Microsoft Corp is up almost 2% on the day with below average shares being traded on the day, yet there's unusual options activity along with a potentially large bet.

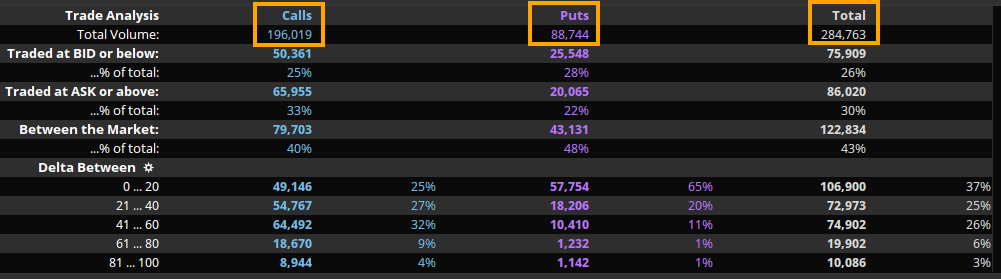

Share volume is muted at over 13 million shares versus the 10-day average of 30 million. However, on the options side, there are over 284,000 traded today, which represents over 11% of the OI (open interest) prior to today (image below).

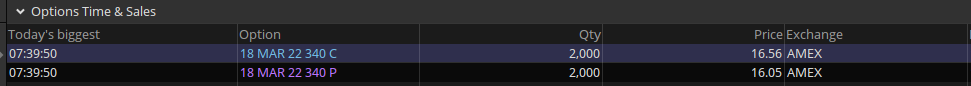

But what really sticks out is the particularly large option bet for the Mar. 18 (2022) expiry, with one trader buying 2000 calls and 2000 puts at the $340 strike (image below).

The 2000 calls and puts at the $340 strike most likely represent a straddle, but the question is are they buying the straddle or are they selling the straddle.

Why It Matters: If the trader bought the straddle (meaning they bought the $340 calls and $340 puts) it means they spent over $6 million dollars in debit to make this trade. It also means they are expecting volatility to increase between now and the Mar. 18 expiry enough to push the price either up or down by more than $32 (which is the relative costs for the calls and puts collectively).

If the trader bought the straddle, they are expecting Microsoft to close either up more than $32 from the current price around $340, or lower than $32 from the current $340 price.

If however the trader sold the straddle, they'd be expecting volatility to decrease between now and the Mar. 18 expiry, hence the stock would need to close below $372 or above $308 to make a profit.

It should be noted, selling a straddle with this many contracts would require approximately $20 million in margin to hold.

What's Next: Currently the market is pricing in the probability of the stock closing between $308 and $372 to be approximately 56%. Implied volatility for the ATM (at-the-money) Mar. 18 contracts are currently at 47% while the Jan. 21 expiry is at 45%, so the volatility term structure is in relative contango.

With the Mar. 18 expiry implied volatility at 47%, it means the market is currently pricing an increase in volatility between now and then, which may suggest the trader is long the straddle. It should be noted earnings are coming out for Microsoft on Jan. 24 which may create a volatility increasing event should there be a surprise up or down.

If however the earnings are flat with no new forward guidance, the stock could see a drop in volatility, thus making the short straddle more viable.