As China’s blue-chip index approaches an all-time high, growing fears about bubbles developing in some parts of the country’s stock market are prodding some investors to seek bargains in Hong Kong.

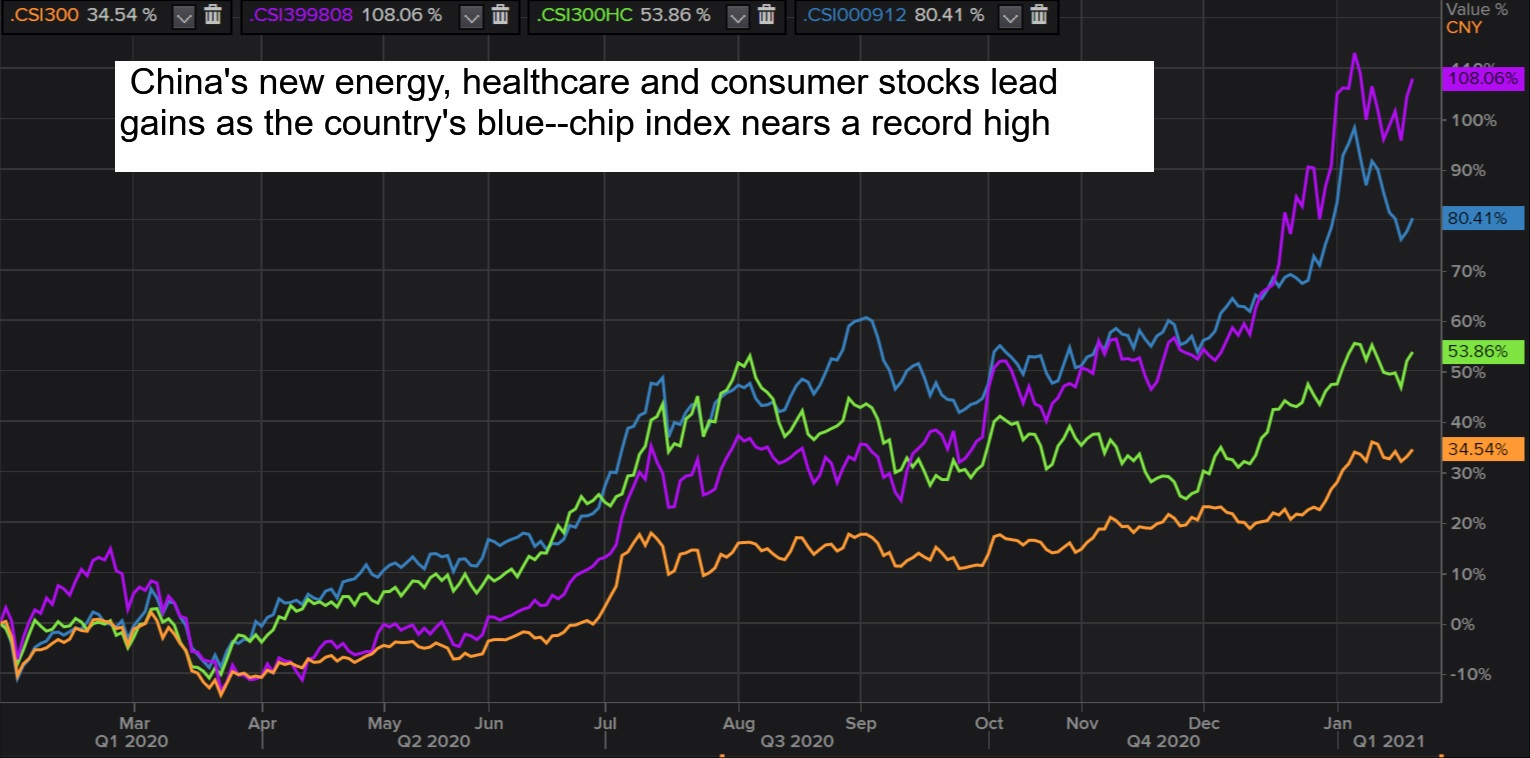

Retail investors have poured money into stocks via mutual funds, pushing valuations in sectors such as consumer, healthcare and new energy to multi-year or even record levels.

For instance, the CSI new energy index has climbed 15% so far this year, after more than doubling in 2020, thanks in part to China’s carbon neutrality pledge.

