- Stock futures are bouncing between small gains and losses, indicating a quiet opening.

- Bitcoin, ethereum and other crypto currenciesrose Wednesday after a tumultous few daysof trading. The SEC meanwhile,delayed a decision about allowing bitcoin ETFs.

- Crude prices hit multiyear highs on economic rebound hopes,with signs pointing to a stronger rebound in the U.S.than the rest of the world.

- Torchlight Energy, a hot stock among the Reddit crowd, tumbled premarket, extending a 29% drop the day before.

- GlaxoSmithKline, MicroStrategy, Shake Shack & more made the biggest moves.

(June 23) U.S. equity futures were steady, while stocks were mixed Wednesday as investors assessed prospects for an economic recovery and continued policy support.

At 7:59AM ET the Dow futures contract was up just 17 points, or 0.05%, S&P 500 futures traded 0.25 points, or 0.01%, lower, and Nasdaq 100 futures climbed 4.25 points, or 0.03%.

Contracts on all three U.S. equity benchmarks were little changed, after two days of gains for the S&P 500 Index. European equities fell despite better-than-forecast outputdata, after high-flying sectors such as luxury-goods makersslidon analyst downgrades. Asian equities advanced.

Oil climbed above $73 a barrel after data signaling another decline in U.S. crude stockpiles added to a bullish outlook.

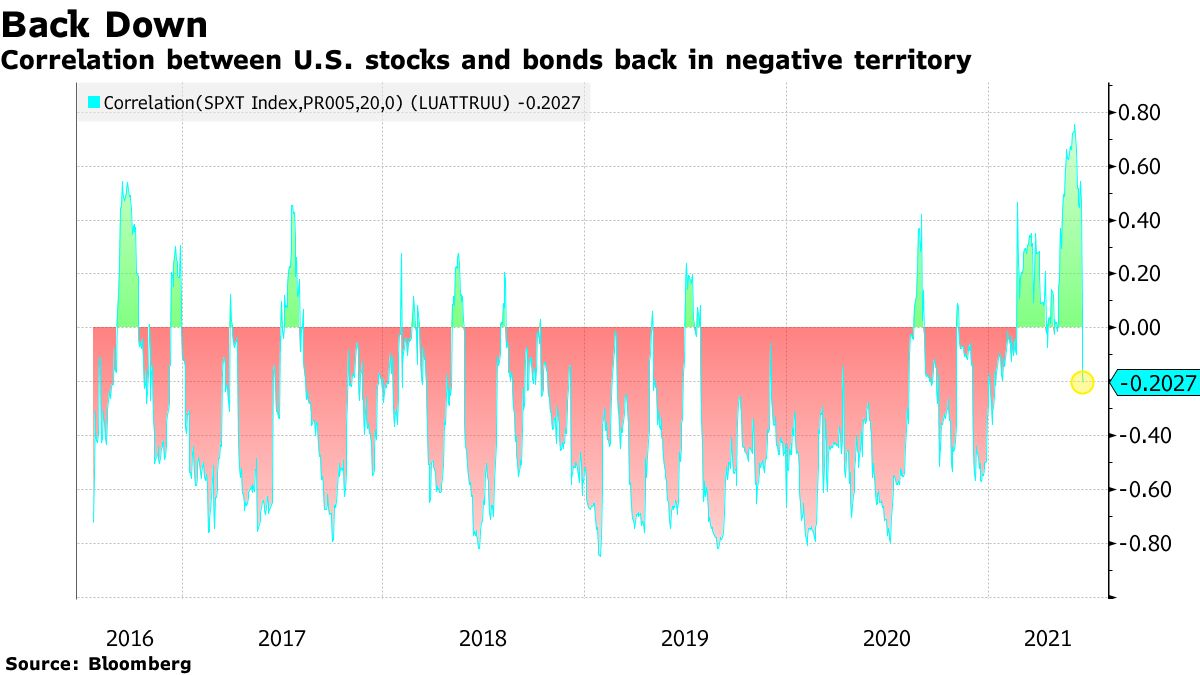

Markets are steadying this week after last week’s volatility spurred by the Federal Reserve’s hawkish tilt at its meeting. Chair Jerome Powell on Tuesday said the central bank would be patient in waiting to lift borrowing costs, andreiteratedthat while price increases are bigger than expected, they will likely wane.

The Fed’s shift last week to acknowledge higher inflation and pull forward its rate hike projections is “a reflection of more positive longer-term dynamics,” BlackRock Investment Institute strategists led by Jean Boivin wrote in a report. “We believe the Fed’s new outlook will not translate into significantly higher policy rates any time soon. This, combined with the powerful restart, underpins our pro-risk stance.”

Elsewhere, commodities including copper and iron ore climbed.Bitcoinrebounded, rising past $30,000.

Stocks making the biggest moves in the premarket: GlaxoSmithKline, MicroStrategy, Shake Shack & more

1) GlaxoSmithKline(GSK) – The drugmaker’s stock rose 3.5% in the premarket after it detailed plans to spin out its consumer health-care business into a separate company. Glaxo will eventually receive an $11 billion payment from the new company.

2) MicroStrategy(MSTR) – MicroStrategy rallied 4.4% in premarket trading, trading in sync with the price of bitcoin. The business analytics company holds several billion dollars worth of bitcoin and took advantage of the recent price drop to buy more.

3) Shake Shack(SHAK) – Shake Shack announced an expansion of its footprint in China, where it currently has 16 restaurants. It will open 10 restaurants in new territories by 2031, and plans to have a total of 79 China locations by that time. Shake Shack gained 1.5% in premarket action.

4) Winnebago(WGO) – The recreational vehicle maker reported quarterly earnings of $2.16 per share, well above the consensus estimate of $1.77 a share. Revenue also topped Wall Street forecasts by doubling to record levels. Sales of towable products nearly tripled from a year earlier.

5) Microsoft(MSFT) – Microsoft became the second company to surpass a $2 trillion market value, achieving that mark during Tuesday’s session.Apple(AAPL), currently worth $2.2 trillion, was the first.

6) Carrier Global(CARR) – Carrier shares rose 1.9% in the premarket after the stock was rated “buy” in new coverage at Deutsche Bank. The industrial equipment maker is poised to benefit from its exposure to non-residential construction as well as an increasing emphasis on indoor air quality, according to Deutsche Bank.

7) Amazon.com(AMZN) – Amazon will bethe target of a nationwide unionization effortby the Teamsters Union, which accuses the retail giant of mistreating warehouse and logistics workers. The effort was announced in a resolution presented at the union’s international convention.

8) Intel(INTC) – The semiconductor maker is creating two new business units, one that will focus on software and the other on high-performance computing and graphics.

9) Alphabet(GOOGL) – Alphabet’s Google unit will soon face a lawsuit by a number of state attorneys general, according to a Reuters report. The suit – which could be filed as soon as next week – will accuse the company’s Google Play app store of violating antitrust law.

10) Xpeng(XPEV) – Xpeng received permission from the Hong Kong Stock Exchange for an initial public offering there, with The Wall Street Journal reporting that the China-based electric car maker is planning to raise up to $2 billion with that offering. Xpeng is already listed in the U.S. with a market value of more than $30 billion. Xpeng jumped 3.8% in the premarket.