Chinese internet firm Baidu Inc.’s U.S.-listed shares have rallied more than 200% over the past year. Analysts now see further upside for the Chinese technology giant’s shares as it lists in Hong Kong, according to a report by CNBC.

What Happened:Shares of Baidu made their debut in a Hong Kong secondary listing on Tuesday, but made a flat debut. The Beijing-based company is best known for its eponymous search engine.

Baidu’s U.S.-listed shares touched a nearly seven-low of $83.62 in March last year, but have since rallied more than 200% and touched an all-time high of $354.82 in February this year.

Brendan Ahern, chief investment officer at KraneShares, told “Squawk Box Asia” on Tuesday that Baidu’s investments since 2014 in electric vehicles, cloud computing, integrating AI are now beginning to pay off, as per the CNBC report.

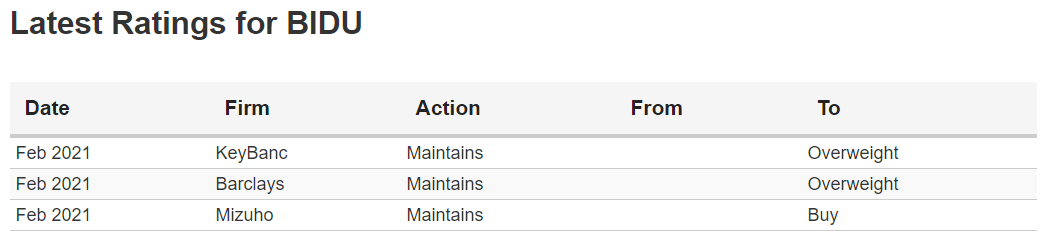

James Lee, U.S. and China internet analyst at Mizuho Securities, reportedly told “Street Signs Asia” that the Chinese government’s continued support for the autonomous driving industry and Baidu’s advertising business gaining momentum in the first quarter of this year are expected to help the company to outperform the market.

Why It Matters:Baidu has in recent years has intensified its focus on AI technology and autonomous driving in order to diversify its revenue streams.

The company’s AI technology has helped it to land partnerships across a variety of sectors, from finance to transportation. In January, the company said it was forming an intelligent electric vehicle (EV) company and forging a strategic partnership with Volvo parent Geely Automobile Holdings Limited.

Baidu also places a lot of emphasis on its Apollo self-driving technology. The company said earlier this month that Baidu Apollo jointly won a bid to construct a 5G intelligent driving project in Chengdu in a tender worth RMB 105 million.

It was recently reported that Baidu’s AI chip unit Kunlun’s recent fundraising valued the business at around $2 billion.

Price Action: Baidu shares closed almost 3.4% higher on Monday at $266.13.