(April 14) Wells Fargoreported earnings and revenue that beat expectations for its first-quarter on Wednesday.

Here’s how the results stacked up to expectations:

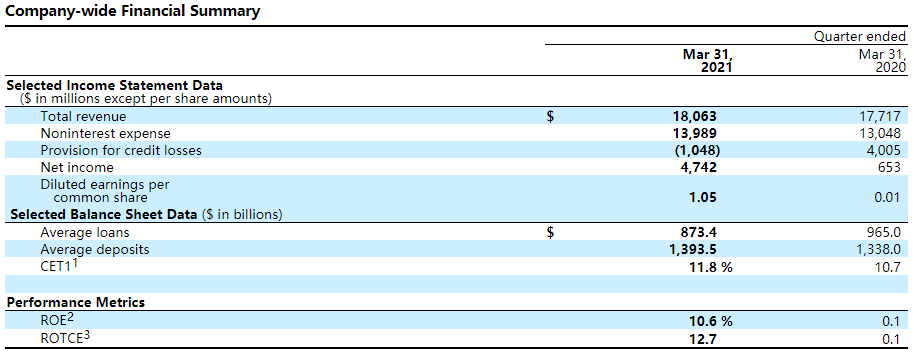

- Wells Fargo Q1 revenue $18.063 bln vs. $17.717 bln a year ago; FactSet consensus $17.518 bln.

- Wells Fargo Q1 net income $4.742 bln vs. $0.653 bln a year ago.

- Wells Fargo Q1 EPS $1.05 vs. 1 cent a year ago; FactSet consensus 71 cents.

- Wells Fargo Q1 reduces allowance for loan losses by $1.6 bln.

- Wells Fargo Q1 net interest income down 22% to $8.798 bln.

- Wells Fargo Q1 noninterest income up 45% to $9.625 bln.

- Wells Fargo Q1 home lending up 19%.

- Wells Fargo Q1 markets revenue up 19%.

Wells Fargo results were helped by a net benefit of $1.05 billion from reserve releases.

CEO Charlie Scharf, who took over in late 2019, is running a company that is still recovering from the aftermath of its 2016 fake accounts scandal. Analysts will be keen to hear about any progress the bank is making in appeasing regulators, especially regarding a Federal Reserve order that caps the bank’s asset growth.

Of the six biggest U.S. banks, Wells Fargo has the smallest Wall Street trading and investment banking operations, areas that have been on fire in recent months thanks to a red-hot IPO market and unprecedented Fed support.

Last year, Wells Fargo was the only bank among the six biggest U.S. lenders to be forced to cut its dividend after the annual Federal Reserve stress test. The firm also posted its firstquarterly losssince the financial crisis and announced it was cutting billions of dollars in expenses.

Wells Fargo shares have climbed 33% this year, exceeding the 25% gain of the KBW Bank Index.

Wells Fargo Shares dipped 0.48% in premarket trading.

Consumer Banking and Lending

- Average loans of $353.1 billion, down 8%

- Average deposits of $789.4 billion, up 21%

Commercial Banking

- Average loans of $183.1 billion, down 19%

- Average deposits of $208.0 billion, up 8%

Corporate and Investment Banking

- Average loans of $246.1 billion, down 5%

- Average trading-related assets of $197.4 billion, down 14%

- Average deposits of $194.5 billion, down 27%

Wealth and Investment Management

- Total client assets of $2.1 trillion, up 28%

- Average loans of $80.8 billion, up 4%

- Average deposits of $173.7 billion, up 19%

Capital

- Repurchased 17.2 million shares, or $596 million, of common stock in first quarter 2021