Options traders on Tuesday are bracing for a key Federal Open Market Committee (FOMC) decision tomorrow at 2 p.m. EST, which is the final monetary policy decision of 2021. The key themes on traders' minds are any new input about inflation concerns from the Fed, along with any potential adjustment in monetary policy.

What Happened:This week the SPY S&P 500 ETF Trust is down more than 2% with option traders buying put protection all week, bringing downward pressure on the major index.

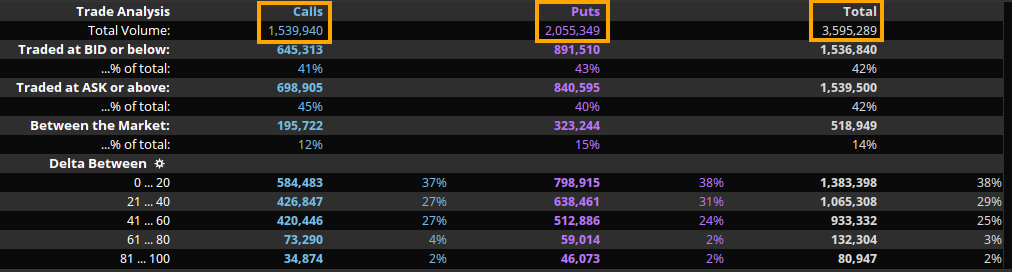

Tuesday's option flows alone have printed over 3.59 million options with approximately 1.53 million calls and 2.05 million puts (image below).

Looking at the option flows, about 58% of all the options traded are puts, which shows a bearish bias. On top of this, more than 400,000 of the options traded today are short-dated. This means while the majority of the options traded are bearish, traders are buying up short-dated protection in case of an unfavorable release out of the Fed tomorrow.

Why It Matters:If options traders have been buying downside protection all week (long puts), but a large portion of those options are short-dated, then when all of these options expire by the end of the week, this could potentially relieve some of the downside pressure as the put options are taken off the board.

It is also important to note the SPY ETF has about 6.7 million calls and 12.9 million puts prior to today, so two out of every three options has been bearish, yet more than 30% of that is expiring Friday.

This further leads to the thesis of options traders having long puts but with a material amount of options expiring on Friday.

What's Next:Options traders should expect volatility to increase drastically after the FOMC tomorrow and the Dec. 17 expiry as a large portion of options will clear off the board and remove the short-term flows driving the market as of late.

If the FOMC has muted concerns over inflation and is not looking to increase its tapering operations, traders could take this as a constructive sign, which could provide a tailwind for equities to rally through the end of the year. This would increase the pace of the long put positions being unwound and provide further support to the market.

For now, the $460 level ($4,600 in SPX) remains the key support level for the markets to hold as option positioning becomes less stable below these levels. On the other hand, if the FOMC comes out with a hawkish stance and the SPY loses the $459/$460 support zone, then the markets could become vulnerable for a quick move lower down to $450.

Either way, traders should be anticipating an increase in volatility after the FOMC and the Dec. 17 expiry as a lot of options will be coming off the board and will force a large amount of repositioning for the rest of the year.