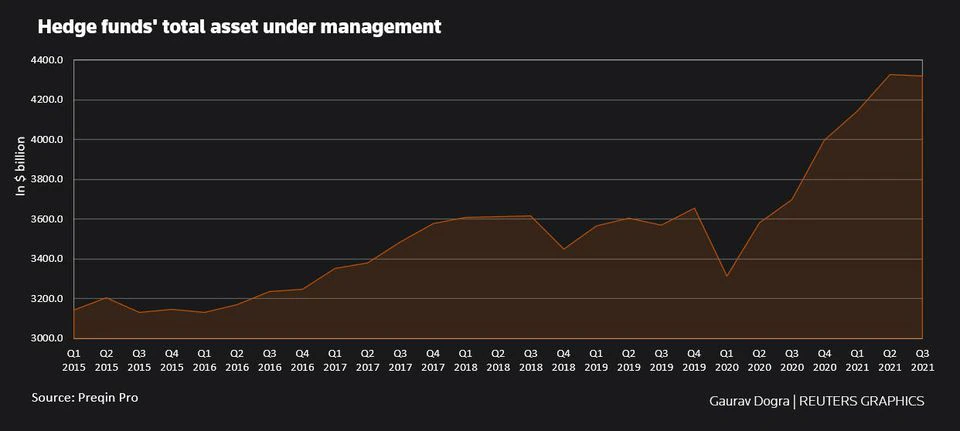

Dec 15 (Reuters) - Global hedge funds are poised to achieve positive inflows in 2021, for the first time in three years, data from Preqin shows, thanks to strong returns and an investor shift to alternative assets during a period of volatility and rising inflation.

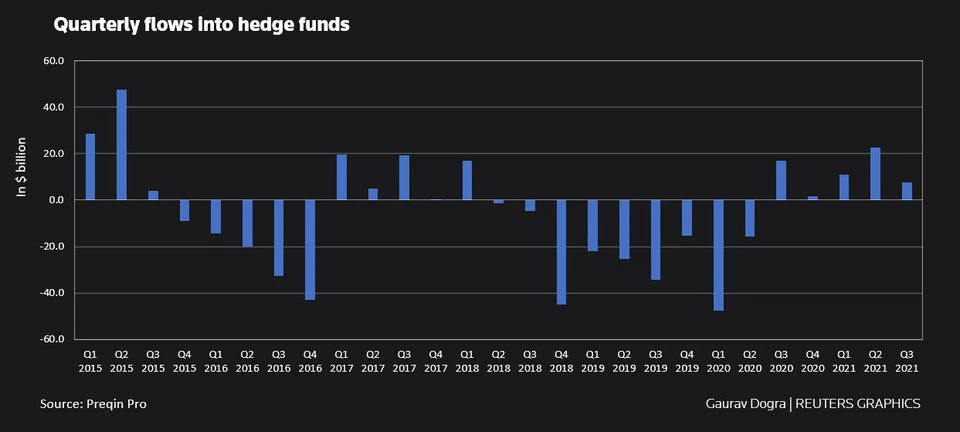

Alternative assets data and analytics firm Preqin's data shows hedge funds have attracted flows totalling $40.9 billion in the first three quarters of the year, after outflows of $97.2 billion and $44.5 billion in 2019 and 2020 respectively.

"Investors are looking to hedge funds to achieve a measure of diversification, particularly considering that the specter of inflation has recently entered the fray," Benjamin Crawford, vice president and head of research at alternate investment data firm BarclayHedge, said.

"Several sectors of the hedge fund industry have a well-earned reputation for shielding assets from inflation."

Analysts said the inflows are likely to rise further next year due to increased market volatility and uncertainty over the Omicron variant of COVID-19.

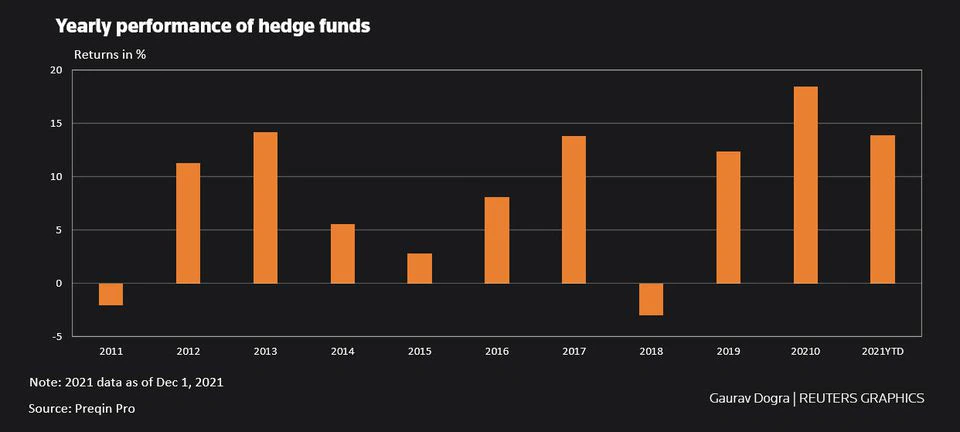

Data from Preqin showed global hedge funds gained 13.9% on average between January and November this year, marking their third successive year of returns above 10%. That compares with the MSCI global stock index's gain of 12.4% in the same period.

