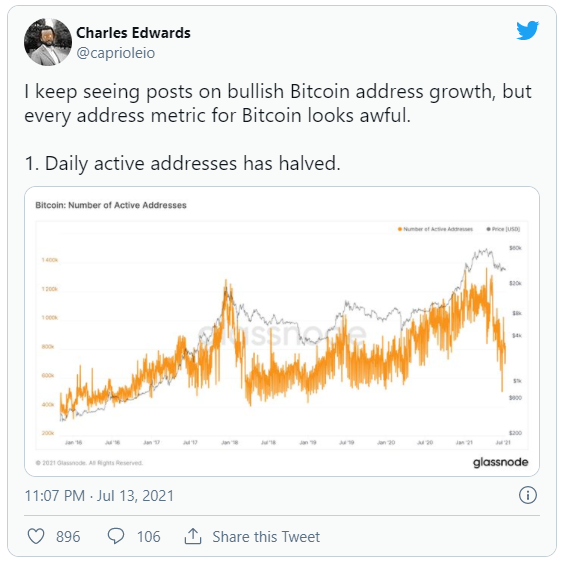

What Happened:Charles Edwards, the founder of Capriole Investments – a fund that takes long or short positions inBitcoin(CRYPTO: BTC) based on autonomous algorithms – isn’t convinced that the digital asset’s address metrics are entirely bullish.

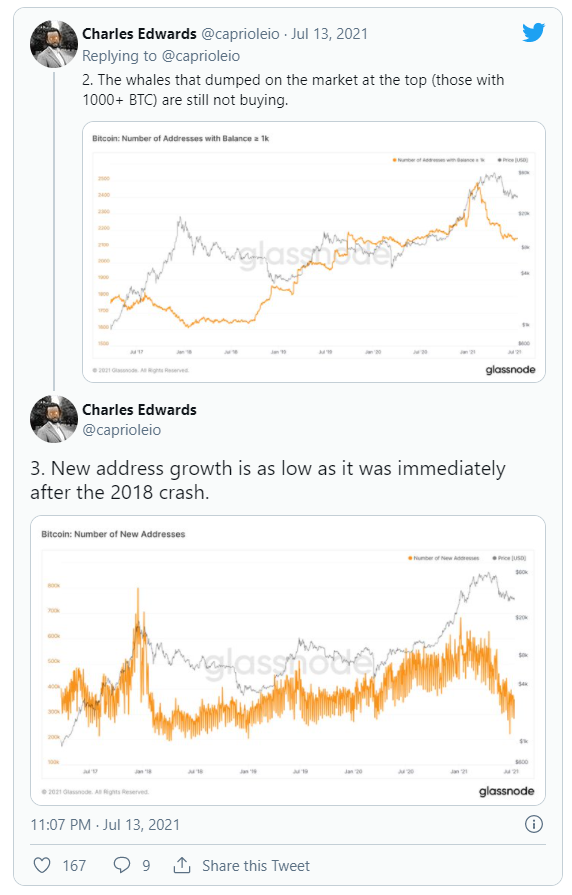

Edwards pointed to the current number of addresses holding over 1000 bitcoins as another concerning indicator. According to him, the whales that sold their Bitcoin holdings at the market top have still not resumed buying back into the leading digital asset.

“New address growth is as low as it was immediately after the 2018 crash,” he added, referring to a Glassnodechartdepicting the number of new addresses to the Bitcoin network.

New Bitcoin addresses have fallen from a high of nearly 700,000 earlier this year to under 300,000 at the time of writing.

“These metrics can change quickly. But for now, Bitcoin addresses metrics look terrible,” said Edwards.

Capriole Investments Bitcoin fund takes a minimum investment of $100,000 from investors who seek “above market, above Bitcoin returns.”

Since its inception in August 2020, the fund has returned over 375% to its investors but has recorded a loss of 28% over the past three months following Bitcoin’s declining price.

Price Action:At press time, Bitcoin was trading at $32,800, gaining 0.72% over the past 24-hours.