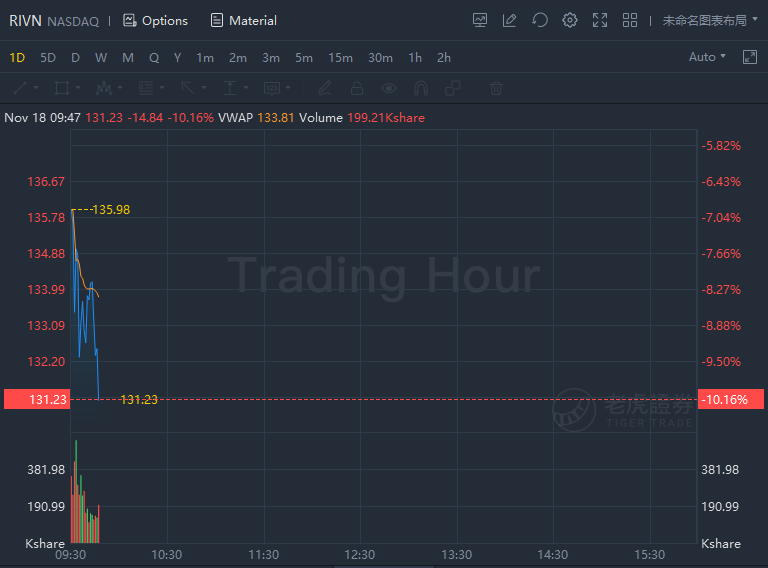

Rivian continued to fell over 10% in morning trading after tumbling 15.1% on Wednesday.

For perspective, Rivian's market cap at its peak eclipsed that of auto giant Volkswagen. Rivian has barely shipped any of its electric trucks, and has lost more than $2.4 billion from 2019 through 2021.

Some strategists like Maley thought the eye-popping gains in Rivian and Lucid underscore the continued high levels of liquidity in the market, in large part fueled by low interest rates.

Maley explained, "Just like 1999 when Amazon [stock] got way, way, way ahead of itself — it's a great company and changed the world — but the stock had to come down. I am not saying we are going to have the same problems next year that we had in 200 with a major bear market. But this market is being run by liquidity, and much less so than on economic growth or earnings growth. This liquidity is going to become less plentiful and people need to be preparing for how they will react when this market starts to come down at point. It's inevitable, and I think will come down at some point in the next 12 months."