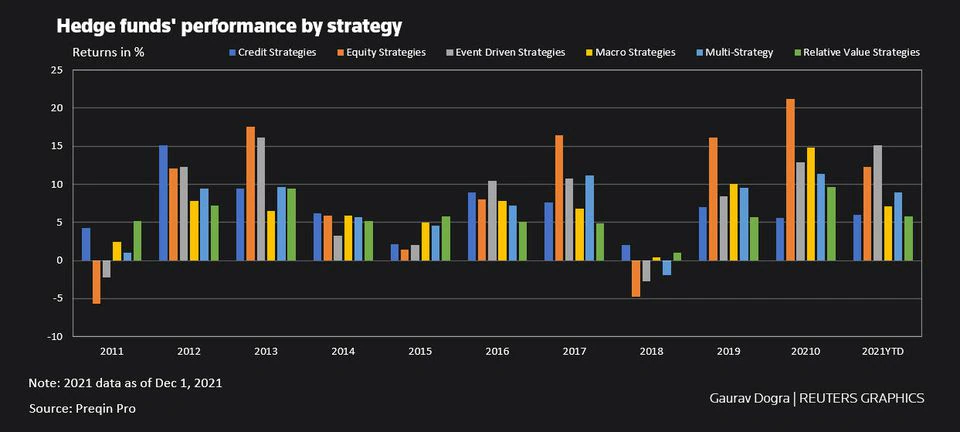

Event-driven strategies, which bet on corporate changes such as mergers and restructurings, led with a 15.1% gain, while equity strategies delivered a 12.3% gain.

On the other hand, macro strategy funds provided just 7% return in the first eleven months of 2021, compared with more than 14% in 2020.

"Global macro hedge funds have been challenged, as some common themes at the start of the year have not played out as planned, such as the steepening yield curve theme and weakness in the US dollar," Robert Christian, co-chief investment officer at K2 Advisors, said.

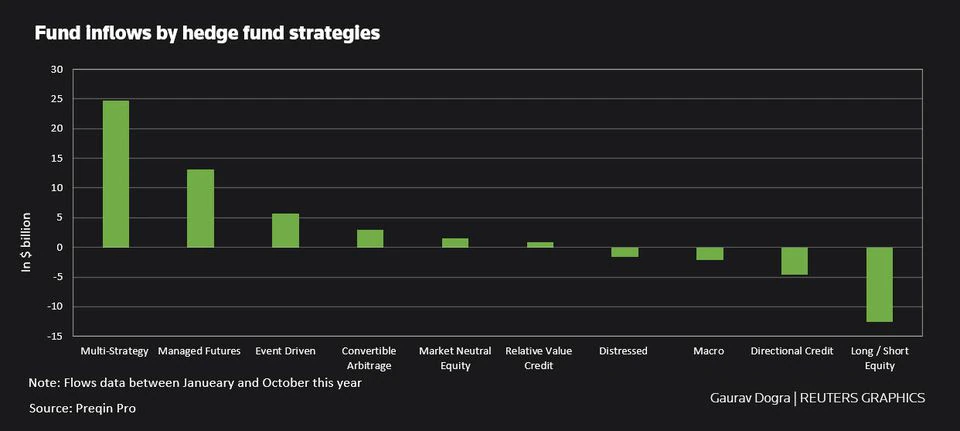

According to eVestment data, multi-strategy funds and managed futures funds were the biggest recipients of cash into hedge funds between January and October this year, taking in $24.7 billion and $13.1 billion respectively.

Long/short equity funds, on the other hand, witnessed the highest outflow of $12.6 billion this year.

Broken down by region, U.S. hedge funds attracted $44.3 billion this year, while Europe and Asian funds obtained $2.95 billion and $2.34 billion respectively.

On the other hand, emerging market funds saw outflows totalling $4.86 billion, the data showed.

"Seemingly, everyone is finding a reason to put their assets into hedge funds, regardless of whether they think the current moment portends doom, the coming of a halcyon age, or have absolutely no idea what's ahead but don't want to be caught off guard either way," BarclayHedge's Crawford said.