- The Federal Reserve will reduce its purchases of Treasurys and mortgage-backed securities later this month as it eases off the economic gas.

- The central bank will reduce its purchase of Treasury securities by $10B per month and MBS by $5B per month from its current monthly rate of at least $80B for Treasurys and $40B for MBS. The Fed had boosted asset purchases at the onset of the pandemic to make sure that credit was readily available when markets froze.

- The federal funds rate target remains at 0.0-0.25%.

- All of the voting member of the Federal Open Market Committee voted in favor of the actions.

- Coming up at 2:30 PM is Chairman Powell's press conference.

The Federal Reserve announced Wednesday it soon will begin reducing the pace of its monthly bond purchases, the first step towards pulling back on the massive amount of help it had been providing markets and the economy.

Tapering of bond purchases will start “later this month,” the policymaking Federal Open Market Committee said in its post-meeting statement. The process will see reductions of $15 billion each month -- $10 billion in Treasurys and $5 billion in mortgage-backed securities – from the current $120 billion a month that the Fed is buying.

The committee said the move came “in light of the substantial further progress the economy has made toward the Committee’s goals since last December.”

The statement stressed that the Fed is not on a preset course and will make adjustments to the process if necessary.

“The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook,” the committee said.

The move was in line with market expectations following a series of Fed signals that it would begin winding down a program that accelerated in March 2020 as a response to the Covid pandemic.

Along with the move to taper, the Fed also altered its view on inflations slightly, acknowledging that price increases have been more rapid and enduring than central bankers had forecast.

“Inflation is elevated, largely reflecting factors that are expected to be transitory,” the statement said. “Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors.”

The policymaking Federal Open Market Committee voted not to raise interest rates, a move also expected by the market.

The tie between interest rates and tapering is a vital one, and the statement stressed that investors should not view the reduction in purchases as a signal that rate hikes are imminent.

On the current schedule, the reduction in bond purchases will start later in November and conclude around July 2022. Officials have said they don’t envision rate hikes beginning until tapering is finished, and projections released in September indicate one increase at most coming next year.

Markets, though, have been more aggressive in pricing, at one point indicating as many as three increases next year. That sentiment has cooled off some in recent days as Wall Street anticipated a more dovish Fed as it tries to balance slowing growth and rising inflation.

Inflation has been running at a 30-year high, pushed by a clogged supply chain, high consumer demand and rising wages that have stemmed from a chronic labor shortage. Fed officials maintain that inflation eventually will drift back to their 2% target, but now say that could take longer.

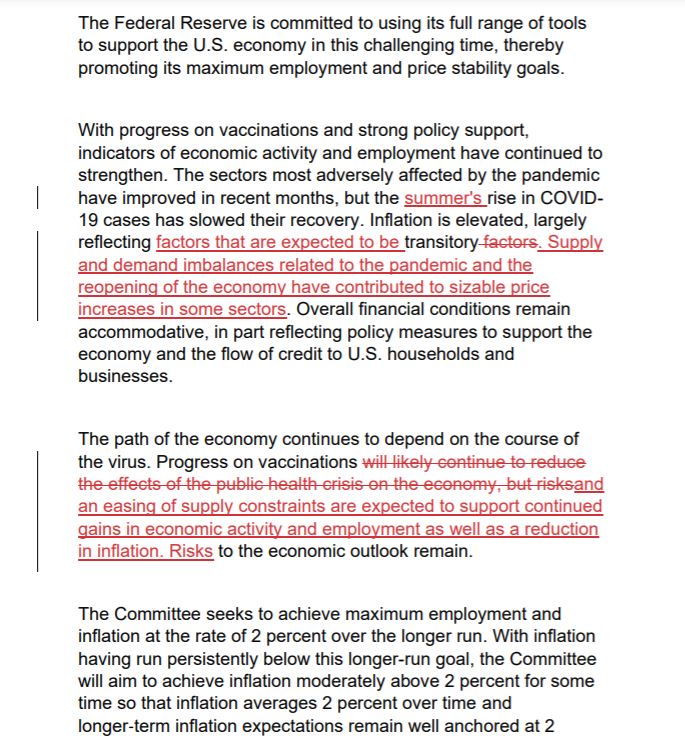

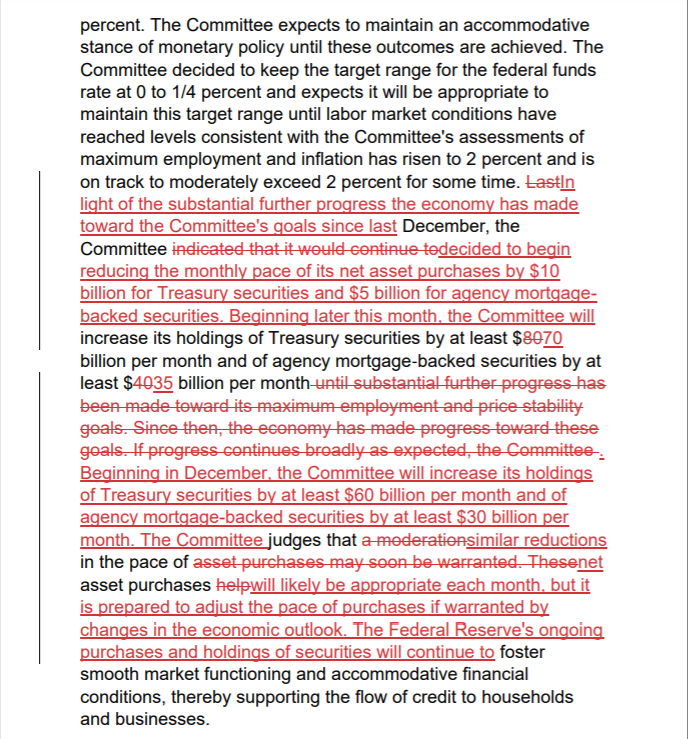

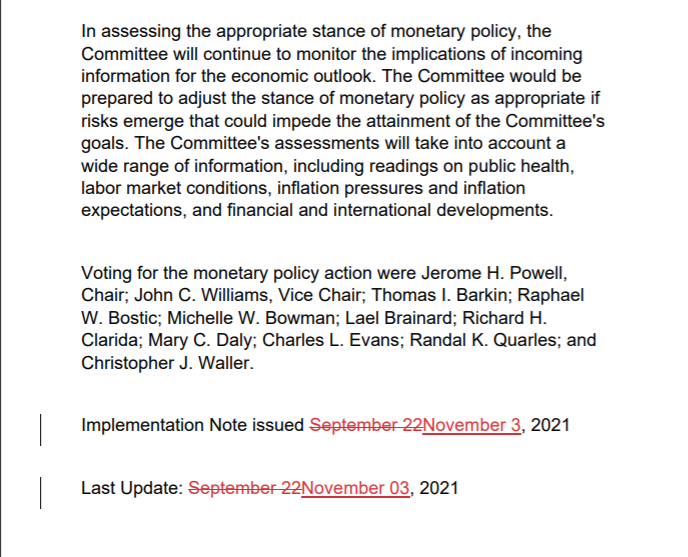

This is a comparison of Wednesday’s Federal Open Market Committee statement with the one issued after the Fed’s previous policymaking meeting on September 22.

Text removed from the September statement is in red with a horizontal line through the middle.

Text appearing for the first time in the new statement is in red and underlined.

Black text appears in both statements.