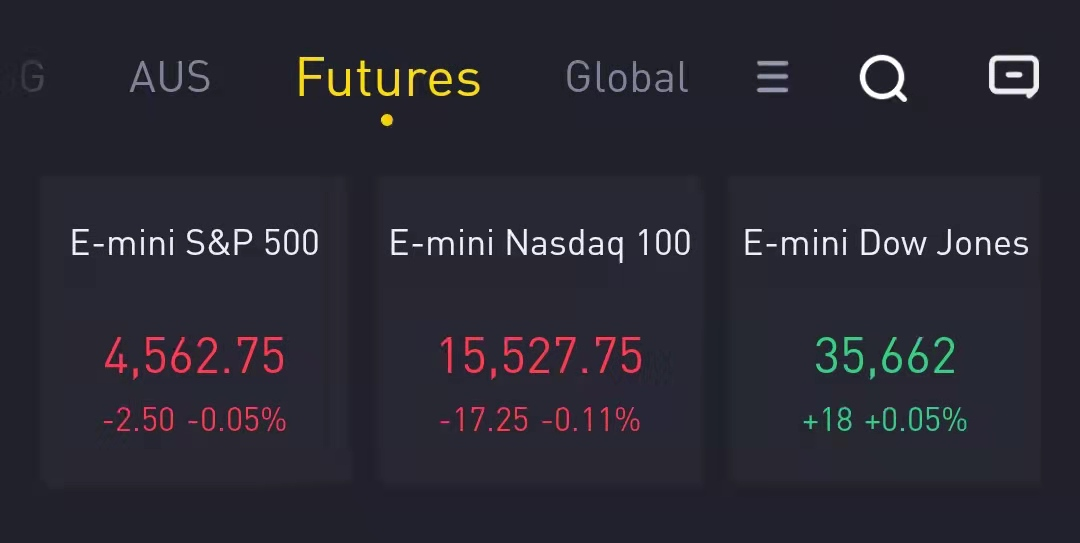

US stock index futures were flat during early morning trading on Wednesday after the Dow and S&P closed at record highs as earnings season continues.

A busy earnings week continues on Wednesday with Coca-Cola, McDonald’s, Bristol-Myers, Boeing, General Motors and Harley-Davidson among the names on deck before the market opens. Ford, eBay and Yum China will provide quarterly updates after the market closes.

On the economic front, U.S. durable goods order data will be released at 8:30 a.m. ET.

Stocks making the biggest moves in the premarket:

- Microsoft and Alphabet were among the headline reports Tuesday after the market closed, with both topping revenue expectations. Microsoft shares rose 2.3% in premarket trading.

- Texas Instruments shares tumbled 4% premarket after the companysaid it earned $1.95 billion, or $2.07 a share, in the quarter, compared with $1.3 billion, or $1.45 a share, in the year-ago period,and its revenue rose 22% to $4.64 billion.

- Visa fell 2.5%in premarket trading although it reported increases in net revenue and earnings for its fiscal fourth quarter driven by higher payments volume, cross-border volume and processed transactions as economies opened up with the wider availability of Covid-19 vaccines.

- Enphase Energy leaped 12.7% after reporting record revenue in face of supply chain headwinds.

- Coca-Cola rose 2.6% premarket after the company posted a beat on the top and bottom lines and raised its outlook, saying the business was getting stronger particularly in areas where the Covid recovery has been the best.

- Robinhood Markets, Inc. shares were getting slammed, down 11% the day after the trading app reported revenue well below expectations primarily due to weakness in crypto trading.