Research analysts of global banks have begun to roll out their predictions for the U.S. equity markets for 2022. The S&P 500 index has risen more than 25% so far this year. The index closed at 4,701.46 on Wednesday.

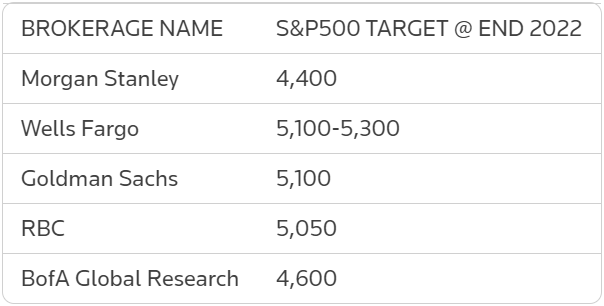

Here is a summary of some analysts' forecast for the index at the end of 2022:

Morgan Stanley: "While earnings for the overall index remain durable, there will be greater dispersion of winners and losers and growth rates will slow materially... 2022 will be more about stocks than sectors or styles, in our view."

Wells Fargo: "Persistent supply shortages and inflation pressures lead us to adjust the magnitudes of some 2022 targets, but we believe the global economy should still mark an above-average pace next year. More importantly, our tactical preferences for the next 6 to 18 months are nearly all unchanged."

Goldman Sachs: "Decelerating economic growth, a tightening Fed, and rising real yields suggest investors should expect modestly below-average returns next year."

"In contrast with our expectation during the past year, corporate tax rates will likely remain unchanged in 2022 and rise in 2023. Corporate earnings will grow and lift share prices. The equity bull market will continue."

"While we remain vigilant on margins, we don't think it makes sense to assume the worst on this front given the strong track record that companies have had managing through cost pressures even before the pandemic."