(August 3) Alibaba posted financial result in premarket, which showed that:

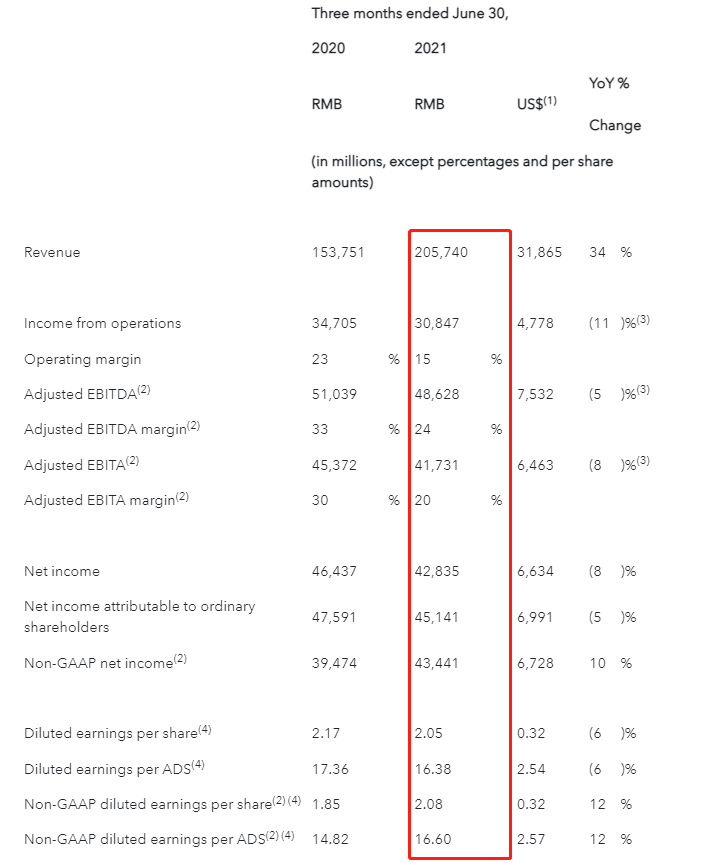

Alibaba Q1 revenue RMB205.74 bln vs. RMB153.75 bln a year ago; FactSet consensus RMB209.11 bln.

Alibaba Q1 adj. EPS RMB16.60 vs. RMB14.82 a year ago; FactSet consensus RMB14.33.

BUSINESS HIGHLIGHTS

In the quarter ended June 30, 2021:

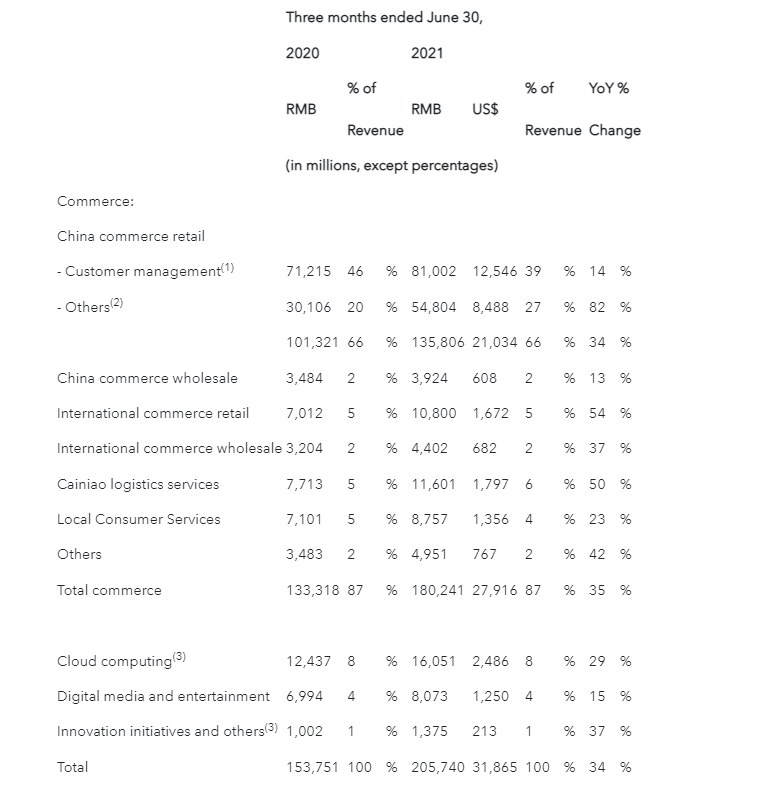

- Revenue was RMB205,740 million (US$31,865 million), an increase of 34% year-over-year. Excluding the consolidation of Sun Art, our revenue would have grown 22% year-over-year to RMB187,306 million (US$29,010 million).

- Annual active consumersof the Alibaba Ecosystem across the world reached approximately 1.18 billion for the twelve months ended June 30, 2021, an increase of 45 million from the twelve months ended March 31, 2021. This includes 912 million consumers in China1and 265 million consumers overseas served by Lazada, AliExpress, Trendyol and Daraz.