(Graphic: China's new energy, healthcare and consumer stocks lead gains as the country's blue--chip index nears a record high, ) (Graphic: Valuations of China's stock market darlings surge, )

“There are big bubbles in consumer, health care and liquor stocks, with valuations of some of these shares exceeding their previous record highs,” said Dong Baozhen, chairman of Beijing-based private securities fund Lingtong Shengtai Investment Management.

“Their rally has nothing to do with fundamentals now and poses huge risks for investors,” he added.

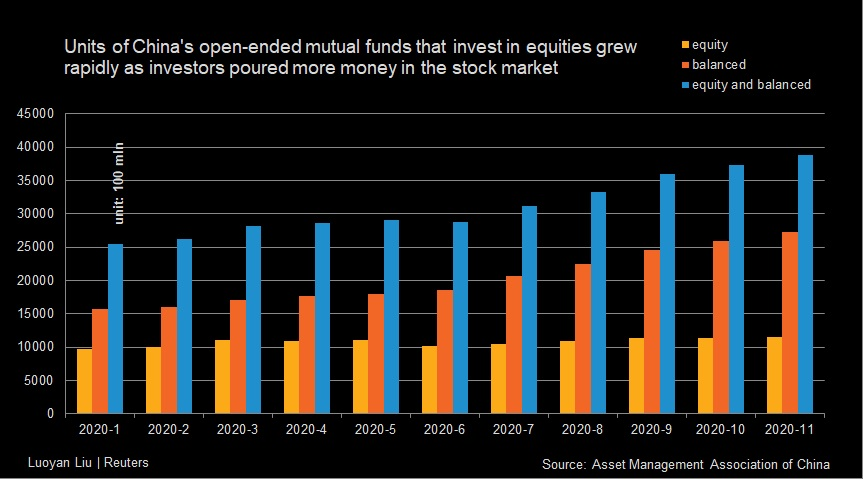

In the latest example of retail frenzy, a Chinese mutual fund attracted a record $37 billion worth of investor subscriptions on the first day of sales.

(Graphic: China's mutual fund industry grows rapidly, )

The rise in stock prices has been fuelled by foreign and domestic money, as Chinese authorities unleashed massive stimulus to deal with the blow from the COVID-19 pandemic and the country’s economy recovered faster than others.

As worries increase over frothy valuations, some investors are turning to cheaper Chinese shares listed in Hong Kong, particularly as U.S. exchanges delist these firms and American investors are forced to offload their shares.

“The (U.S.) bans actually tell people what good assets are in Hong Kong,” said Xia Tian, managing director at Shanghai-based asset management firm Minvest.

Investor buying via Stock Connect from the mainland to Hong Kong hit a record high of HK$26.6 billion ($3.43 billion) on Tuesday, and the total southbound purchases in the new year hit HK$221.8 billion as of Thursday, according to exchange data.

The Stock Connect scheme gives investors access to both markets when investing in A-shares in the mainland and H-shares in Hong Kong.

Morgan Stanley reckons the robust flows into Hong Kong owe to mainland policymakers’ encouragement of outbound investment and an elevated premium of domestic A-shares over the Hong Kong-listed H-shares. Companies’ A-shares listed in China are currently trading at a more than 30% premium over their Hong Kong-listed shares.

(Graphic: Mainland investors hunt for bargains in Hong Kong, )

JUSTIFIED EXUBERANCE?

The rally in China’s A-share market has also been driven by foreign investment. As of Thursday, foreign investors had purchased a total of 48.7 billion yuan ($7.53 billion) worth of A-shares via the Stock Connect this year, which is already a fifth of what they bought in 2020.

UBS expects flows of 200 billion yuan into the A-share market in 2021, citing improvement in China’s legal protection for investors, better information disclosure by major shareholders and more capable leading firms in various industries.

(Graphic: Foreign investors continued to buy A-shares in 2020, )

Some investors believe the exuberance onshore is justified due to China’s solid economic recovery, continued policy support and further opening up of its capital markets.

“There is no frothiness in leading large-cap stocks, seen as safer bets as China pushes forward with registration-based IPO reforms in the market,” said Wang Mingli, executive director of Youpu Investment, a Shanghai-based private securities fund.

“Investors would come back even later if they reduce exposure for now as there are few options out there that represent the country’s future economic development,” he added.

($1 = 6.4676 Chinese yuan)

($1 = 7.7517 Hong Kong dollars)