted a profit that came in 4 cents per share above consensus.

Ambarella — Shares of Ambarella surged more than 16% in early morning trading after a better-than-expected quarterly report. The semiconductor company earned 57 cents per share, beating Refinitiv estimates by 8 cents. Revenue came in at $92.2 million versus the $90.3 million expected.

Allbirds — Allbirds shares sunk nearly 6% in the premarket after the shoe maker’s losses widened even as its revenue rose from last year. The quarterly report was Allbirds’ first as a public company.

Goldman Sachs,Amazon — Shares of Goldman Sachs and Amazon both moved higher in premarket trading after CNBC reported the bank is unveiling a cloud service for Wall Street trading firms backed by Amazon’s cloud division. The new service is called GS Financial Cloud for Data with Amazon Web Services. Goldman added 1.5% while Amazon gained 1.2%.

Lennar — Lennar shares gained more than 4% after an upgrade from Goldman Sachs to a buy rating. Goldman says demand for new homes remains high in the country.

Krispy Kreme — Shares of Krispy Kreme fell more than 3% in early morning trading after Goldman Sachs downgraded the stock to a sell rating. Rising cost pressures should weigh on the stock, according to Goldman.

DoorDash — Shares of DoorDash gained more than 3% premarket after Gordon Haskett upgraded the stock to buy from hold. The firm said the omicron variant could spark a rebound for the food delivery app as Covid fears flare up.