(July 23) Intel slides ss earnings underwhelm despite raising guidance.

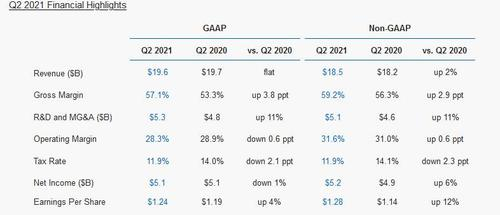

- Revenue $19.6B, -0.6% Y/Y,

- Adjusted revenue $18.53 billion,beatingthe estimate of $17.80 billion

- Adjusted EPS $1.28, +4% vs $1.23 y/y,beatingthe estimate $1.07

Looking closer at the company's segments reveals the following revenue picture:

- Cloud Computing was up 6% annually to $10.1 billion, and beating estimates of just under $10 billion

- Internet of Things was up 47% to $984 million, beating consensus of $887 million.

- MobileEye is up 124% to $327 million, below Bloomberg consensus of $374 million.

- Data Center Group was down 9% to $6.5 billion

- Programmable Solutions is down 3% to $486 million

- Non-Volatility Memory Solutions is down 34% to $1.1 billion

But as noted above, investors would be more focused on the company's guidance, and while the company projecting Q3 revenues which missed consensus expectations, this was more than offset by a hike to its full year 2021 revenues which means the company now expected Y/Y revenue growth:

- Sees 3Q Adj Rev About $18.2B, Est. $18.27B

- Sees FY Rev. $77.6B, Saw $77B

- Sees FY Adj Rev $73.5B, Saw $72.5B, Est. $73.13B

There were more good news in the company's gross margin which surged from 55.2% currently to 59.2% vs. 54.8% a year ago, and solidly above the estimate 57.0%. Bloomberg Intelligence semiconductors analyst, Anand Srinivasan, said he was surprised by the strength of Intel’s margin.

Healthy year-over-year growth in PCs and enterprise data center, along with a weak showing for cloud revenue came as no surprise, though.

Commenting on the results, CEO Pat Gelsinger said that "there’s never been a more exciting time to be in the semiconductor industry. The digitization of everything continues to accelerate, creating a vast growth opportunity for us and our customers across core and emerging business areas. With our scale and renewed focus on both innovation and execution, we are uniquely positioned to capitalize on this opportunity, which I believe is merely the beginning of what will be a decade of sustained growth across the industry. Our second-quarter results show that our momentum is building, our execution is improving, and customers continue to choose us for leadership products."

Looking at the cash flow statement, Intel said it generated $8.7 billion in cash from operations during the second quarter. It also paid out dividends of $1.4 billion. Here’s the company’s sources and uses of cash year-to-date.

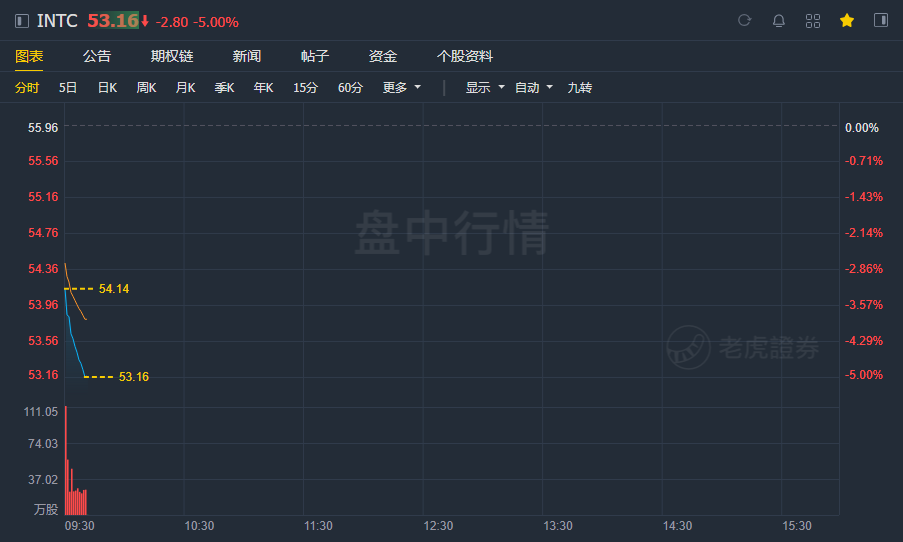

In kneejerk reaction, INTC stock surged, but then pared gains because as Bloomberg notes, on a non-GAAP basis, the Intel numbers were basically in-line; additionally investors were not too happy with the 6% revenue drop in the Data Center Group.

Other semiconductor stocks mixed in morning trading.