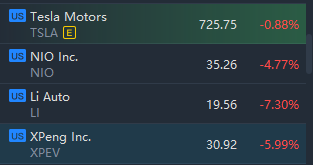

(April 15) Chinese electric vehicle stocks fell sharply. Xpeng Motors fell about 6%, NIO fell about 5%, Li fell more than 7%.

Here are highlights from Monday’s Analyst Blog:Chinese Auto Sales on Fast Track - Will It Hit a Speed Bump?

Vehicle sales in China for the month of March soared for the 12th straight month to 2.53 million units, per the China Association of Automobile Manufacturers (“CAAM”). Sales spiked 75% from the corresponding period of 2020, when the country’s vehicle demand was badly hit by coronavirus woes.

Digging Into Sales Numbers

For the first quarter of 2021, sales surged 76% year over year to top 6.48 million units. The massive jump was due to lower severity of COVID-19 impacts, which crimped showroom traffic in the comparable year-ago quarter.

In fact, automakers in China suffered their bleakest ever quarter in the January-March 2020 period. However, thanks to supportive government policies, gradual reopening of economic activities and pent-up vehicle demand, China is now at the forefront of global auto market recovery.

Deliveries of new light vehicles including sport utility vehicles, sedans and multi-purpose vehicles grew 77% to exceed 1.87 million units in March 2021. Deliveries of commercial vehicles including pickups and buses rose 68% year over year to 651,000 units. Electric vehicle sales jumped a whopping 240% year over year to 226,000 units.

New light vehicle deliveries in first-quarter 2021 climbed 75% from the comparable year-ago period to 5.08 million units. Sales of commercial vehicles and EVs spiked 77% and 280% to 1.41 million units and 515,000 units, respectively, on a year-over-year basis.

China EV Market on Fire, Competition Revs Up

Demand for new energy vehicles (NEVs) has been on the rise amid climate change concerns and favorable government policies. Importantly, the country projects electric vehicles (EVs) to account for 25% of new car sales by 2025.

Last April, the government of China announced plans to extend subsidies and tax breaks for NEVs such as electric or plug-in hybrid cars for another two years to spur sales. Buoyed by favorable government policies and improving consumer confidence and economy, China — world’s largest EV market — is seeing solid sales of zero-emission vehicles.

China-based EV makers includingBYD Co,NIO,Li AutoandXPengregistered strong EV sales last month. Warren Buffett-backed BYD sold 24,218 EVs in March, representing a year-over-year jump of 97.6%.

NIO — which currently carries a Zacks Rank #3 (Hold) — delivered 7,257 EVs last month, skyrocketing 373% year over year. EV makers Li Auto and XPeng delivered 4,900 and 5,102 vehicles, up a whopping 238.6% and 384%, respectively, on a year-over-year basis. You can seethe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Foreign carmakers includingTesla,GMandFordare also registering strong sales and actively ramping up operations in the country. Per China Passenger Car Association, EV behemoth Tesla sold 35,478 China-made cars last month. The company commands a huge market share in the EV market of China, thanks to robust production from the Shanghai Gigafactory.

Overall vehicle sales by Ford and General Motors in China witnessed a year-over-year rally of 73% and 69%, respectively, for first-quarter 2021. General Motors is speeding up the development of advanced technologies in China to enable an all-electric future.

The company’s next-generation EVs (across all brands) in China will be powered by Ultium Drive. It should be noted that the Cadillac LYRIQ SUV would be the first Ultium-powered vehicle to be rolled out in China at Auto Shanghai 2021 later this month.

Importantly, Sales of Hong Guang mini-EV — under General Motors’ Wuling brand — exceeded 72,000 units in first-quarter 2021, retaining its position as the best-selling green vehicle in the country. Meanwhile, Ford is set to manufacture its electric Mustang Mach-E in China with its joint venture Changan Ford.

Amid soaring demand, competition is heating up in the China EV market. Even with the subsidies ending in 2022, the e-mobility battle in China is getting fiercer by the day with new upstarts, legacy automakers and tech titans foraying into the space.

A few days back, China’s leading smartphone maker Xiaomi announced that it is set to invest $10 billion in the development of EVs over the next 10 years. The company intends to establish a wholly-owned subsidiary with an initial investment of around $1.5 billion.

Ride-hailing platform Didi Chuxing has also launched an EV unit and collaborated with BYD to develop EVs designed for its services. Telecom equipment giant Huawei Technology also aims to launch electric cars under its brand and may roll out a couple of models this year. Search engine behemoth Baidu also announced plans to launch an electric car business in January.

Chip Deficit to Play Spoilsport

While China’s vehicle sales have rebounded quite strongly, will the recovery sustain amid the global chip crunch? Well, CAAM has already warned that the chip shortage is set to adversely impact auto production in the nation in second-quarter 2021. The agency does not expect the shortfall to ease until the fourth quarter of this year.

Although China is the largest auto market, it depends heavily on chip imports and is the largest buyer of semiconductors. Amid the chip shortfall, carmakers are scrambling to procure semiconductors, which are forcing them to undergo production cuts and idle factories. NIO shuttered operations for five days beginning Mar 29 due to microchip shortfall. Volvo Cars, owned by Geely Holdings, also halted production last month. In the absence of a quick solution to this chip problem, auto industry recovery in China may soon be losing steam.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.