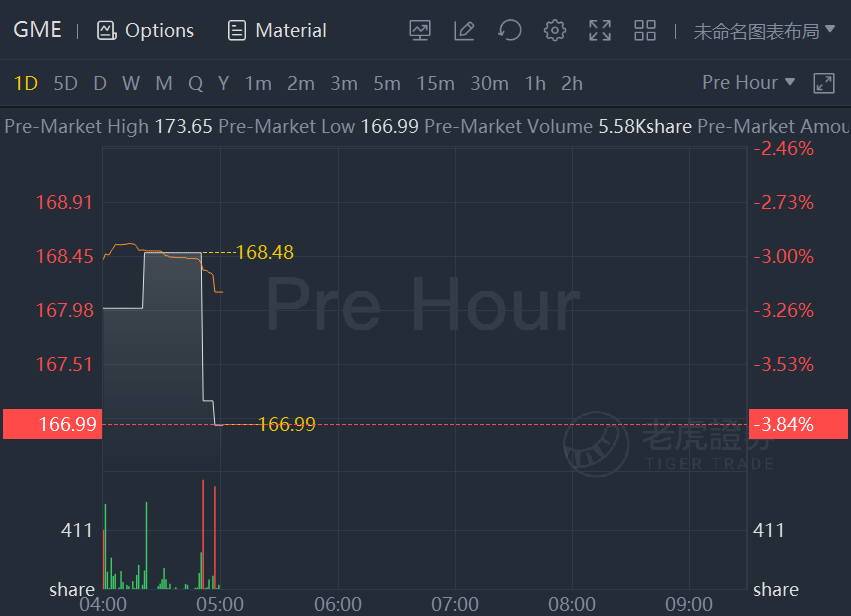

GameStop shares dipped nearly 4% in premarket trading after the videogame retailer disclosed SEC subpoena on trading activity, posted bigger-than-expected loss.

Video game retailer GameStop Corp said it was issued a subpoena by the U.S. securities regulator back in August for documents on an investigation into its share trading activity, while reporting a bigger-than-expected quarterly loss.

GameStop was one of the companies whose shares hogged the limelight in this year's meme-stock frenzy, which was led by day traders and fueled by chatter on social media platforms such as Reddit.

"We are in the process of producing the documents and have been and intend to continue cooperating fully with the SEC Staff regarding this matter," GameStop said in a regulatory filing on Wednesday, adding that the inquiry was not expected to have an adverse impact on the company.

On an adjusted basis, the company lost $1.39 per share in the third quarter ended Oct. 30, compared with estimates of a loss of $0.52 per share, according to Refinitiv IBES data.

GameStop's business model, which was suffering even before the pandemic hit, was further impacted by the COVID-19 lockdowns, with the company shutting down hundreds of brick-and-mortar stores.

The company has since then tried to take advantage of the pandemic-fueled demand for online shopping by trying to sell its consoles and games online.

GameStop's overall revenue rose to $1.30 billion, beating estimates of $1.19 billion.