U.S. stock index futures stabilized on Tuesday, after a steep sell-off on Wall Street in the previous session as investors assessed the impact of a spike in oil prices and Western sanctions on Russia over its invasion of Ukraine.

The Nasdaq on Monday ended down 20.1% from its Nov. 19 record high close, confirming the tech-heavy index has been in a bear market since hitting that record high, according to a widely used definition.

The Dow (.DJI) confirmed it was in a correction from its Jan. 4 all-time closing peak. A correction is confirmed when an index closes 10% or more below its record closing level.

Meanwhile, the benchmark S&P 500 index (.SPX) lost $1.08 trillion on Monday, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, as investors worried over soaring crude prices on a possible ban of Russian oil imports fueling higher inflation.

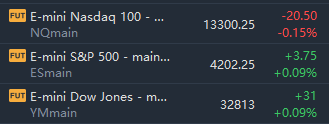

Market Snapshot

At 07:58 a.m. ET, Dow e-minis were up 31 points, or 0.09%, S&P 500 e-minis were up 3.75 points, or 0.09%, and Nasdaq 100 e-minis were down 20.5 points, or 0.15%.

Pre-Market Movers

Shell - The U.S.-traded shares of the energy giant rose more than 2% in premarket trading after Shell apologized for buying a shipment of Russian oil. The company said it will no longer do spot purchases of Russian oil and was shutting down other operations in the country.

Dick’s Sporting Goods - The retail stock gained more than 4% in premarket trading after Dick’s released its fourth-quarter results. The quarter beat expectations for adjusted earnings and revenue, according to estimates compiled by Refinitiv. The company said same-store sales grew 5.9%, which was faster than the rate in the fourth quarter of 2019 before the pandemic.

Carnival Cruise Line, Norwegian Cruise Line Holdings — Cruise stocks rebounded on Tuesday morning after selling off sharply in the previous session. Shares of Carnival and Norwegian were each up more than 3% in premarket trading.

Enphase Energy, SunPower — Solar and other clean energy stocks moved higher in premarket trading as the continued rise in oil prices shifted focus toward alternative energy sources. Enphase Energy and SunPower each rose more than 3% in premarket trading.

Chevron, Exxon Mobil — Traditional energy stocks were pointing toward a strong open as oil prices moved higher once again on Tuesday morning. Shares of Chevron and Exxon each rose about 1% in premarket trading.

Dish Network — The telecom stock rose more than 2% in premarket trading after Dell upgraded Dish to buy from neutral. The investment firm said in a note that Dish’s spectrum holdings are undervalued.

Apple — Shares of the tech giant rose slightly in premarket trading on Tuesday. Apple is holding a product launch event later in the day, and some Wall Street analysts expect the company to announce a budget iPhone.

Market News

The London Metal Exchange was forced to halt trading of a key metal this morning after disorderly price rises threatened to derail the market. The 145-year-old trading venue stopped nickel trading after what CEO Matthew Chamberlain called “unprecedented overnight increases” in price. The metal spiked more than 250% in two days.

U.S. President Joe Biden is expected to sign a long-awaited executive order this week directing the Justice Department, Treasury and other agencies to study the legal and economic ramifications of creating a U.S. central bank digital currency, a source familiar with the matter said on Monday.

Tesla sold 56,515 China-made vehicles in February, including 33,315 for export, the China Passenger Car Association (CPCA) said on Tuesday.

Google agreed to buy cybersecurity firm Mandiant for $23/share in cash. Mandiant fell 4% in premarket trading after jumping 16% on Monday.

Moderna Inc said on Monday it plans to develop and begin testing vaccines targeting 15 of the world's most worrisome pathogens by 2025 and will permanently wave its COVID-19 vaccine patents for shots intended for certain low- and middle-income countries.