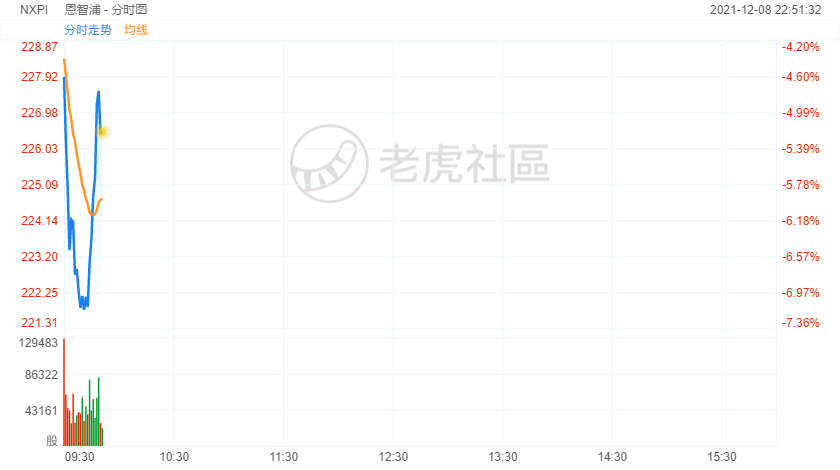

Shares of NXP Semiconductors fell 5% Wednesday after UBS initiated coverage on the stock with a Sell rating and $170 price target.

UBS said it expects growth at the company’s automotive division to “underperform the auto semis market.”

“While we believe NXP (ticker: NXPI) will remain a leader in its product categories with a solid business, we expect the automotive division’s growth (50% of revenues) to underperform the automotive semis market, due predominantly to a relatively lower content opportunity in EVs vs. peers” such as ON Semiconductor and Infineon,UBS said in a research note Wednesday.

The analysts, led by Francois-Xavier Bouvignies, also said the company’s “industrial/IoT and Mobile divisions deserve a discount due to high fragmentation and high disruption risks.”

Analysts surveyed by FactSet rate the stock, on average, at Overweight with a price target of $242.20.