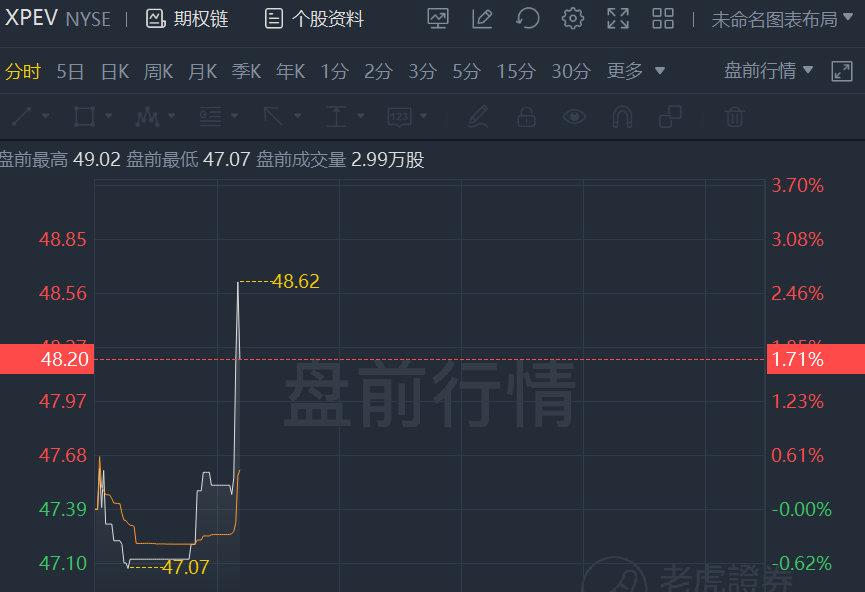

XPeng shares rose 1.71% in premarket trading after announcing its financial results for Q3.

Operational Highlights for the Three Months Ended September 30, 2021

- Deliveries of vehicles were 25,666 in the third quarter of 2021, setting a new quarterly record and representing an increase of 199.2% from 8,578 in the corresponding period of 2020 and an increase of 47.5% from 17,398 in the second quarter of 2021.

- Deliveries of the P7were 19,731 in the third quarter of 2021, reaching a record quarterly high and representing an increase of 71.2% from 11,522 in the second quarter of 2021.

- Among the total P7s delivered in the third quarter of 2021, 99% can support XPILOT 2.5 or XPILOT 3.0.

- XPeng’s physical sales network consisted of a total of 271 stores, covering 95 cities as of September 30, 2021.

- XPeng-branded super charging stations expanded to 439, covering 121 cities as of September 30, 2021.

Financial Highlights for the Three Months Ended September 30, 2021

- Total revenues were RMB5,719.9 million (US$887.7 million) for the third quarter of 2021, representing an increase of 187.4% from the same period of 2020, and an increase of 52.1% from the second quarter of 2021.

- Revenues from vehicle sales were RMB5,460.1 million (US$847.4 million)for the third quarter of 2021, representing an increase of 187.7% from the same period of 2020, and an increase of 52.3% from the second quarter of 2021.

- Gross margin was 14.4% for the third quarter of 2021, compared with 4.6% for the same period of 2020 and 11.9% for the second quarter of 2021.

- Vehicle margin, which is gross profit of vehicle sales as a percentage of revenues from vehicle sales, was 13.6% for the third quarter of 2021, compared with 3.2% for the same period of 2020 and 11.0% for the second quarter of 2021.

- Net loss was RMB1,594.8 million (US$247.5 million) for the third quarter of 2021, compared with RMB1,148.8 million for the same period of 2020 and RMB1,194.6 million for the second quarter of 2021. Excluding share-based compensation expenses and fair value change on derivative liabilities related to the redemption right of preferred shares, non-GAAP net loss was RMB1,492.1 million (US$231.6 million) in the third quarter of 2021, compared with RMB864.9 million for the same period of 2020 and RMB1,096.4 million for the second quarter of 2021.

- Net loss attributable to ordinary shareholders of XPengwas RMB1,594.8 million (US$247.5 million) for the third quarter of 2021, compared with RMB2,025.8 million for the same period of 2020 and RMB1,194.6 million in the second quarter of 2021. Excluding share-based compensation expenses, fair value change on derivative liabilities related to the redemption right of preferred shares and accretion on preferred shares to redemption value, non-GAAP net loss attributable to ordinary shareholders of XPeng was RMB1,492.1 million (US$231.6 million) for the third quarter of 2021, compared with RMB864.9 million for the same period of 2020 and RMB1,096.4 million for the second quarter of 2021.

- Basic and diluted net loss per American depositary share (ADS)were both RMB1.89(US$0.29) for the third quarter of 2021. Non-GAAP basic and diluted net loss per ADS were both RMB1.77 (US$0.27) for the third quarter of 2021. Each ADS represents two Class A ordinary shares.

- Cash and cash equivalents, restricted cash, short-term deposits, short-term investments and long-term deposits were RMB45,357.9 million (US$7,039.4 million)as of September 30, 2021, compared with RMB35,342.1 million as of December 31, 2020 and RMB32,871.2 million as of June 30, 2021.

Business Outlook

For the fourth quarter of 2021, the Company expects:

- Deliveries of vehicles to be between 34,500 and 36,500, representing a year-over-year increase of approximately 166.1% to 181.5%.

- Total revenues to be between RMB7.1 billion and RMB7.5 billion, representing a year-over-year increase of approximately 149.0% to 163.0%.

The above outlook is based on the current market conditions and reflects the Company’s preliminary estimates of market and operating conditions, and customer demand, which are all subject to change.