What Happened:Apple Inc is having a volatile day, initially up over 2.5% but having since lost all of those gains over the last two hours of trading.

Trading activity has been strong with over 104 million shares on the day versus the 10-day average of 78 million. The recent sell-off late in the session might be due to supply constraints out of Asia for the upcoming holiday shopping season.

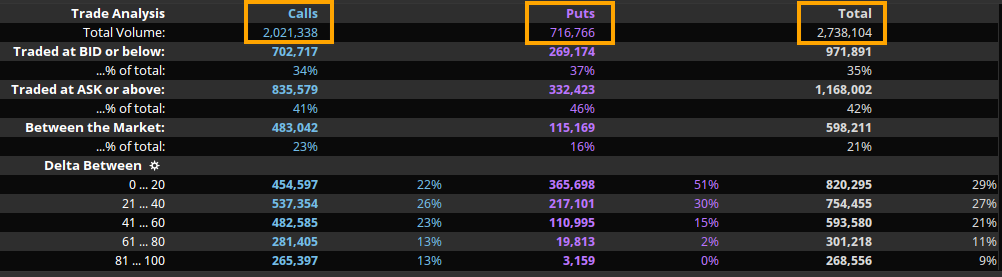

But what is fascinating is the heavy level of options activity in the stock today with over 2.73 million contracts traded on the day (see below).

Why It Matters:Prior to Monday, Apple had approximately 4.1 million calls and 3.3 million puts for a total of 7.4 million options. Thus, today's 2.7+ million options represent a massive 36% increase in options in one day.

Any time a stock trades 36% of the total options in one day, it suggests option traders are highly active in the stock. And considering 73% of the options traded were calls, it suggests option traders have a strong bullish bias.

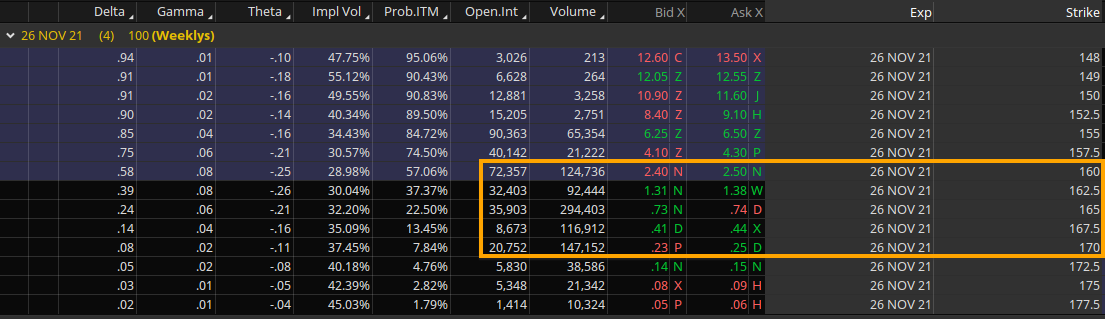

What's Next: About half of the option flows today were short-dated (expiring Friday) with the largest concentration of strikes between $160 and $170 (image below).

The short-dated calls suggest option traders are targeting a range between $160 and $170 for the week. However, with the strong sell-off into the close, the stock could probe below the $160 strike.

If Apple loses the $160 level, there is solid open interest down to the $155 strike, but falls off materially below that, so any sharp moves below here could represent a bigger selloff in the stock.

Meanwhile, if the stock can break the all-time highs just above $165, there is potentially room for a move up towards the $175 level.