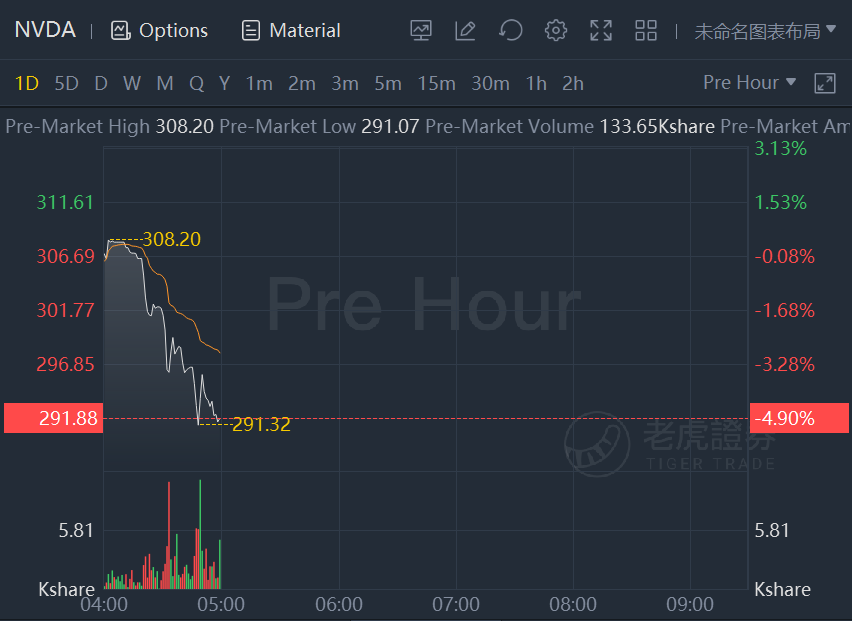

Nvidia stock dropped nearly 5% in premarket trading.Nvidia’s plan to dominate chip design stymied by antitrust angst;CEO Jensen Huang sold 440000 shares last week,with a total value of about $140 million.

When Nvidia Corp. announced plans to buy Arm Ltd. in September 2020, the deal was more than just the chip industry’s largest-ever acquisition -- the company said it would supercharge the technology found in everything from cars to smartphones.

Now, more than a year later, that audacious plan is in peril. The U.S. Federal Trade Commission sued to block the $40 billion purchase on Thursday, calling it a threat to semiconductor innovation. Arm customers have lined up against the transaction. And investors and analysts have written off the idea of it ever happening.

EU antitrust regulators have temporarily halted their investigation into Nvidia's bid for British chip designer ARM,as they await more information, according to a European Commission filing.

British antitrust agency CMA has also said it would open a full-scale investigation into the deal.

Nvidia has vowed to fight on, but with regulatory scrutiny escalating around the world, the prospects are dim.

![[Sad]](https://c1.itigergrowtha.com/community/assets/media/emoji_010_nanguo.57d6c251.png)