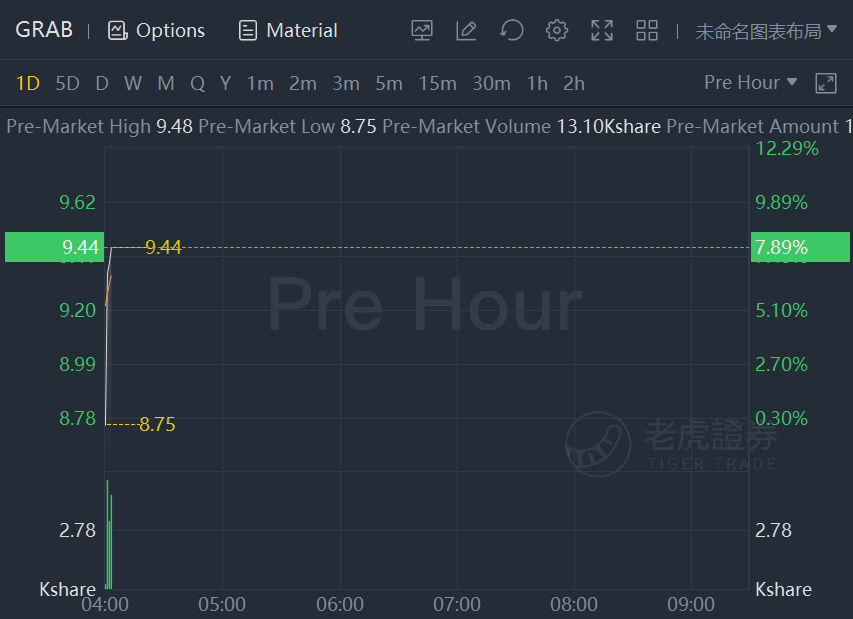

Grab stock rallied 7% in premarket trading after plunging 20% on first day of trading.

After completing the richest deal yet for a special-purpose acquisition company,Grab Holdings Ltd. shares experienced an initial pop Thursday, their first day of trading in the U.S., but then slumped to a decline of more than 20%.

The Singapore-based company makes a "superapp" offering ride-hailing, delivery and financial services in more than 400 cities in Southeast Asia. Grab's chief financial officer, Peter Oey, said in an interview on Thursday that the company had its "roughest patch" in the third quarter ended Sept. 30 because of COVID-19-related shutdowns in Southeast Asia, especially Vietnam. But he pointed to continued expected growth and recovery, even as the company watches what happens with the new coronavirus variant, omicron.

Backers of Grab, which was founded in 2012, include Didi Global Inc, Toyota Motor Corp. and SoftBank Group Corp.'s Vision Fund.