US stock futures fell in early pre-market trading on Friday after the S&P500 suffered worst month since March 2020

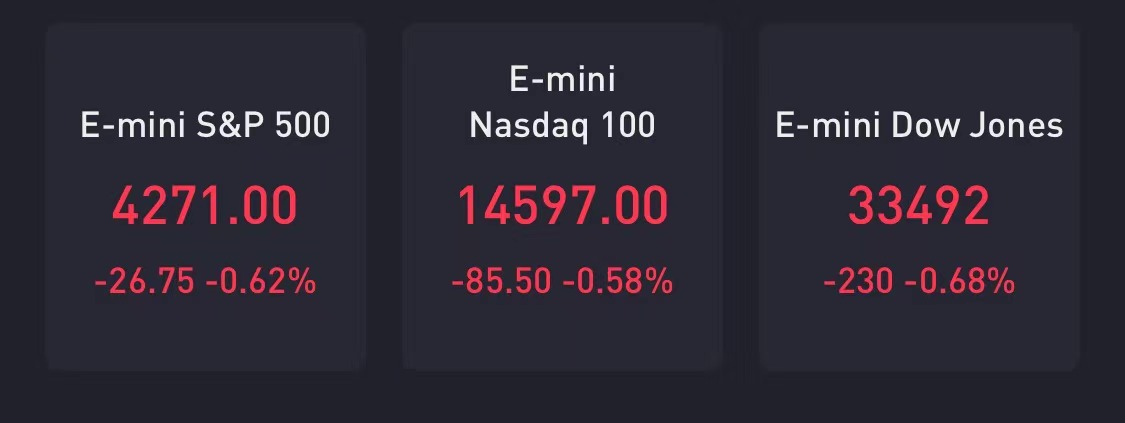

Dow futures dropped 230 points. S&P 500 futures and Nasdaq 100 futures both traded in negative territory and pointed to opening losses.

The market just capped a tumultuous September as inflation fears, slowing growth and rising rates crept up. The S&P 500 finished the month down 4.8%, breaking a seven-month winning streak. The Dow and the Nasdaq Composite fell 4.3% and 5.3%, respectively, suffering their worst months of the year.

Investors await key inflation data due Friday 8:30est, to gauge the state of price pressures as the economy recovers from the pandemic. The core personal consumption expenditures price index, the inflation measure the Federal Reserve uses to set policy, is expected to rise 0.2% in August and 3.5% year over year, according to economists polled by Dow Jones.

The inflation measure jumped 3.6% year over year in July, which hit the highest level since May 1991.

“As we wrap up the third quarter and look ahead, investors will likely need to remain nimble as the economic recovery continues in a zig zag,” said Mike Loewengart, managing director of investment strategy at E-Trade Financial.

Congress was poised to prevent a government shutdown Thursday. The Senate and House both passed a short-term appropriations bill that would keep the government running through Dec. 3 and sent it to President Joe Biden to sign.