- Income from operations was RMB30,847 million (US$4,778 million), a decrease of 11% year-over-year.Adjusted EBITDA, a non-GAAP measurement, decreased 5% year-over-year to RMB48,628 million (US$7,532 million).Adjusted EBITA, a non-GAAP measurement, decreased 8% year-over-year to RMB41,731 million (US$6,463 million). The year-over-year decreases were primarily due to our investments in strategic areas to capture incremental opportunities, such as Community Marketplaces, Taobao Deals, Local Consumer Services and Lazada, as well as our increased spending on growth initiatives within China retail marketplaces, such as Idle Fish and Taobao Live, and our support to merchants.

- Net income attributable to ordinary shareholders was RMB45,141 million (US$6,991 million),andnet incomewas RMB42,835 million (US$6,634 million).Non-GAAP net income was RMB43,441 million (US$6,728 million), an increase of 10% year-over-year, mainly due to an increase in share of profit of equity method investees.

- Diluted earnings per ADS was RMB16.38 (US$2.54) anddiluted earnings per sharewas RMB2.05 (US$0.32 or HK$2.46).Non-GAAP diluted earnings per ADSwas RMB16.60 (US$2.57), an increase of 12% year-over-year andnon-GAAP diluted earnings per sharewas RMB2.08 (US$0.32 or HK$2.50), an increase of 12% year-over-year.

- Net cashprovided by operating activities was RMB33,603 million (US$5,204 million).Non-GAAP free cash flowwas RMB20,683 million (US$3,203 million), a decrease compared to RMB36,570 million in the same quarter of 2020, mainly due to the partial settlement in the amount of RMB9,114 million (US$1,412 million) of the RMB18,228 million fine levied earlier this year by China’s State Administration for Market Regulation pursuant to China’s Anti-monopoly Law (the “Anti-monopoly Fine”) and a decrease in profit as a result of our investments in key strategic areas.

China Retail Marketplaces

In June 2021, Alibaba's China retail marketplaces had 939 million mobile MAUs, representing a quarterly net increase of 14 million.

Cloud Computing

In the June 2021 quarter, our cloud computing revenue grew 29% year-over-year to RMB16,051 million (US$2,486 million), primarily driven by robust growth in revenue from customers in the Internet, financial services and retail industries.

Cash Flow from Operating Activities and Free Cash Flow

In the quarter ended June 30, 2021, net cash provided by operating activities was RMB33,603 million (US$5,204 million), a decrease compared to RMB50,099 million in the same quarter of 2020. Free cash flow, a non-GAAP measurement of liquidity, decreased to RMB20,683 million (US$3,203 million), from RMB36,570 million in the same quarter of 2020. The year-over-year decreases were mainly due to the partial settlement in the amount of RMB9,114 million (US$1,412 million) of the RMB18,228 million Anti-monopoly Fine and a decrease in profit as a result of our investments in key strategic areas. A reconciliation of net cash provided by operating activities to free cash flow is included at the end of this results announcement.

Increasing Share Repurchases

Since April 1, 2021 and through the publication of this results announcement, we repurchased approximately 18.1 million of our ADSs (the equivalent of approximately 144.5 million of our ordinary shares) for approximately US$3,680 million under our share repurchase program. In addition, on August 2, 2021, our board of directors authorized the Company to upsize our Company's share repurchase program from US$10 billion to US$15 billion. This share repurchase program will be effective through the end of 2022.

We are increasing our share repurchase program from US$10 billion to US$15 billion, the largest share repurchase program in the Company’s history, because we are confident of our long-term growth prospects. Our net cash position remains strong and we have repurchased approximately US$3.7 billion of our ADSs since April 1, 2021.”

In June 2021, our China retail marketplaces had 939 million mobile MAUs, representing a quarterly net increase of 14 million. We continue to increase penetration in less-developed areas, reflecting our success in broadening product offerings to meet diverse consumer demand.

“Alibaba started the new fiscal year by delivering a healthy quarter. For the June quarter, global annual active consumers across the Alibaba Ecosystem reached 1.18 billion, an increase of 45 million from the March quarter, which includes 912 million consumers in China. Over more than twenty years of growth, we have developed a company that spans across both consumer and industrial Internet, with multiple engines driving our long-term growth,” said Daniel Zhang, Chairman and Chief Executive Officer of Alibaba Group. “We believe in the growth of the Chinese economy and long-term value creation of Alibaba, and we will continue to strengthen our technology advantage in improving the consumer experience and helping our enterprise customers to accomplish successful digital transformations.”

“We delivered strong revenue growth of 34% year-over-year. As we said in last quarter's results announcement, we are investing our excess profits and additional capital to support our merchants and invest in strategic areas to better serve customers and penetrate into new addressable markets,” said Maggie Wu, Chief Financial Officer of Alibaba Group. “We are increasing our share repurchase program from US$10 billion to US$15 billion, the largest share repurchase program in the Company’s history, because we are confident of our long-term growth prospects. Our net cash position remains strong and we have repurchased approximately US$3.7 billion of our ADSs since April 1, 2021.”